Commercial Real Estate Implosion: 67 Percent Fall in Multifamily Starts, Ghost Buildings, $3 Trillion in Debt, 41 Percent Drop in CRE, and Collapse in Rents.

- 2 Comment

Driving along the highway at night, it is an eerie sight to look at some of the vacant buildings. The lights are on but the floors are empty awaiting an audience that will never come. Can it be that commercial real estate, with over $3 trillion outstanding be in worse shape than residential housing? In a short answer, yes. I’ll give you a few reasons but the most obvious is that unlike housing, there is rarely a price point where a commercial real estate development will make sense without a sustainable economy.

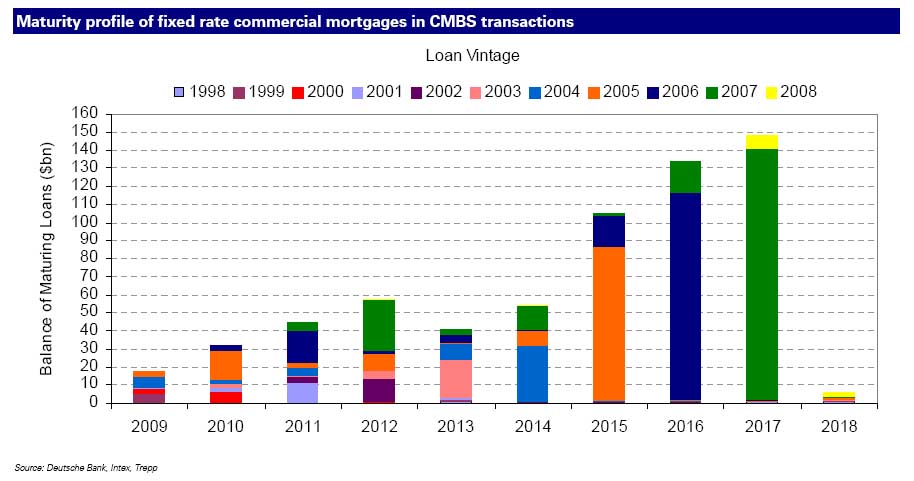

For example, there are places in Nevada and Arizona that were built with no residences coming and commercial real estate to feed this ghost population. Another point that makes commercial real estate more problematic is the way commercial projects are financed. These projects are financed with short-term financing that requires refinancing every 5, 7, or even 10 years. This stands in sharp contrast to the 30 year fixed mortgages on residential properties.

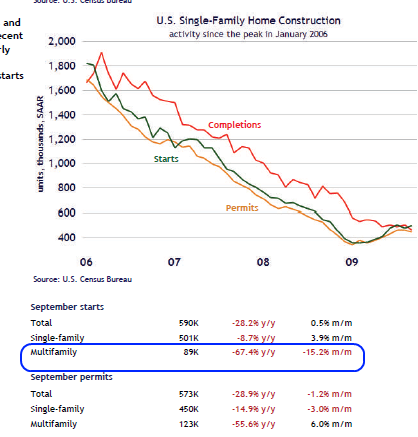

If you really want to see what is happening on the ground, you need to look at housing starts. After all, these are the builders and should have a better sense of regional niches and demand. Now their projections are never perfect but they probably have a better sense than say Wall Street which is a few thousand miles from billion dollar construction projects:

Now here is a fascinating case and point. Single family starts have collapsed. This is true. Since the peak, they have been trending lower and lower. The U.S. Treasury and Federal Reserve even with virtually interest free money cannot stimulate demand in an overbuilt market. Single family starts are down 8.7 year over year. But multifamily starts? Try a stunning 67.4 percent. Many of these projects are financed with commercial loans and you can see that the demand is virtually gone. This is one of those unintended consequences that Wall Street and the government fail to notice.

