The $2.3 Trillion State and Local Government Debt Monster – California Pension Systems on Unsupportable Path with $500 Billion Projected Shortfall. CalPERS, CalSTRS, and UCRS.

- 6 Comment

Much of the focus on government debt over the past few years has revolved around the federal government. No doubt, this is a stunningly large amount. Yet the government has the ability to finance this debt through the U.S. Treasury and Federal Reserve with a buffet of choices. You have direct bailouts to Wall Street, quantitative easing, and systematically dismantling the U.S. dollar. But one issue that is rising to the top is that of state and local government debt. States do not have the ability to print money at the whim of any central banker. And the state and local government debt market is up to a whopping $2.3 trillion. At this point, trillion is the new billion.

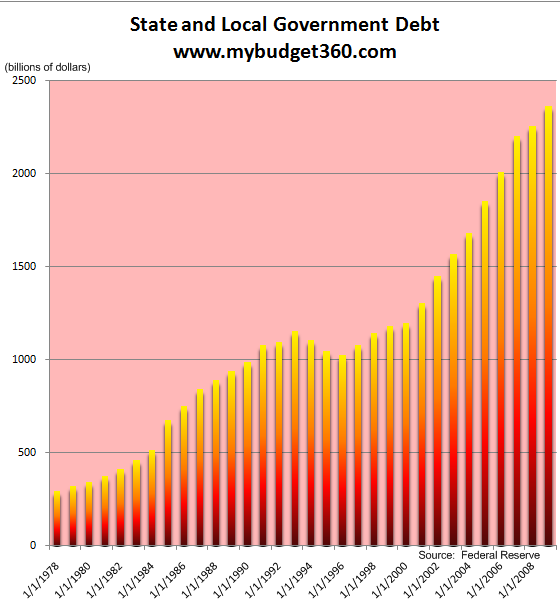

Let us examine the growth of this debt over the last forty years:

The growth in local government debt has exploded since the 1970s. We went from $295 billion in 1968 to $2.3 trillion today. But as Greece is demonstrating, there is such a thing as having too much debt and at a certain point the markets no longer have an appetite for so much borrowing. Average Americans probably have a hard time examining the large numbers being thrown around. Yet state and local governments are now finding a hard time balancing their budgets. In many cases, the ability to balance their budget goes in direct conflict with paying out pension distributions. Or in many cases states need to raise taxes or cut services.

Wall Street enjoys exploiting this fact because they actually loot the public sufficiently with golden parachutes and ridiculous bonuses that they never need any sort of pension. Yet the truth is, many of the gold plated pensions are just another side of the Wall Street mentality coin. That coin relies on having others pay for your bailout or extended retirement.

Now Wall Street has implemented the biggest transfer of wealth in history with the $13 trillion in bailouts and backstops. But many pension funds also bought into what Wall Street was pushing. Let us examine the California state pension systems.

California Pensions – $500 Billion Underfunded

The Stanford Institute for Economic Policy Research issued a stunning report on the three largest pension systems in California. The report was titled Going for Broke and what we find is a rather daunting mountain that California has to climb if it seeks to remedy their pension system.

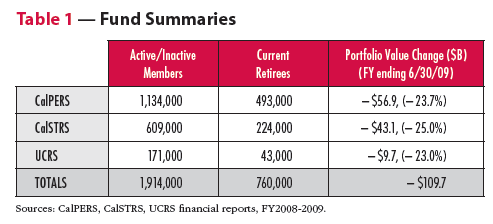

Let us look at the three largest systems:

In total these cover 2.6 million of California state workers. These are CalPERS (the largest), CalSTRS, and UCRS. But if you look at the funds performance through the crisis, all of the funds saw 23 to 25 percent declines. These declines only exacerbate the shortfall of the system.

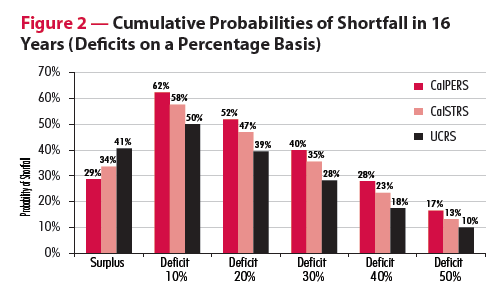

The odds of shortfalls are virtually assured for all systems. We are now entering a stage where many workers will be retiring and drawing into the system. Expectations for deficits are large:

Part of this stems from the notion that markets will always return a standard rate. As we have seen with the massive market volatility, markets are largely unpredictable especially when they become casinos for the wealthy.

