Federal Reserve welcomes a Brave New Economy – how the Fed is robbing the public in open daylight. Maiden Lane Special Purpose Vehicles purchased toxic mortgages like option ARMs and commercial real estate.

- 0 Comments

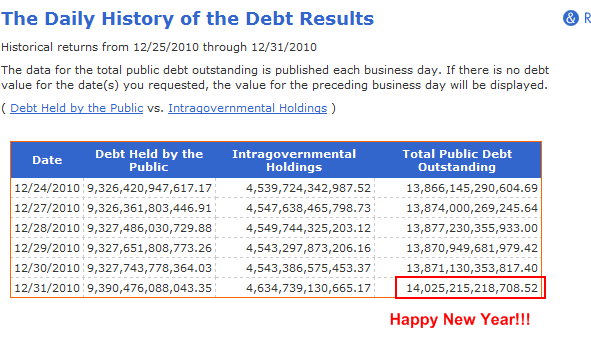

The global economy seems to be facing a Brave New World envisioned by Aldous Huxley where the world is operating under a command economy and all citizens are psychologically conditioned from to birth to value consumption. The Federal Reserve is the ultimate spend more than you earn machine. It is amazing that a few hours after the US national public debt crossed the $14 trillion threshold (yes, we crossed this line on the last day of the year) that this euphoria is setting in only because people spent money during the holiday season. “Ending is better than mending†is a platitude repeated in Brave New World. It would seem that with credit cards burning holes in wallets many went ahead and spent money they did not have this holiday season. The conditioning has been strong and has provided substantial distraction from the bigger heist committed by the Federal Reserve.

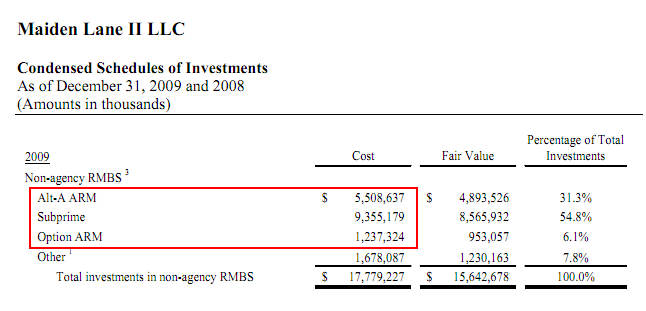

The Fed doesn’t even attempt to hide the fact that they are bailing out some of the worst toxic waste in the market. This was accomplished through many archaic mechanisms including the oddly named Maiden Lane Special Purpose Vehicles (SPV). Take for example Maiden Lane II:

Source:Â New York Fed

The above is from a report conducted in April of 2010. You would think that this data would be hard to find but the Fed and Wall Street is starting to come to the conclusion that they can simply create complicated names with weird acronyms and most of the public will be consumed with spending instead of mending. Just look at the above closely. This Maiden Lane is full of option ARMs, subprime, and junk Alt-A loans. This is the waste found in the financial sewers of Wall Street and here it is sitting on the balance sheet of our central bank. Not only is it sitting there, this data is publicly available and is a clear indication that the Fed has bailed out many banking institutions through shadow methods. They simply shifted junk from one entity onto the backs of the American taxpayer. It is interesting that BlackRock Financial Management is the manager of this SPV:

“BlackRock Financial Management, Inc. (the “Investment Manager†or “BlackRockâ€) manages the investment portfolio of the LLC under a multi-year contract with FRBNY that includes provisions governing termination. BNYM provides administrative services and has been appointed to serve as collateral agent under multi-year contracts with FRBNY that include provisions governing termination.â€

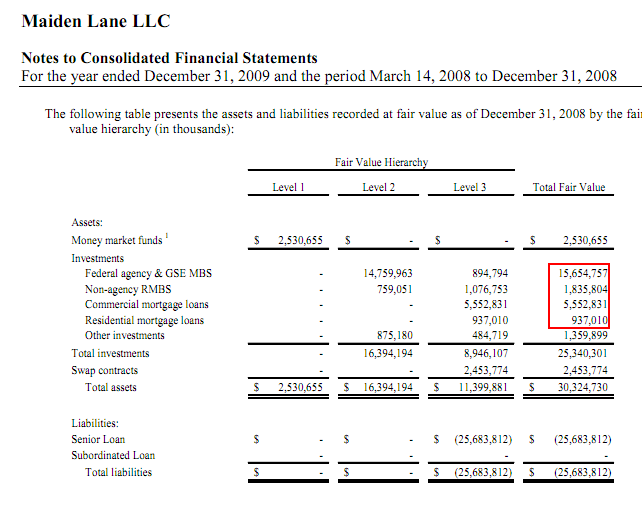

In other words, you have banks shifting junk from one garbage can to another and letting the excess expenses run off and pollute the average American either through dilution of their currency or creeping inflation. This is not the only Maiden Lane out there. We have others that are heavily leveraged with commercial real estate debt:

More toxic mortgage waste that was bailed out with no Congressional approval. This Maiden Lane is specifically setup for the Bear Stearns fiasco. Maiden Lane II was focused on waste run off from the AIG debacle. In the end the Federal Reserve is the waste management solution for the banking industry using the American taxpayer as the filter to wash off the financial sewage of Wall Street and their years of bad gambles. They do not even bother to hide this since this is all accessible from the New York Fed website. Of course what they do hide is the larger trillions of dollars that are currently sitting on their balance sheet.

While much of this junk sits in ruin the stock market seems to have forgotten about this and is bursting upwards and has taken a pill of soma:

Source:Â Bloomberg

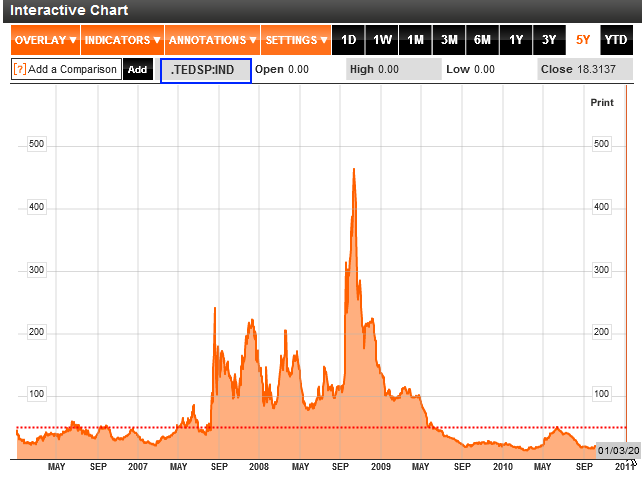

The above is the TED spread which reflects the difference in interest rates between interbank loans and short-term US government debt. A lower TED spread reflects lower credit risk in the economy and as you can see during the crisis months the spread went to 465 basis points. Today it stands at 16.69 which is lower than the days prior to the economic crisis and when the stock market peaked! In other words, forget about the European debt problems or the $14 trillion in US national debt or the fact that many states are facing bankruptcy. Things are looking up just because people shopped a bit during the holidays with credit cards. Keep taking that financial soma.

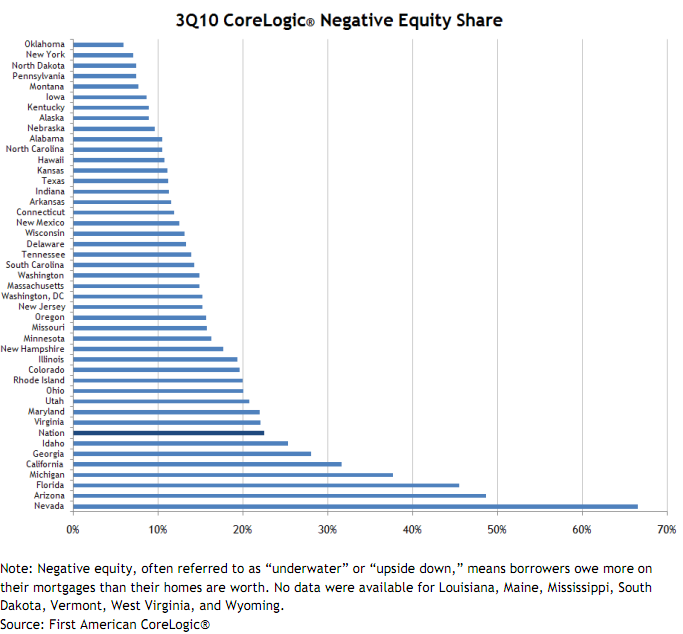

The amount of bad debt banks have is still incredible. Look at the amount of negative equity in the US still looming in the ether:

The banking system is largely insolvent and the FDIC is trying to put out a forest fire with an eye dropper. As long as people can collectively pretend things are fine then the system can go on for a bit longer. This is why the Fed can publish data like the above which frankly is outrageous and outright robbery yet nothing is done about it. Our politicians need to protect the financial interest of the people yet with so much money tied up in the political arena the interests of Wall Street are first and foremost. That is why we have 17 percent unemployment and underemployment and 43 million Americans on food stamps. At the same time Disneyland over the holidays set a park record for attendance. Just like the questionable assets in these SPVs, the Fed and Wall Street are trying to figure out another method of putting the horrible employment and wage stats of average Americans into a SPV so the media can keep feeding the public a line that all is well.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!