With a tunnel vision focus on propping up the residential housing market, demand for homes has increased. People are buying up foreclosures and financing their purchase with historically low interest rates courtesy of the Federal Reserve. The government has also sweeten the pot with the $8,000 poorly targeted tax credit. But what the Fed fails to see is that vacancy rates were already high for both residential and commercial buildings in the form of say, apartments. So what happens? You shift demand from lower priced rental units to homes. Good news right? Not at all. Now what you have is an increase in defaults for commercial loans instead of residential loans because of even higher vacancy rates.

As I mentioned before, the problem with commercial real estate loans is also how they are financed. Take a look at the turnover profile for the next few years:

Source:Â Zero Hedge

From 2009 to 2010 the amount of MBS maturing is double and it only elevates from that point on. Who is going to refinance an empty strip mall? Or a gym with no membership? What about an office complex with no tenants? This is the big problem with commercial loans. Consumer demand has shifted. With the U.S. dollar tanking the average American is facing higher costs for daily items like food and is seeing some items like cars drop on the secondary market but what is a priority?

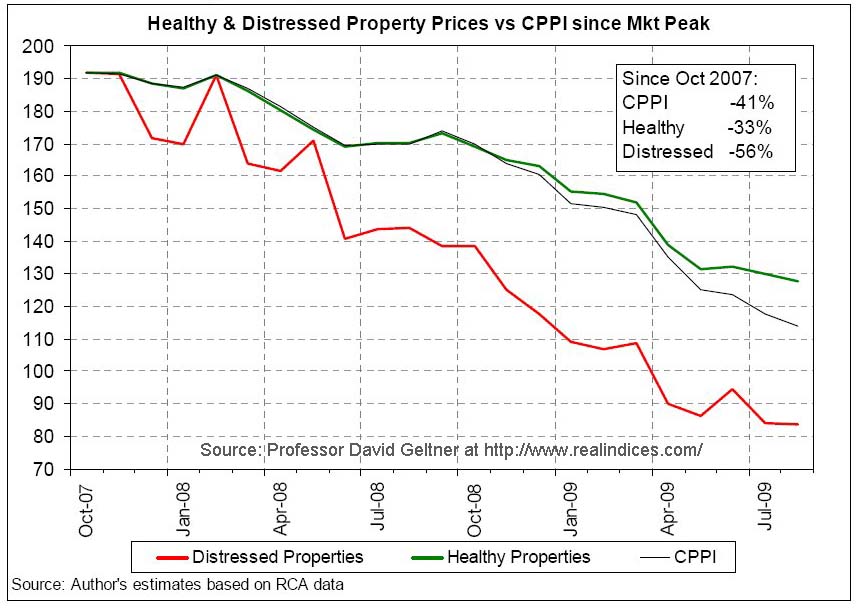

How deep have prices fallen on commercial real estate? Try 41 percent:

Unlike residential housing that has stabilized in terms of pricing because of trillions in bailouts, commercial real estate is on the way down. But make no mistake, the U.S. Treasury has been having off poorly publicized talks about preemptive bailouts in this market. Even without the talks, the Fed is willing to take everything and anything in exchange for Treasuries. While the residential housing market peaked in 2005, it looks like CRE peaked in late 2007. It looks like a two year lag is in the commercial real estate market and this is typical. These projects take longer to build and usually follow residential projects.

Rents have been falling and this has hurt real estate in Manhattan to apartments in Los Angeles. In many cases, you would think that a lower price for something is good but this is only reflecting a weaker American consumer that is confronting an unemployment and underemployment rate of 17 percent. We hear much about this jobless recovery but incomes are low, commercial real estate is a major problem, and the average American is seeing their view of the American Dream become more and more of a mirage. The only winner seems to be Wall Street.

David Einhorn from Greenlight Capital summed it up well:

“And the neighbors are angry, because at some level, Americans understand that the Washington-Wall Street relationship has rewarded the least deserving people and institutions at the expense of the prudent. They don’t know the particulars or how to argue against the “without banks, we have no economy” demagogues. So, they fight healthcare reform, where they have enough personal experience to equip them to argue with Congressmen at town hall meetings. As I see it, the revolt over healthcare isn’t really about healthcare, but represents a broader upset at Washington. The lack of trust over the inability to deal seriously with the party goers feeds the lack of trust over healthcare.”

