Commercial Real Estate Holders Decide to Walk Away: The Continuing Double Standard from the Banking Industry. Debt Ceiling Raised to $12.4 Trillion Making Room for more Bailouts.

- 0 Comments

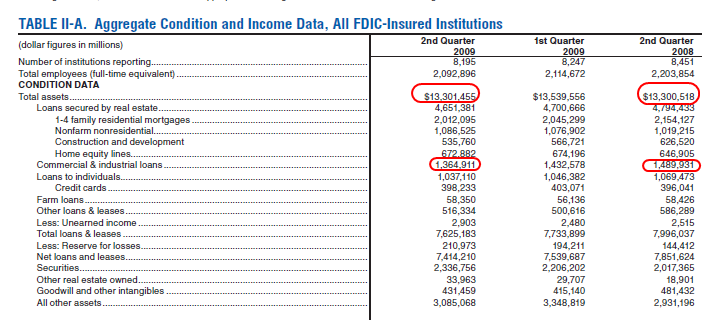

There will be many new financial stories in 2010 but one that is certainly to garner much attention is the implosion of the commercial real estate market. A $3.5 trillion market that has taken it on the chin alongside the residential real estate market. The commercial real estate debacle usually follows a similar pattern. Residential real estate pulls back followed by commercial real estate. But in this massive decade long real estate bubble commercial real estate debt ballooned into uncharted territory. The bust is going to be deep and has no parallel in history just like the housing bubble bursting.  Yet the U.S. Treasury and Federal Reserve have already had backroom talks about coming out with a “Plan C” to bailout this segment of the American economy.

Yet the commercial real estate bust reveals again the hypocritical nature of the banking industry. Hank Paulson last year came out and stated that homeowners that walked away on their obligations were acting immorally. Well Morgan Stanley just demonstrated not only that Wall Street is amoral but corrupt to the bone:

“(WSJ) So we’ve discussed the ethics of individual borrowers walking away from their mortgages. (Some say we’ve over-discussed it.) If it’s immoral, as some would say, for a borrower to walk away their mortgage, is it any different for a bank?

Morgan Stanley is doing just that. News reports on Thursday said the bank plans to give back five San Francisco office buildings to its lender-just two years after buying them at the top of the market.

“This isn’t a default or foreclosure situation,” spokeswoman Alyson Barnes told Bloomberg News. “We are going to give them the properties to get out of the loan obligation.”

Sound familiar?

Morgan Stanley bought the buildings, along with five others, in San Francisco’s financial district as part of a $2.5 billion purchase from Blackstone Group in May 2007. The buildings were formerly owned by billionaire investor Sam Zell’s Equity Office Properties and acquired by Blackstone in its $39 billion buyout of the real estate firm earlier that year, Bloomberg reports. One analyst estimates that the buildings are now worth half of what Morgan Stanley paid.”

And keep in mind that Morgan Stanley is raking in massive profits since the corporatocracy bailouts:

So they are making a conscious choice of walking away from their bad choice. The problem with this of course is that the American taxpayer has bailed out this company that actually had a direct hand in creating massive amounts of mortgage backed securities that imploded the residential housing market. Now, here they are moving away their commercial real estate obligations and wiping their hands of any responsibility. Average Americans are getting the raw end of deal in so many of these banking bailouts. The commercial real estate bailouts have no justification for the safety of our economy but hundreds of banks will implode because of local loans they made. Yet bigger banks enjoy the safety of the U.S. government and their printing press.

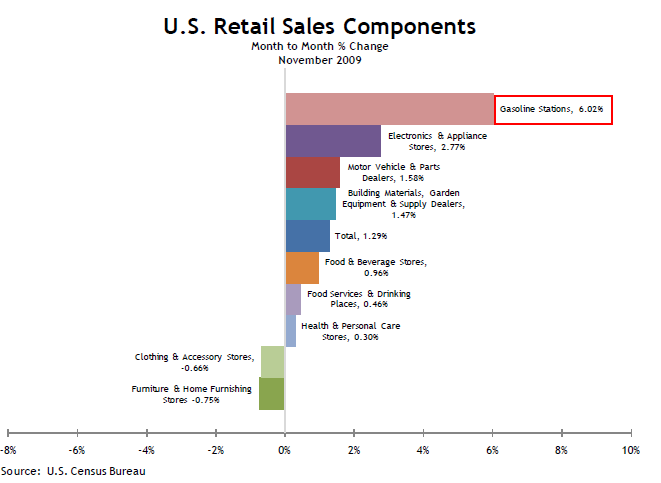

Unlike the too big to fail banks smaller regional banks will fail in the upcoming year as they have in 2009. They made loans on local businesses that simply had no way of succeeding in a new austerity that demands people cut back. The revised GDP number is down to 2.2 percent and without the government stimulus, the economy would still be contracting. And those great retail sales? Where did they come from?

The biggest jump came from gasoline stations. As you might guess there is little need for commercial real estate in this segment of the economy. So we are left with countless buildings that now sit empty while banks try to figure out their next step. At least with homes, there will be a price point where homes sell. Lower the price enough like some of the foreclosures and people will buy the property. But in some commercial real estate buildings there is little demand for properties. It is amazing that a bank like Morgan Stanley can simply walk away while having their industry chastise average Americans who even contemplate the idea of walking away.

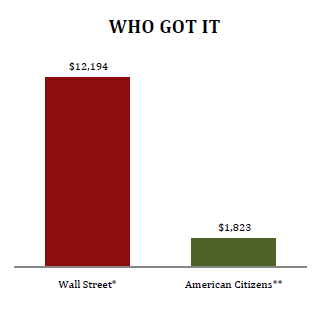

The hypocrisy of the corporatocracy has reached a crescendo. Â Â Of the $14 trillion in bailouts Wall Street received 87 percent of all the money:

The above is disturbing. What we are seeing is that the banks are basically pushing all the downside of risk to average Americans while keeping any ill gotten profits. They are rushing to payback TARP funds because they want to be unchanged so they can go back to gambling again. So what if another crisis hits in a year or two? After all, the poor U.S. taxpayer will be robbed yet again. What has changed? Nothing has changed. These corporate friendly bailouts don’t even reflect a healthy capitalist system. This is socialism for the too big to fail. The way the commercial real estate bust is handled will tell us a lot regarding our government and Wall Street. However, given the continuous hypocrisy coming from Wall Street expect more sweetheart deals for these failed bets.

And as a holiday gift, the Congress voted to raise the debt ceiling:

“(ABC) The Senate voted Thursday to raise the ceiling on the government debt to $12.4 trillion, a massive increase over the current limit and a political problem that President Barack Obama has promised to address next year.

The Senate’s rare Christmas Eve vote, 60-39, follows House passage last week and raises the debt ceiling by $290 billion. The vote split mainly down party lines, with Democrats voting to raise the limit and Republicans voting against doing so. There was one defection on each side, by senators whose seats will be on the ballot next year: GOP Sen. George Voinovich of Ohio and Democratic Sen. Evan Bayh of Indiana.”

Merry Christmas from your friendly Wall Street and Congress cronies.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!