The Global Pension Nightmare – Global pension underfunding will be $400 trillion by 2050.

- 6 Comment

Apparently good things do come to an end. The global pension outlook is looking bad and a large part of this stems from people living longer and simply not saving enough while they work. There are some major problems on how pensions are structured and the US, the wealthiest nation in the world is shifting to a “work until you die†retirement plan. And this is for the richest nation so you can imagine how things look in other countries. Most people continue to ignore these massive problems but it is hard to miss the fact that by 2050 global pension funds will be underfunded by $400 trillion. Does this sound sustainable?

The global pension problem

There are some major reasons as to why this problem is occurring. For one, long-term growth has slowed and returns are simply not looking great. Many pension funds have optimistic return rates that are just unsustainable. We are in a lower return market.

Another issue is that people simply do not save enough for retirement. In the US half the country is living paycheck to paycheck. The recommended savings rate is 10 to 15 percent of annual salary but that just isn’t happening across the board. With the shift from defined benefits to 401k casinos, people are now left with virtually nothing for retirement (outside of Social Security).

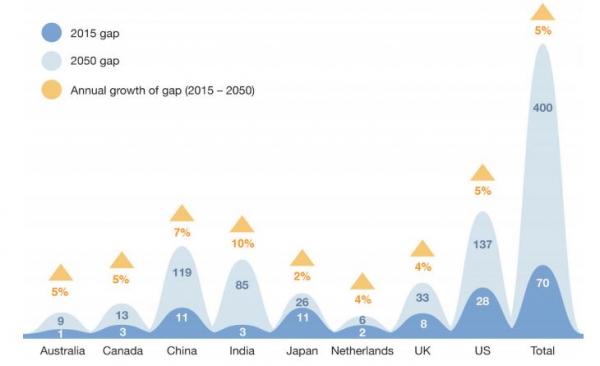

Take a look at how underfunded global pensions are:

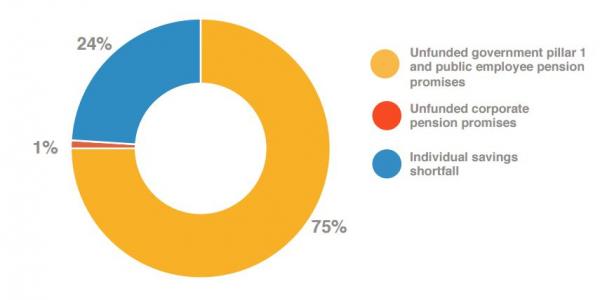

This problem is only going to get more pronounced. This of course has to do with people living longer and the fact that globally we are entering into a slower growth phase. You can see that by 2050 pension obligations are going to balloon to dramatic levels and it comes from this:

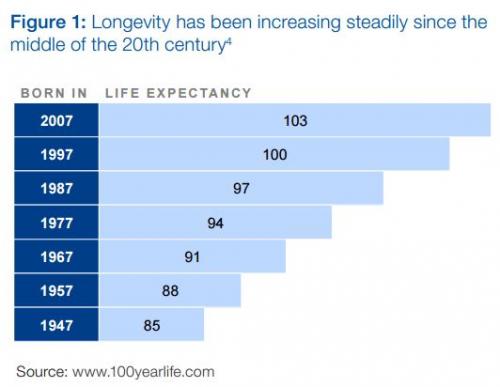

What does this mean? For those with pensions expect lower payouts. For those without, you need to start saving if you are able to do so. Because overall people are living longer:

Is this a good thing? Sure if your quality of life is up to par, but we know that as we age the cost of healthcare just goes up as our biological bodies deteriorate. In the US people are simply walking closer and closer to the financial edge and are gearing up to dive off it with no parachute.

The American pension system has slowly disappeared since the early 1980s and has been replaced with 401k style investment options. Now, nearly 40 years later, that change shows that the vast majority of people just don’t put money away on their own. Hence, nearly half of the US elderly rely fully on Social Security as their primary source of retirement income.

We need to think about what this will mean when low wage jobs dominate the landscape and the middle class is now a minority. Are we ready to deal with a $400 trillion underfunded pension system globally? And this of course is assuming that we don’t hit any type of recessions or crisis in the next three decades. How likely is that?

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

6 Comments on this post

Trackbacks

-

BeenThere said:

You’d have to be crazy to count on getting your full pension promises at retirement, they are nothing but lies based on impossibilities. Most be lucky to get half their monthly payout amounts.

Best bet is save on your own, live modest lifestyle, by real estate for rental properties. Real estate is about the only investment you can make money on and not get taxed to death on or pay any income taxes on if you do it right. The stock market is casino and risk is way to high, price discovery doesn’t exist anymore.

Have everything paid off when you retire or before if possible (I already do at 43, zero debt and live in $430k house in FL). The biggest what if for retirement is healthcare in the US. The healthcare system is a fraud price gouging people 5x and way more then costs in other 1st tier countries pay if you pay cash even. Might have to join a healthcare share group if they have them in your area. Or travel overseas for care and pay cash. Exercise and eat right take care of yourself and stay in shape to help mitigate needing healthcare.

