Fannie Mae Mortgage Portfolio: $64.5 Billion in Alt-A or Sub-prime Loans. Why This is not a Conservative Bailout.

- 0 Comments

As we inch closer and closer to a full fledged bailout of the two giant government sponsored entities, Fannie Mae and Freddie Mac it would be useful to dig into their financial statement to see how one of their portfolios’ is structured.  Unfortunately the general public is under the impression that Fannie Mae somehow operated only in the ultra conservative world of traditionally fixed 30-year mortgage products. Yes and no.

Most will be surprised to realize that Fannie Mae does have a sizable number of questionable loans.

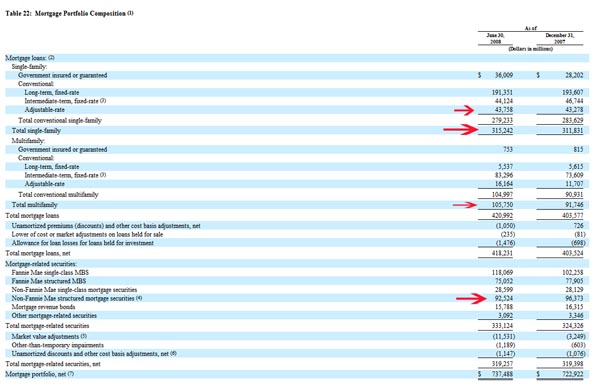

First, the net portfolio value of mortgages with Fannie Mae is $737 billion up from $722 billion since December 31 of 2007:

*Source:Â Edgar Online

Keep in mind that this includes mortgage backed securities as well that are pledged as collateral. First, let us go through a few important highlights in the mortgage portfolio:

Aside from popular legend, Fannie Mae does carry mortgages that are not traditional 30 year fixed products. In fact, the first arrow highlights that Fannie Mae has $43 billion in adjustable rate mortgages. Not exactly a 30 year fixed payment mortgage.

In fact, we spot $191 billion in the portfolio that is what we would call a conventional mortgage. So that brings our total to $315 billion in single family mortgages. The next point we should look at is the large number of multi-family loans in the portfolio. $105 billion in loans to be exact here. So again, not exactly a single family traditional 30 year fixed mortgage.

The last arrow points to the most alarming part. That is $92 billion in “non-Fannie Mae structured mortgage securities.” When we look at the footnote we find this:

“(4)Â Includes private-label mortgage-related securities backed by Alt-A or subprime mortgage loans totaling $57.8 billion and $64.5 billion as of June 30, 2008 and December 31, 2007, respectively. Refer to “Trading and Available-for-Sale Investment Securities-Investments in Private-Label Mortgage-Related Securities” for a description of our investments in Alt-A and subprime securities.”

Good to know out of the $737 billion portfolio, only 25% is what we would consider your typical 30-year fixed mortgage product. Don’t you feel better now?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!