Federal Reserve Paying Interest on Excess Reserves: Why Lend when you can Earn Interest for Holding on to Funds with Low Risk? The U.S. Treasury and Federal Reserve Walking a Tight Rope.

- 2 Comment

One tiny announcement made by the Federal Reserve back in October of 2008 is finally making some noise in the dark corners of the internet. What the Federal Reserve announced at the time was that it would begin paying interest on depository institutions’ excess reserve balances. Now why this is important is that it offers a differing perspective on why banks are holding onto money tightly. Initially it looked like banks were holding off on making additional loans because of the fear that was permeating through the market. The U.S. Treasury and Federal Reserve tossed all they could at the market in the form of liquidity and this has caused the stunning 50 percent stock market rally since the March lows.

Why this is important to understand is that it helps to focus on an otherwise black box of important information. The idea that consumers will not borrow is only true if they are held to some form of standards (i.e., jobs, income, etc). Remove those and people will borrow and spend as the cash for clunkers program has demonstrated. And the question of why banks are holding off so much in excess reserves is that of the interest rate. Why would you lend money if you can keep it socked away risk-free and earning interest? This notion needs to be explored with a simple example. If the Federal Reserve jacked up the interest to 20 percent there would be virtually no lending because banks would simply hold on to reserves and earn risk-free interest. But paying the interest rate theoretically gives the Fed some room to navigate. How so? Well they can technically pay zero percent on reserves and thus force banks to find some form of lending to make.

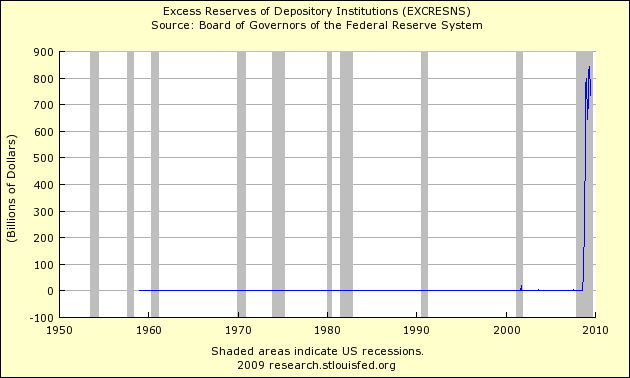

Let us take a look at the excess reserves picture:

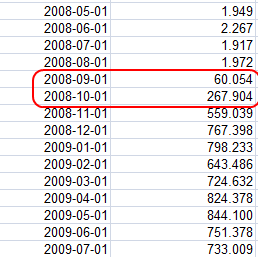

It is fascinating to look at the data even closer because you can see once the policy was announced, excess reserves spiked up at the same time:

Now it is a mix here between crisis and interest. Clearly the large majority of reserves occurred because of Fed liquidity and backstops but also, the interest rate clearly had an impact and probably has a longer term impact for what will occur. Now the idea of course is that the Federal Reserve will ideally lower the rate on member banks as the crisis ebbs and slowly lending will filter through the economy in some form of controlled inflation. But as we all know, institutions like Goldman Sachs have better ideas than the petty interest rate and have done well in the crisis despite the fundamentals of the economy being mired in problems.

As long as the interest rate is high enough in terms of market risk for member banks, the excess reserve will remain high. Many banks don’t have the trading wherewithal (and political connections) of a Goldman Sachs. Yet one major issue of course is whether member banks would want to lend this money to the consumer or simply use it as free subsidized gambling money for the stock market casino? Given the pulling away of 8,000,000 credit cards and interest rates being jacked up, the average consumer is seeing no benefit. And with banks like Wells Fargo and Bank of America offering near zero percent rates on savings accounts, the banks seem to be the only folks with access to free flowing capital. It is also the case that banks have detailed knowledge of their balance sheets including future bad debt that may require usage of some of the additional funding.

The Fed has been running the printing press as we all know:

The velocity of money has slowed in the current economy. That is, the average frequency in which a unit of money (say the dollar) is spent in a specific period of time. This is important in actually seeing if there is risk of inflation. Take for example the following:

Economy with 2 institutions and $50 of money, a home builder and supermarket:

-The homebuilder buys $40 worth of food from the supermarket

-The supermarket spends $50 in adding a new room with the homebuilder

-The homebuilder buys $10 worth of sodas from the supermarket

So in essence $100 of money changed hands in this timeframe. Assuming this is all that took place in one year, the velocity was 2 / yr. Now why is this important? The actual amount of money exchanging hands is important and keeping funds in excess reserves doesn’t allow it to be free in the economy. The problem is whether there is enough real activity in the market to justify further lending (especially with a high unemployment rate). The only reason we are allowed to do this is because the U.S. dollar is still a reserve currency. Can you imagine the other side of the coin? Imagine a new country called Spendville. This country spends nearly all their money and saves virtually nothing. Would you invest your money there? Maybe. If the interest rate were set high enough possibly. That is what occurs with emerging markets. But in this case, Spendville is the U.S. but we have the reserve currency. Yet China and other nations are starting to voice their concern. What is certain is if we keep our same path, the interest rate will have to rise to compensate for the added risk.

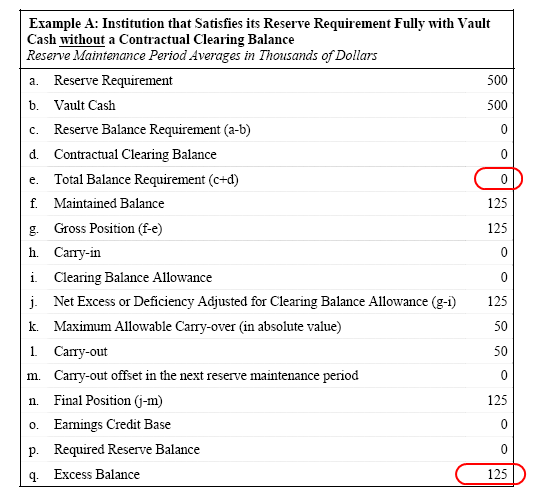

The Fed gave us a nice example of this back in October of 2008:

I would love to see what kind of assets current banks are valuing at these levels to quote off their excess reserves. It would be fascinating to see a breakdown of which banks have the highest excess reserves. Think we have any luck getting that breakdown?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Paul Revere said:

>>>>>>>>>>>>>>>>>>> WITHOUT this site YOU will be BLINDSIDED by WHAT is COMING!!!!!!!—-> http://www.infowars.com <— GOOD LUCK Brother , You are going to need it when you SEE and HEAR what this admin. has planned FOR YOU!!!John3:36!

August 25th, 2009 at 9:24 am -

flow5 said:

Excess reserves are not the same as the name implied in 1920. The name is outdated and no longer meaningful. Today an increase in the renumeration rate for excess reserves and required reserves acts exactly like raising reserve ratios would. An increaase in either reserve ratios or the renumeration rate increases the volume of idle reserves or in the bank’s unused lending capacity. These reserves are now the bank’s earning assets and belong in the bank’s secondary liquidity reserves category. They are no longer primary reserves or cash assets. They do not belong in the same category as “cash assets” on the H.8 release.

September 14th, 2009 at 2:46 pm