When the financial clock strikes zero – Half of Americans pass away with nearly zero wealth. The middle class has contracted by ten percent in the last 40 years.

- 2 Comment

A recent study demonstrates the precarious financial position many Americans find their lives in. The National Bureau of Economic Research found that nearly half of Americans pass away penniless. The exact figures were sobering stating that many of these Americans end up with no financial assets including home wealth and typically rely heavily on Social Security. This study points out a couple of important items regarding the state of the economy for many families. Many simply cannot save and end up relying on external funding. The system is witnessing heavy strain on these sources at a time when government spending is off the charts for bailouts and other targeted spending. Yet the typical American is still ending up in a financially precarious state. In the last four decades the middle class has contracted by ten percent. What does it say about the economy when half of the inhabitants of the wealthiest country pass away with almost no wealth?

The shrinking middle class

It is troubling to see that the middle class has contracted hand and hand with the reshaping of our FIRE driven economy and dismantling of the manufacturing sector:

Source:Â CNN Money

Yet the upper-income group also increased during this time and income inequality is at its highest level ever. This is another statistic that demonstrates the growing disparity in the low wage capitalism economy that is emerging. The fact that 46 million Americans are on food stamps is startling. So the data on the study is fascinating showing that half of the country will reach the end of their lives with little to their name:

“(NBER) We find that a substantial fraction of persons die with virtually no financial assets – 46.1 percent with less than $10,000 – and many of these households also have no housing wealth and rely almost entirely on Social Security benefits for support.â€

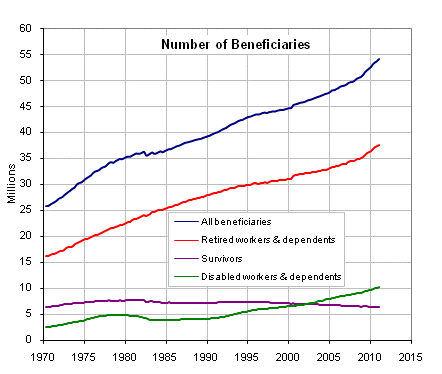

The heavy reliance on Social Security is telling. As our national debt reaches nearly $16 trillion the costs for items like Medicare and Social Security are set to soar. Keep in mind this is coming at a time when young Americans, those that are largely paying into the system to keep funds flowing, are much less affluent than their parents.

Low wage and temp work

The number of Americans in low wage jobs is increasingly high. We are seeing that the days of any sort of job security are out the window. Many are now contending in a fast paced economy where little protection is offered to frontline workers while the select few with big wallets can protect their wealth via political bailouts.

The notion of the Horatio Alger story is largely a giant dream, sort of like hitting the lottery. Most Americans think that a little bit of hard work and sweat will make you into a millionaire. A recent study shows some data on this mobility in our country:

“(Pew Research) Americans raised at the top and bottom of the income ladder are likely to remain there themselves as adults. Forty-three percent of those who start in the bottom are stuck there as adults, and 70 percent remain below the middle quintile. Only 4 percent of adults raised in the bottom make it all the way to the top, showing that the “rags-to-riches†story is more often found in Hollywood than in reality.â€

This tells you that many will continue to rely on things like Social Security once they reach retirement and this number is not going down:

The economy is splitting up into two clear fields. Those that are in the growing smaller middle class and lower income class and those that are pulling away. Half of Americans will end their days penniless so young Americans in many cases need not worry about an inheritance.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Hillary said:

Those are interesting figures. I am fortunate to come from a family that worked hard for they got and were smart with what they had. That being said I don’t think I would ever want to rely on the government to have to take care of me. I will find a way no matter what. Because you should be able to rely on yourself.

September 3rd, 2012 at 9:38 am -

mike said:

^ That attitude is precisely why so many folks vote against their self interests. If you want to “rely on yourself”, do so–on a desert island. The rest of us are part of a civilization and society that functions through interdependence, and not Randian fantasies of self-bootstrappitude.

October 16th, 2012 at 3:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!