As the report finds, these funds do not have the flexibility required in an unpredictable market:

“A public employee’s pension constitutes an element of compensation, and a vested contractual right to pension benefits accrues upon acceptance of employment. Such a pension right may not be destroyed, once vested, without impairing a contractual obligation of the employing public entity.â€

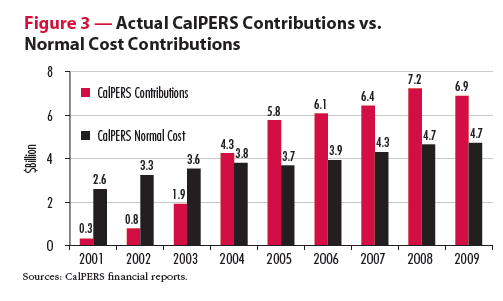

It becomes a matter of law to pay even if the economy has rendered a new reality. As Greece is showing, having very early retirement rates with generous packages is not supportable with a younger generation that isn’t having larger families. The math doesn’t work but good luck changing that. Some will argue that people contribute into these systems. This is true but not anywhere to cover the actual payout over time:

In other words, there is a shortfall of coverage and a market decline only pushes the problem to the surface for all to see:

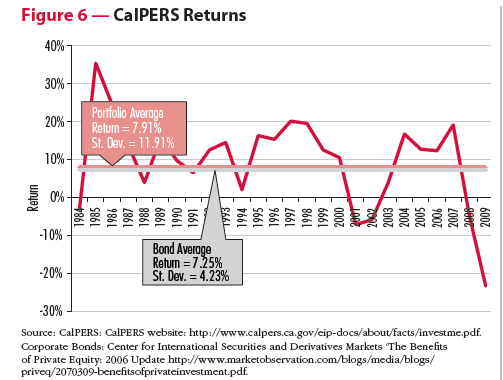

“As mentioned earlier, the pressing nature of California pension shortfalls is due in part to the losses CalPERS, CalSTRS, and UCRS sustained in the marÂkets over the past 18 months. CalPERS expects an average annual investment return of 7.75 percent, CalSTRS targets 8.00 percent, and UCRS expects 7.50 percent.â€

Those expected rates of return are simply too optimistic. These funds are expecting 7.5 to 8 percent annual returns in a market that is giving 0 percent rates to savings accounts and 4 percent for 30 year fixed government debt. Instead of realigning to this low yield environment fund managers went all in to the market and gambled on Wall Street:

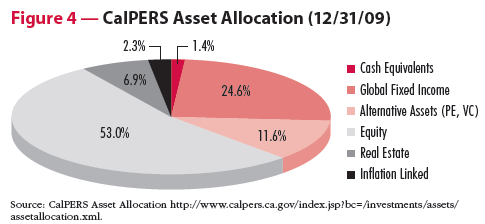

It is amazing that many fund managers look at the above as “safe†but it is anything but safe if you are losing 23 percent. Part of the bets were flat out risky:

“(LA Times) SACRAMENTO — The value of residential real estate investments owned by the country’s largest public pension fund has plummeted 35% — a paper loss of $3.3 billion for current workers, retirees and their state and local government employers.

The California Public Employees’ Retirement System reported Wednesday that in the year ended June 30 its real estate portfolio declined to $6.08 billion from $9.36 billion, based on 461 independent appraisals of its investments in 288,000 housing units across the country.â€

Housing, both residential and commercial has not recovered. So these losses are still likely part of the funds new reality. The massive rise in equities probably has helped but it is a long way from that 7.5 to 8 percent annual return:

Past performance is no indication of future returns especially when more and more retirees are going to draw from the system:

“In 1999 California passed Senate Bill 400 (SB400), substantially raising benefit factors and lowering retirement ages for public employees (see Table 3). Based on a National Institute on Retirement Security report, average monthly public pension benefits in California were $2,008 in 2006, the eighth highest nationwide.â€

Now that $2,008 monthly benefit does not factor in additional healthcare benefits which cost a lot and are also provided. Just do the quick math, let us assume someone retires at 55 and lives to 85 and receives that $2,008 monthly benefit:

$2,008 x 12 = $48,000 $24,096 x 30 = $722,880 in total paid out

We are also assuming no COLA adjustments which some of these plans have. We aren’t adding the added healthcare cost which an older retiree will be using up. Something tells me that a state worker did not even come close to putting in $722,880 over their working career. And you wonder why these pension funds combined are projected to have a $500 billion shortfall? And good luck if the stock market turns lower or simply remains stagnant for years. California is only one example of many.