If everything paid off retiring with only $500k very possible, don’t believe all the BS way over shooting financial advisors. Personally shooting for having $2 million then retiring, should happen by time I am 50-54 years old. Have $1.1+ million now (not counting primary residence). Good luck wish everyone the best, don’t work more than you have to life is short and there are so many wonderful things to see and do!!!

July 28th, 2017 at 5:55 pm -

Princess Luna said:

They’re simply going to print the money, which will cause massive inflation. Sure, you’ll get your $1,700/month pension, but it will be worth about $170 thanks to inflation. Either that or they’ll give pensioners $0.10 on the dollar and get massive riots. I guarantee you they’ll choose the inflation route because it’s the path of least resistance and most people are too stupid to be able to figure out what’s really going on. Inflation is the “invisible” tax that the government puts on all of us.

July 28th, 2017 at 8:13 pm -

roddy6667 said:

“With the shift from defined benefits to 401k casinos” ???

There is nothing “gambling” about a 401K. The biggest failure has been the failure of the average worker to put money into his own retirement fund. The shift from defined benefits avoids all this. It is a forced savings plan-the worker does not get to be lazy or short-sighted and not save for retirement.

Two problems with pensions. Lack of government oversight allows unreasonable rates of return to be used in projections. Corruption in government is the problem here. Even an honest, attainable pension rate makes the employer responsible for forecasting the economic future, something that is not in their field of expertise.

Why not use a lower than expected rate and let any extra accumulations be a windfall to the retiree?July 28th, 2017 at 10:45 pm -

Perplexed Pete said:

Only 5% of all “money” is cash. The remaining 95% exists as digital blips in the hard drives of the banker’s computer. All “money” is created out of thin air when bankers make loans. Bankers charge you interest for loaning you something they never had! Most people toil away decades of their life repaying interest for imaginary loans. We are all debt slaves.

It is true that the US Treasury creates the coins and paper currency, BUT this monopoly money is sold to the bankers for the cost of production. For example, the bankers buy $100 bills from the US Treasury for about twenty cents each. Only bankers release cash into circulation; never the US Government.

The US Government funds itself from two sources: taxation, and borrowing. All borrowing is from the “Central Bank,” called “Federal Reserve.” The “Fed” creates unlimited money out of thin air to loan to the government. The “Federal Reserve” is privately-owned by the bankers, and acts as a credit card with an unlimited balance.

The purpose of the banker-owned “Fed” is to keep the government buried in debt. This way labor and wealth can be stolen from the people by “taxation” in order to pay the interest to the bankers on the imaginary loans. Much of the income tax collected by the government is used to pay interest on the “National Debt.”

Bankers have grown so rich from this scheme that they are now multi-trillionaires who effectively own most of the resources of the world. The ultimate source of their wealth is parasitic theft through deception.

As you can see, the money system is a legalized-counterfeiting, debt-enslavement scam. The distortions caused by this scheme cause inflation and the boom-to-bust business cycles. These truths have been hidden from you by the news media, Hollywood, politicians of BOTH parties, public schools, colleges, and courts, all of which are largely controlled by bankers.

Can you imagine a world without inflation, income tax, national debt, business-cycles, and predatory lending? Surely peace and prosperity would increase while poverty and suffering would be diminished.

Please help spread this message by cutting and pasting in other comment sections and anywhere else you can think of!

August 4th, 2017 at 8:07 am -

CJS said:

Pete said: “The purpose of the banker-owned ‘Fed’ is to keep the government buried in debt.” True. Pete said economy is 5/95% mixture of government created to bank created money. True. That mixture is like matter and anti-matter mixture. The bank created money is debt that will not exist when the debt is paid. Understanding that, maybe a person can conclude that the debt cannot be paid? There is not enough government created money to pay the bank created debt. So when the economy crashes and people default on some of their debt, an amount of that bank created money ceases to exist by default, and deflation occurs, prices drop, income streams are interupted, and the promises to pay you (retirement funds) become questionable. If the bond market is a bubble, and bond prices rise to facilitate borrowing, and there are no buyers of bonds … then everything falls. I try to not imaging what a black swan can do to Americian life.

August 17th, 2017 at 7:35 pm -

lorungee said:

How much is enough ? How much are you going to save for a 401k, when you are making 10/14 $ per hr. Your rent is gonna take almost 50% of after tax income. Your taxes of all different types, will soak up between 20/25% of pre-tax income. Then there is your car note, utility bills, water bills, (which average 200 dollars by themselves every quarter). Oh….let’s not forget groceries, court “judgements” of different kinds, fines and penalties of different kinds, “fees” of different kinds, and my greatest bug-a-boo……lousy and costly insurance…..of all different kinds. After every entities hands are stuffed with your cash after payday/pension day, you’re broke.

August 29th, 2017 at 7:35 am