Economic Dependence on Real Estate, Finance, Insurance, Retail, and Construction. 3 Major Sectors of our Economy set to Decline.

- 0 Comments

The employment situation has quickly deteriorated as the credit crisis deepens and more and more Americans are quickly holding on tighter to their wallets. This isn’t necessarily pervasive to our nation alone as we are seeing globally people from many nations are starting to feel the impacts of this economic contraction.

The challenge of course is trying to determine where things will be heading or how low things will go. It is rather apparent that things are tough in the current climate. But how much of our country’s employment is truly based on real estate, finance, or even insurance? That is a challenging question to examine but I will dig up some data today to try to put an actual number on this.

I went through the Occupational Employment Statistics over at the Bureau of Labor and Statistics and found some startling numbers. It is one thing to understand that our nation has moved away from manufacturing and good producing jobs yet it adds a sense of perspective when we look at the breakdown of each sector.

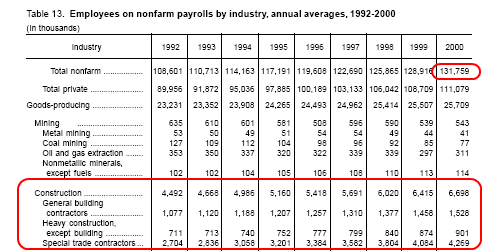

First, let us get a number of the employment workforce:

Total non-farm (Year 2000) = 131,759,000

Keep in mind the above number also includes part-time workers so the number is higher than that reported normally under the BLS monthly employment data. For the purposes of this article, we are simply trying to get an overall percentage of employment by select industries.  Let us now look at areas that will be impacted by this credit and housing contraction:

Construction = 5%

Â

Â

Construction employment makes up over 5% of all non-farm employment. This industry is one of the first to feel the pain of the current economic collapse. Real estate developers pull back and the first to go are construction workers. After all, if you are not building any new homes then what is the point of keeping workers on the payroll? These are normally higher paying jobs and have a larger impact on nationwide consumption. You also have to remember now that retail developers are starting to feel the pinch. Retail developers lag the market by 1 or 2 years. That is why you are now seeing companies that develop commercial real estate are starting to fall and fall hard. Why is this? These companies focus for the most part on developing around booming areas. For example, say a new housing development in Arizona is going up. Commercial developers make the assumption that the future population will need items from stores like Circuit City, Starbucks, or any other service industry. These are your strip malls.

The issue that happens with commercial development is that they start projects one or two years after the housing area started thus lagging the initial growth but trying to time population movements. But what if the housing area is a ghost town? Then they are developing retail space with no retail clientele. That is the next bubble to burst. The residential housing market has already seen much pain. The next sector to face equal pain is commercial real estate developers.

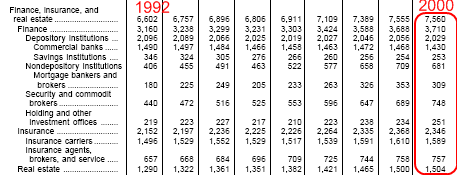

Finance, Insurance, and Real Estate = 5.7%

Â

The finance, insurance, and real estate side of business now makes up 5.7% of all employment. This number understates the boom of this decade. We can assume that it has gone up but the equal number of people being unemployed in this sector may serve as an equalizer.

This area is the one that will see additional devastating declines. First, take a look at how many are under the direct real estate category. 1.5 million people are employed in this category which includes agents. This area will face major job loses simply because home sales are falling by incredible numbers. Even if sales even out, many of these jobs are commissioned based and now that homes are much cheaper the eventual paycheck will certainly be lower for those still in the industry.

It is estimated that there are currently 8,500 FDIC insured banks. Some recent analyst and forecast have predicted failures of 40 to 50 percent. Meaning, we can expect a few thousand banks to go under. Much of this will come from the commercial real estate bust since the government is taking a heavy hand in the residential side of things trying to put a bottom on the market. I really doubt any bottom can be placed but their actions show this is what they are seeking. 3.7 million people are employed in this sector. Mortgage bankers and brokers may go by the wayside now that the only game in town is starting to be Fannie Mae and Freddie Mac. The insurance side of this area has 2.3 million employed. You need only look at places like A.I.G., the Hartford, and other major insurance players and you’ll understand that this sector will face future loses.

