The financial disaster of continuing to bailout commercial real estate through the shadows of Federal Reserve jargon. Why you haven’t heard of this trillion dollar bailout.

- 2 Comment

The media has done a fantastic job painting over the enormous sinkhole of a problem that is commercial real estate (CRE). U.S. banks hold over $3 trillion in commercial real estate loans on properties that were once valued at over $6 trillion. Today those values are down to roughly $3 to $3.5 trillion depending on what metric you believe. How is it possible for a market that has lost $2.5 to $3 trillion to become largely hidden in the dark from the mainstream media? We constantly hear about $3 billion deficits or other issues but is the trillion dollar figure just so enormous that they don’t even bother investigating? It is probably more likely that the Federal Reserve has concealed massive failures in CRE by allowing banks to play a game of extend and pretend that continues today. The shadowy problems of empty shopping centers, vacant car dealership lots, and misplaced strip malls is largely a taxpayer problem now. Banks made these irresponsible loans but had the Fed hand over taxpayer loot in exchange for worthless real estate.

“Another empty strip mallâ€

CRE bringing down FDIC banks

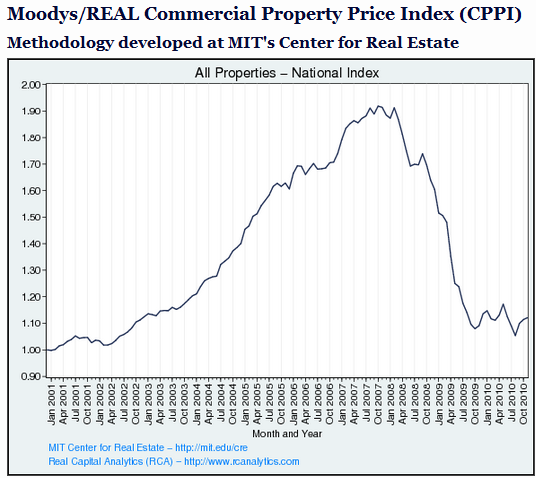

Source:Â MIT

CRE values are still hovering near their trough and are likely to move lower. The only reason these prices haven’t moved lower is because banks are more generous with the borrowers of CRE debt since these holders are grappling with multi-million dollar cuts in each deal. Banks would rather pretend a mall is valued at $100 million instead of marking it to a real value of $40 million or less. The fact that the Federal Reserve allows this to happen is financial chicanery. Can you pretend to the government that you really don’t make $100,000 a year so instead you will act as if you make $30,000 a year and act accordingly? This is what is happening here. Banks are essentially allowing these toxic loans to be laundered through the system in exchange for taxpayer dollars. The Fed is betting that the public doesn’t wake up to this scam.

CRE is a giant and pernicious problem. With residential real estate it hits directly home and many American families are considered home owners. This bubble has garnered most media attention as it should. Yet CRE debt is enormous, larger than every state budget deficit combined by many times! In fact, the losses on CRE loans is larger than the state budget issues. Of course the Fed wants the public to look away from the real culprit behind the decline of the American middle class. The scheme was to build junk and pawn off the loans to average Americans whether they wanted to accept the debt or not.

The cost of CRE problems

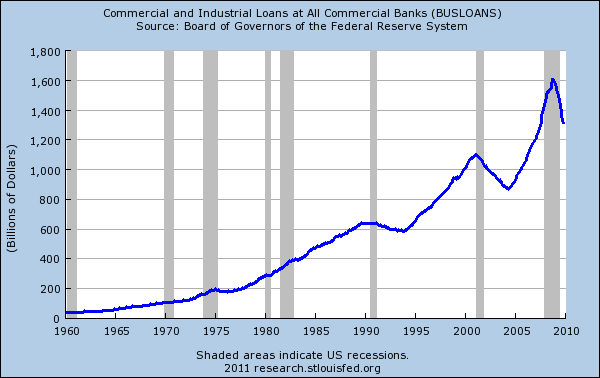

Banks have no faith in this recovery. Look at the above regarding commercial loans. Banks continue to claim that the reason for the taxpayer bailouts was to help the American public weather the economic storm and for banks to continue lending to average Americans. Instead, as you can see above, commercial loan lending has collapsed and banks have hoarded money and speculated on the stock market casino on the taxpayer dime. This money was used to shore up bad balance sheet problems and for gambling on the stock market to boost profits. In short it was one giant swindle perpetrated on the public.

