Financial Independence, Retire Early: The FIRE Movement.

- 3 Comment

I’ve been intrigued by the Financial Independence, Retire Early (FIRE) movement for many years now. There have been a few camps of thought when it comes to retirement. (1) You have those that say save very little of your paycheck and put it away in a 401k for 30 or 40 years and then you will have a nice nest egg when you retire. (2) You have those that don’t save and work until they die and heavily rely on Social Security – a larger number of Americans than you probably would think. (3) The wealthy that simply watch their money grow. (4) The FIRE crowd that earns well but lives frugally and stashes away a lot of money in order to accelerate their financial independence. We’ll focus on number four for this article.

The FIRE movement

The FIRE movement is nothing new really. You have books like Your Money or Your Life that really focused on living a good life and tried to instill the value of money and time and that with savings, you could purchase more time in your life to pursue worthy life goals. The initial book came out in 1992 so again this isn’t a new idea. However, there is now a massive number of people that aspire to the FIRE movement. The goal isn’t necessarily to retire early but to have a financial buffer to pursue other life goals and possibly choose a career you love but maybe doesn’t pay well or to alleviate the pressure of having to live paycheck to paycheck even with a high salary. You also have many FIRE adherents practicing geo-arbitrage – earning big bucks in say Seattle or San Francisco and then “retiring” in low cost of living areas.