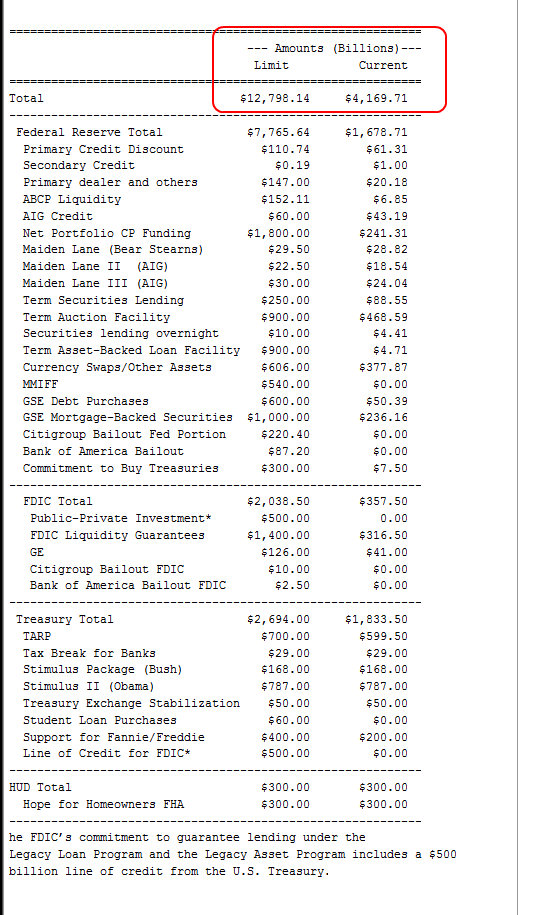

And this leads us to where we are at. When have we heard prolonged debates regarding commercial real estate or even the bailouts? We sometimes hear the plutocracy argument that we should have bailed out Lehman Brothers. Really? We should have a talk about why we didn’t let more firms fail.

From both parties we get estimates of healthcare reform between $800 billion and $1.2 trillion over a decade. Commercial real estate has 3 times that sum! Not one hour of airtime is dedicated to talking about this. The U.S. Treasury and Federal Reserve have backstopped nearly $13 trillion from the banking sector. The airwaves should be saturated on a daily basis talking about this and the other bailouts that were never fully vetted. Don’t believe it? Here is your bill:

If there is no resistance, we are going to have another major stealth bailout of the commercial real estate industry. The U.S. Treasury already has a nice name of “Plan C” for it. Next time you see those empty buildings keep in mind that you might be paying the mortgage on it pretty soon.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

Matt Anderson said:

I’m amazed that the multi-fam homes starts are down so much. Here in the Dallas area we are see some good starts with multi-fam, but not like the boom of the mid 90’s. With everyone strapped for cash and buyers not flooding the residential market I am surprised investors haven’t turned to the multi-fam side. With all the foreclosures and bad credit you would figure people have to live somewhere.

October 27th, 2009 at 7:19 pm -

Ken said:

>you would figure people have to live somewhere. . . .

There’s a multi faceted answer to that riddle. However, the saddest part of that answer is the number of people who simply become homeless. You could look into the number of tent cities springing up thourghout the nation, or the occupancy rates at homeless shelters in order to gauge the scope of the problem. There’s also a growing number of people simply staying in their homes after forclosure because the forclosing banks don’t have ready access to the necessary paperwork to effect a forclosure due to the securitization of the debt. I’ve heard that there are people who just pay the taxes and utility bills and have continued to live in the forclosed home for one or two years or more after foreclosure. And, many Sheriffs departments are now refusing to enforce evictions from foreclosed homes. That would be my plan ‘A’ should that happen to me. BTW . . . Go COWBOYS

October 29th, 2009 at 8:36 am