Government Tax Receipts Down 20 Percent Year over Year: Wall Street Banks Earning Billions. The Unsustainable Economic Course.

- 0 Comments

The Congressional Budget Office puts out a long term analysis examining the economic health of the United States each year. In major recessions like the one we are in right now, these reports provide a projection into the future but the most important indicators like taxes are in a state of flux. It is also the case that we have never spent so much money with bailouts and fiscal stimulus in a time of peace. The U.S. Treasury and Federal Reserve are betting it all that their actions will stabilize the economy. Wall Street has stabilized but the employment situation is still up for debate. Yet looking at the report it is clear that the bill is coming due. Either we increase taxes or cut spending. I’m not pushing one or the other but this is a basic math problem here.

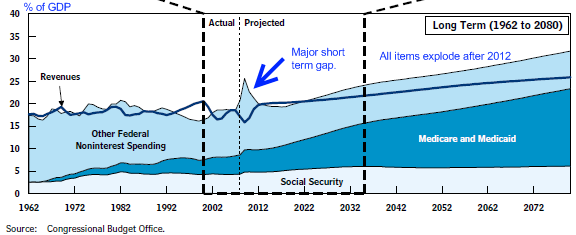

Let us take a look at the projections as put out by the CBO:

Notice that quick spike in “Other Federal Noninterst Spending” which shows the current bailout programs and fiscal stimulus. Largest spike in government spending on the chart so this should tell you the magnitude of the current recession. It is also the case that revenues are falling rapidly and that trend has not reversed. Spending is up and tax collections are down. You can tell that after 2012, the entitlement programs are going to grow at an exponential rate. We really aren’t dealing with these issues currently. At the moment all measures are focused on that blip on the chart in attempting to stabilize the economy.

I agree that the economy needs stabilization. But bailing out the banking industry with $12 trillion in explicit back stops was not the way. The FDIC has a reserve fund that is at zero and it backs up over $9 trillion in deposits. Is it smart to give this industry the right to $12 trillion in taxpayer money when clearly the CBO shows other important expenditures? Probably covering the savings of depositors is fine but this is a minor issues. Did we need to convert Goldman Sachs and Morgan Stanley into banks with easy access to the Federal Reserve? The bailouts focused on toxic debt like residential mortgages and the coming $3 trillion in commercial real estate problems.

From the chart above, it is also clear that the CBO expects income to shoot back up rather quickly and once again regain a steady course for the next 5 decades. Clearly these are rough estimates. Let us look at the latest balance sheet report from the U.S. Treasury:

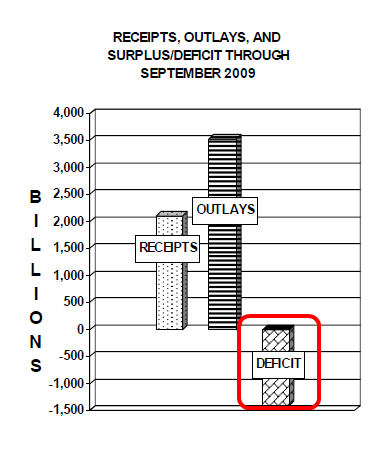

In other words, we are spending a gigantic sum more than we are bringing in. Now this isn’t something new for us. We have been doing this for years. Yet the magnitude of the current spending is enormous. If we really want to get a sense of the actual revenues and spending let us look at the U.S. Treasury monthly report:

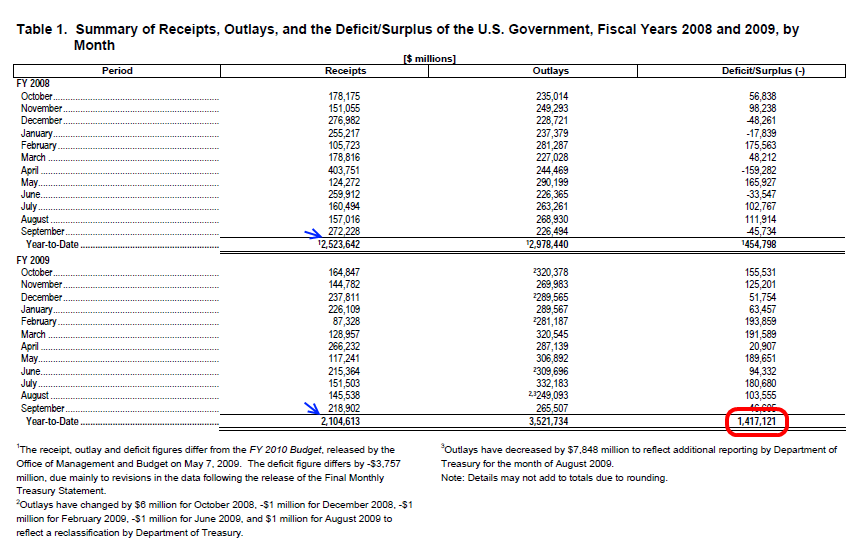

This is where the big recovery talk is lost on many. Last year in 2008, September was a horrible month for us. The entire year was troubling but September was a tipping point. With that said, the government managed to pull in $272 billion from U.S. taxpayers.

Now with the supposed recovery and all the bailouts, how did the government do in September of 2009? The government pulled in $218 billion or a year over year decrease of approximately 20 percent. This is enormous. Yet when we are hearing about all these record banking profits clearly the money isn’t going back to the government even though taxpayers bailed out these institutions. This is a major recession and the balance sheet of the government reflects this.

Look at the year to date deficit above. We are running a $1.4 trillion deficit. Just incredible in terms of how much we are spending yet on the tax side, the government is still not collecting enough revenues to cover current expenditures. That is why some things will shift in the next few months. Either taxes will go up or spending will need to be cut. This pace is unsustainable.

Raising taxes on everyone is not a smart move. Just look at California. It raised sales taxes, a largely regressive tax on everyone and overall collections are actually down. Being smart about tax increases would probably make more sense. Since Wall Street investment banks and every bank is pretty much dependent on the U.S. taxpayer, why not tax their profits by 80 to 90 percent? After all, they need to pay back the trillions in bailouts so if they are making money why not have it come back to the people? Plus, banking should never be a big profit center for an economy. It should serve primarily to allocate capital to the best real economy industries. Banks should not make the bulk of their money gambling on Wall Street.

If you want to see an infuriating stat, Goldman Sachs which came inches away from imploding with horrible bets is now sitting on cash while numerous states sit at the edge of bankruptcy:

“(CNN) More than a million Americans have filed for bankruptcy this year, according to the American Bankruptcy Institute. A September survey of state finances by the Center on Budget and Policy Priorities think tank found that state governments faced a collective $168 billion budget shortfall for fiscal 2010.

Goldman, by contrast, is sitting on $167 billion in cash, in the name of making sure it can withstand another market meltdown if that day comes.”

Goldman’s bonus pool is on pace to reach $21 billion for 2009. At the same time, 27 million Americans are unemployed or underemployed. Until we reform Wall Street we are going to see the standard of living for the average American dwindle away. It is time to look at these balance sheets and see where the money is going. If you follow it, you will realize that the best interest of the nation is not being pursued.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!