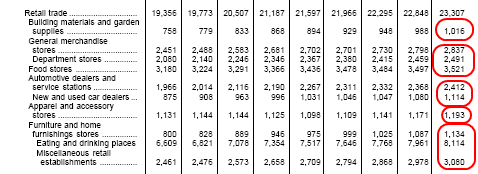

Retail Trade = 17.6%

Retail trade is usually the first place that lets people go.  But given that our society is consumption based this area has held out a bit longer than quicker falls in construction.  But this is now quickly catching up. Take a look at the recent bankruptcy of Circuit City, Mervyns, and the announcement that earnings are down 97% at Starbucks.  That is a major contraction on the retail side of things.  And keep in mind these are lower paying jobs here.  People are hanging by their nails here so a strong contraction here will tip the economy over into a severe and prolonged recession.

Many of these sectors rely heavily on finance and real estate. Â Take a look at how many people are employed in the auto industry. Â 3.5 million work at dealers, service stations, and in the car sales side of the equation. Â You need only look at GM and Ford to get an idea of what will be happening here:

These companies are trading at multi-decade lows. Â People are simply not buying not because they don’t want to but because they simply do not have the money anymore. Â You can also see that 8.1 million people are employed by eating and drinking places. Â Well people are now starting to eat more and more at home. Â You can see how quickly this is like one domino tipping over and impacting everything else.

Furniture and home stores? 1.1 million people and even some recent companies in California have gone bankrupt because people are simply not buying new and expensive furniture.  Need to make that bed last another year or hold out on buying a new sofa.

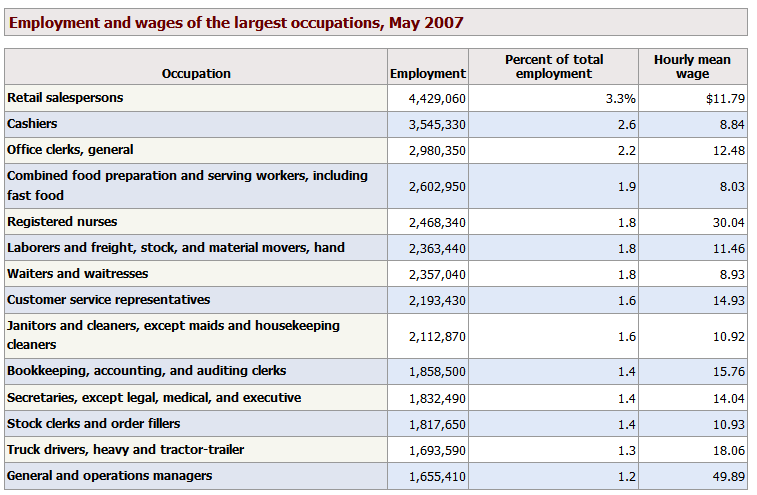

And just so you can see the top employment fields by actual job, let us look at another chart. Â Keep in mind this is a chart for actual job, not sector:

What you will quickly notice is the hourly mean wage is very low for these jobs.  I would say all the fields above are at risk aside from registered nurses.  Everything else, is going to see big job losses. Just look at how many people are employed in retail sales.

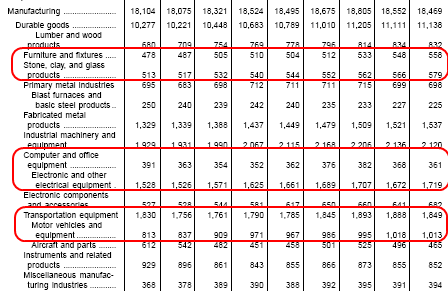

Manufacturing = 14%

We quickly mentioned that many people work on the service side of automobiles but take a look at how many are employed on the manufacturing side of the equation. We have over 1 million people working in this field so couple that with the service side and you have nearly 5 million American workers directly tied to the auto industry.  Take a look at the furniture side. We have nearly half a million people here.  Again, these fields will face major contraction because the American consumer is seeing their paycheck disappear or be squeezed down on a monthly basis.

Manufacturing makes up 14% of all employment.  Not a large number. And when you start breaking the numbers down, you see that many of these jobs are directly tied to the service side of industries that will be seeing less and less demand.  A poor employment picture is a recipe for demand destruction.

Putting the numbers altogether you can see that fields that will be directly impacted by this economic recession are anywhere from 25 to 30 percent of all employed Americans. Â Keep in mind that recent state budget short falls are going to require state agencies to lay many people off in that sector. Â This is the circle of employment and a severe recession will impact it all. Â All these industries are elastic and will stretch with the economic climate.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!