And think about the supposed recovery we are experiencing. If we were truly growing and expanding don’t you think there would be healthy demand for loans as businesses expand their workforce? Wouldn’t it be logical to conclude that commercial loans would reflect the supposed increased demand from a booming American economy? Of course the only boom occurring is for the top 1 percent who are siphoning off the wealth from average Americans to spin their continuing speculation in the stock market. Many are starting to wake up from this collective sleepwalk where taxpayers were robbed in open daylight.

The problems are coming up

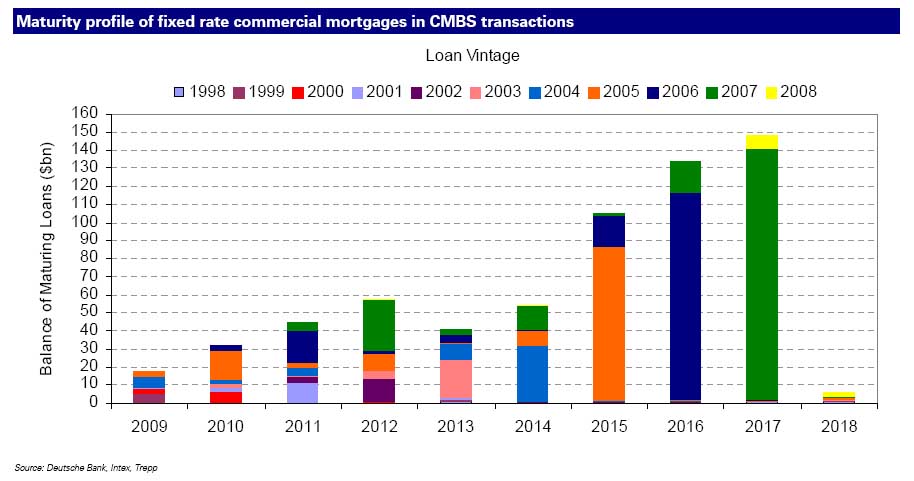

Source:Â ZeroHedge

What is even more problematic is many of the CRE loans are going bad in the next few years. Just like residential real estate is now experiencing a second collapse, CRE will have another move lower. Banks can only carry fantasy paper for so long. So far we have been paying for it through QE1, QE2, TARP, and other convoluted programs to launder money and devalue the U.S. dollar and decrease the quality of life of average Americans. The public did not sign up for this. The banks talk about shared responsibility and many are paying for it by losing their homes and going bankrupt. Millions are facing this economic “responsibility†on a daily basis. What penalty for the banks? Instead, they get bailouts and continue to pretend the junk loans they made on concrete disasters are worth inflated values only to shovel them off to taxpayers. How is it that there are no buyers for these supposedly highly priced items?

CRE debt exposes the worst aspect of the bubble. Pure profit motive by supposed sophisticated investors on both sides of the coin with no financial responsibility or ownership. This isn’t some poor family in a low-income neighborhood taking out a subprime loan. This is actually a supposed responsible bank and a supposed financially savvy investor. There is no justification for one penny of a bailout here. Yet the Federal Reserve continues with their hidden bailout where they support malls in Oklahoma to Chick-fil-A. Don’t expect to hear about this on your nightly news.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

mybudget360 said:

test

February 23rd, 2011 at 10:02 am -

surfaddict said:

Commercial property loans have much higher downpayment requirements than residential. So theoretically, there should be cash at the institutions to the tune of around 50% of the outstanding loans. Did they spend it?

February 23rd, 2011 at 4:40 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!