Catch 22 economics – The U.S. economy has 7,400,000 less workers than the peak in late 2007 yet nominal GDP is at a record. What does that mean for those without jobs?

- 0 Comments

The Friday jobs report was significant for a variety of reasons but one key theme is that it shows the true fragility of the state of the economy. Even though it was a net add of 39,000 jobs we need to remember that the nation needs to add roughly 150,000 jobs per month just to keep pace with population growth. Many economists agree that an unemployment rate over 8 percent is felt by virtually everyone in the economy. The average American is facing some of the most dramatic changes to our employment market in over a generation. While the recession on paper has been over since summer of 2009 most Americans would agree that the economy is still in deep problems. This is because most Americans would view a recovery with actual job growth. Yet when we look at the Gross Domestic Product (GDP) or the aggregate production of the U.S. we are back and growing. This dichotomy raises some troubling questions moving forward. Do we need as many workers to grow? GDP tells us that we don’t.

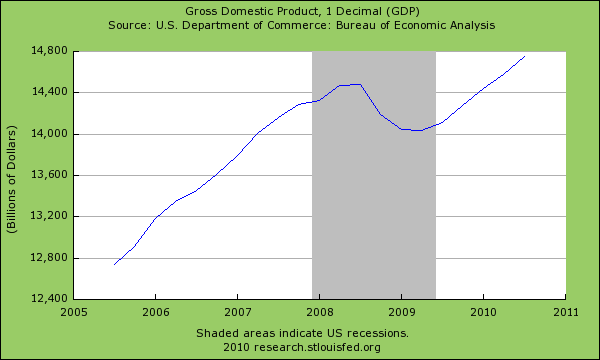

Let us look at the GDP chart first:

While it is clear that GDP contracted during the recession it is now moving back up and in record nominal territory. As many banks are pulling in billions of dollars in profits some sectors of the economy seem healthier than they ever have been. The deeper issue is that the Federal Reserve lends money to banks yet many of these banks simply chase the next best thing and this doesn’t necessarily mean that it will be good for the domestic economy. So you have major S&P 500 companies making half their revenues overseas while adding wage pressure on domestic workers. This is merely an observation of what is occurring. It is hard to compete with this some may say but the fact that banks are leveraging the credit of the U.S. to invest in areas that hurt the domestic economy is something Americans will have to wrestle with in the coming decade. If what banks are doing is bad for the domestic economy why allow them to borrow so cheaply from the central bank?

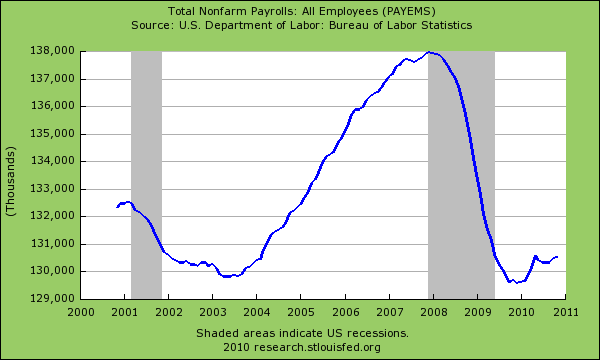

Let us take a look at the damage done in terms of employment:

The U.S. employment market is down by 7,400,000+ jobs from the peak and we’ve been adding more and more workers to the economy. This has happened via population growth and the natural progression of people entering the work force. The above chart is clear. There has been no growth in terms of added jobs. Yet going back to the first chart of GDP, we are now back to record levels in terms of our nation’s output. In other words, we are producing even more on a GDP basis than we did at the peak employment level but with 7.4 million less workers. The stance from banks is that this is an inevitable outcome of globalization and money will chase the lowest cost centers. Yet this also applies with the Federal Reserve allowing banks to borrow money backed by the U.S. taxpayer and government and then adding no restrictions since these banks chase yields anywhere around the world even if it means hurting the domestic economy. This is the longer chain and journey that money follows but these will quickly become political questions moving forward. The fact that Ben Bernanke has now been on 60 Minutes twice in the last few months tells you the Fed is quickly trying to jump ahead and conduct PR operations.

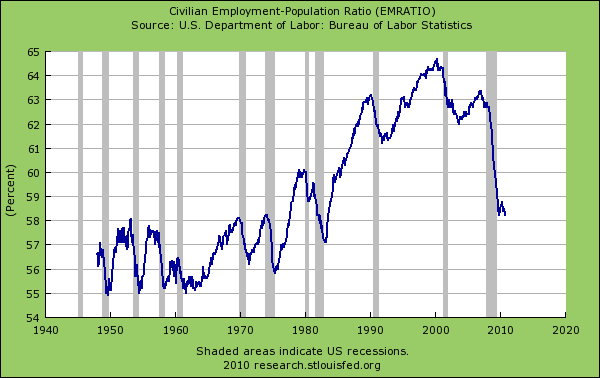

The civilian population ratio is also at historically low levels:

This is a very troubling trend. In this new economy we are having less and less workers producing more and more. Yet this is counter to the essence of a strong American middle class and more reminiscent of countries where there is a strong upper-class and the large remainder of the population. Income disparity in the U.S. is at all-time record highs and this trajectory has been moving forward for two decades now. The question that many Americans will have to deal with is whether they are happy with this progression of events. The banking system would like to put this out as some inevitable path going forward but it is not.

Take for example the Ireland bailout. The main reason the Euro (and the world for that matter) is bailing out Ireland is to protect bondholders. This was the crux of the U.S. bailouts as well. But for Ireland, the best option would be to default since there is absolutely no way they can pay back their debts given their GDP. I agree that this is no light decision but the bailout option is worse. It is virtually impossible and saddles them with debt for years to come. This is like someone who over paid for a home and simply has no way of meeting their obligations. The best option is to default, start new and hopefully do it right the second time around (i.e., Brazil comes to mind). What these bailouts amount to is a prolonging of the inevitable since bank debt holders just don’t want to face the music but this causes sustained unemployment in the working and middle classes of these nations.

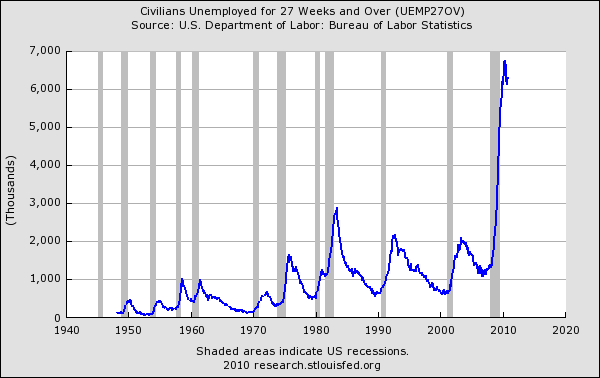

In the U.S. we already see this problem with long-term unemployment:

Nearly half of the unemployed are out of work by 6 months or more. Studies have shown that the longer someone goes without stable work the harder it will be for them to ever get back on economic track. Yet GDP growth signifies that the economy is growing. So what then of this large base of unemployed? Is this simply the new economic reality? Unfortunately the above chart is counter to what many Americans envision as a strong middle class. The language coming out from the banking sector is familiar to companies in the 1920s and the belief that there really is no need for a middle class. That somehow a country is strong if we allow the strongest to manipulate politics and policy to benefit their entrenched needs.

These are challenging questions we face. I don’t proclaim to have the answers here and you can see from the above charts that the complexities are deeper than merely a simple stump speech. These are issues we will need to confront as a nation for the decade moving forward. What I do know is that the current path is slowly eroding the middle class and this isn’t good for the majority in the country.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!