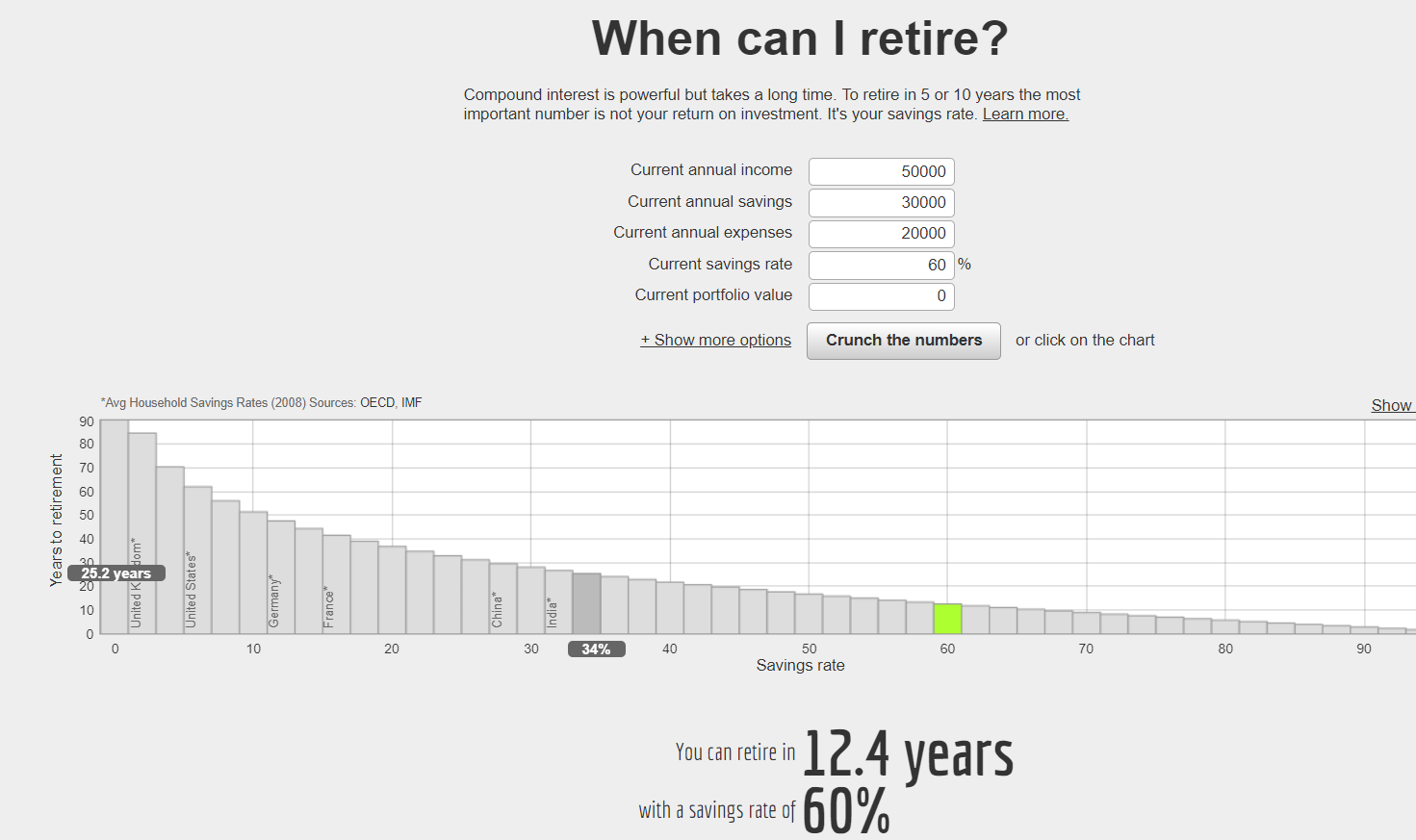

There are now calculators that focus on this movement:

Instead of saving the recommended 5 or 10 percent recommended by many financial advisors those in the FIRE movement save half or more of their paychecks and cut back on many excesses of our consumption based economy. The goal is to essentially cut your “working†years from say 30 to 40 to something like 15 to 20 (or less in some of the cases online). Of course in many cases those that follow the FIRE movement are in tech and have higher earnings compared to your average American. But your typical worker can always benefit on smart budgeting and investing.

The movement has grown and has now taken some criticism as well. Part of the criticism is people don’t understand the full tenets of the movement because there really isn’t a monolith here. Some save a ton of money and actually stay at their jobs but gain more confidence and take on different roles because they now have the added buffer of a safety net. Many leave high pressure jobs to pursue goals such as spending more time with family, volunteering, working out, reading, or joining larger social groups. Because the trend is so large, of course you will find criticism.

The stock market trend

There is also the pesky issue that the stock market is in a 9-year bull run. Many new FIRE adherents only know a good economy and a booming stock market. What happens when you have a 10, 20, or 30 percent correction? Forget about maintaining the course with your investments when this happens, you are probably trying to keep your career going.

So the FIRE movement has a lot of good going for it. It is definitely better to consume less and save more.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!     Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!     Â

3 Comments on this post

Trackbacks

-

Abdul Bilal said:

I love your articles. I’ve been waiting for months for you to post another article and finally it’s here! I thoroughly enjoy your financial articles and I gain much insight from them. I hope you continue to write them as they are a source of wisdom and understanding in a world which distorts the financial reality of many.

November 6th, 2018 at 6:23 pm -

Rachel said:

I love this site and hope you will be able to post a couple times a week, I have been reading faithfully for just under 3 years and am glad to see your take on FIRE. For many Americans, saving even 20 or 30 percent of their incomes is not possible and just as you point out, many people who are on FIRE have well above average American’s pay to begin with with is a massive head start. I think the critics may just want to keep the flow of worker bees going despite FIRE clearly being the best thing for those who can make it happen.

November 7th, 2018 at 7:44 pm -

gammer said:

Good article, bottom line is live below your means. This is a hard lesson for most people. The main reason is Envy and Covetousness. We have not learned the lesson of our grand parents and it appears that we will be condemned to repeat their mistakes.

There are also many more ways of saving and growing your money than the stock market. Obviously cash is king and most fluid, stocks and bonds next, then real estate, rentals and others. Spread your savings around, do not put it all in one basket. I am about 1/3 in real estate, 1/3 in stocks, 1/3 in cash at the moment. Looking for more rental real estate as the prices drop. Interested in building my own if the prices dont come down enough.

January 25th, 2019 at 7:43 am