The paper lays out a few suggestions including higher contributions, a hybrid 401k/403b system, and safer investments but also a tiered system. In reality, Wall Street has not wanted to deal with reality and has used the taxpayer as a bailout for their wealth protection. Now that taxes are being talked about including a value added tax (VAT) people are getting angry. You didn’t think bailing out Wall Street was free? The same reality will hit the state pension systems. Younger workers are going to enter a tiered system where they have to pay out more with no future guarantee while they watch older workers take on funds that they will never see. I’m sure that is politically going to go over well.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

PONZI SCHEMES said:

All of these pension funds are PONZI SCHEMES. They’re all going to be looted by the governments every single one of them, and the poor idiots who contributed will be holding a bag of IOU’s in the end.

same for 401K funds. If you haven’t gotten your money out, you need to do it NOW!!

or else, be ready for a bitter ugly disappointment soon when Obombya announces the FED (Rothschilds) had to loot those for you to save the nation’s big banks! 🙂

April 11th, 2010 at 10:53 am -

Dave said:

Find out just how much rampant fraud is occurring with stocks and State pensions search for Comprehensive Annual Financial Reports or CAFR. You will learn how stock-based compensation and bonuses are underpinned by fixed term buys into publicly-traded companies with your pension money! The executives can literally gauge the rise in the stock price solely on the terms from special investment deals with State pensions. You invest thinking the stock is “performing” but do not have access to data like how many shares a particular pension owns or is buying annually. They (Wall Street Investment Banks) naked short the stock to keep the price from sky-rocketing all the while knowing companies like Motorola are 3/4 owned yet the share price never rises. You are referred too as “retail” and “peon” market participants. The whole game is in figuring out how to steal your money without you understanding what they are doing.

April 11th, 2010 at 11:47 pm -

Honneker said:

$2008 x 12= $24096, not $48192. $24096 is not that much of an income in CA. Discounted over 30 years at 4.75 percent/annum (the current 30-year US Treasury Bond yield) indicates that a lump sum of $385K present value should support the average pension.

April 12th, 2010 at 6:49 am -

Don Levit said:

Ponzi Schemes:

It’s my understanding that a very small percentage of the state retirement funds are invested in state debt.

The balance is invested in private bonds, stocks, etc.

As long as the money remains in trust, this is not a Ponzi scheme, except for the state debt, if it is simply rolled over.

Contrast this with Social Security and Medicare, in which their trust funds are fully leveraged to pay for current governmental expenses. There is no money to help pay future liabilities, as in the state trust funds.

According to the GAO Paper on Federal Debt, number 04-485SP entitled “Federal Debt,” when it refers to the trust funds “In effect, one part of the government pays the interest to another part of the government – there is no net change in current spending. Like the rest of the balances in the trust funds, the interest received on debt held by government accounts represents a future priority claim on the U.S. Treasury.

Don LevitApril 13th, 2010 at 9:19 am -

MF Miles said:

Yeah… That’s what I want.. My retirement held in the hands of state debt, especially California.

If California falls into the Pacific, will they please take their debt with them?

September 23rd, 2010 at 8:36 am -

Ponzi Schmonzi said:

A Ponzi scheme is specifically one where the con men (who constitute the first tier) convince their victims to give them money on the promise of their being able to similarly con yet another, larger group below them (leading to the other name of “pyramid scheme”). It falls apart because the total pool of potential marks is inherently limited. Many if not most multi-level marketing schemes fit this model.

Programs such as social security or pension funds do not fit the model of a Ponzi/pyramid scheme, as neither one features an exponential characteristic. Social security, in particular, is funded on a “pay as you go” basis. If a pension fund is “raided” inappropriately, that still does not fit the Ponzi model. Both kinds of social programs can be easily corrected by either addressing the funding issues or else resetting the benefit levels.

The reason that “pay as you go” social programs are not inherently limited is that the payout occurs over time, and can be calibrated to the amount of new wealth which the economy is generating. Obviously, a trust funded during the “fat years” will help smooth out the benefits during the “lean years”. Whether or not that actually happens is a question of governance.

January 8th, 2016 at 4:04 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!