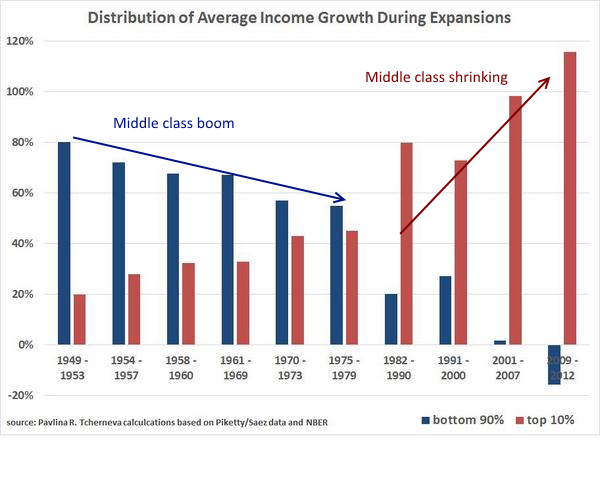

When income growth hits a brick wall: From 1949 to 1979 over 60 percent of all income growth went to the bottom 90 percent. After that, things changed for the middle class.

- 1 Comment

People routinely wake up every day, grab breakfast, and hurry out of their door to work. Most are merely running on a treadmill trying to make sure they have enough money to pay the bills that come down like a torrent of water. Is this pinching of the wallets really a shrinking of the middle class or is something else going on? If we examine income growth after World War II we find convincing data that yes, people are feeling financially pressured because income growth is simply not occurring like it once did. Most of the gains are not going to the working and middle class. Healthy income gains with steadily rising prices allowed many Americans to truly increase their standard of living. Today, you have many items including housing, healthcare, and education quickly outpacing any income gains to be had. On top of this situation you have many other costs being thrown onto the public including rising healthcare costs and the need to save for retirement. When we look at retirement figures the numbers are troubling. Most will need to work until their heart stops beating on that treadmill. Many are feeling poorer because in many measurable ways, they are poorer.

Where the income growth occurred

Having a robust middle class like the US experienced after World War II is really a unique situation in human history. For most of civilized human history, we typically had a system of the elite with their lives of exclusive privilege versus the struggling masses. Even prior to World War II, the Great Depression sent many families off the economic cliff. People tend to forget that many families even prior to the Great Depression lived on a very meager economic existence. The notion of a middle class was simply not there. The Great Depression simply pushed the country (and world) into an economic dark age.

Yet after World War II, the US found itself with a booming and thriving middle class. Wages were growing, jobs were plentiful, and people had strong buying power. Inflation has eroded much of this buying power in recent years. If we look at income growth over this period, we find that many families did enjoy substantive income growth for a solid generation:

You’ll notice that from 1949 to 1979 the bottom 90 percent of our population saw healthy income growth. Even those in the top 10 percent had strong income growth. Yet things changed starting in the 1980s. We went from a 30 year middle class friendly boom to a 30 year slow erosion of the middle class.

Even more troubling, starting in 2001 there has been no real gains in income for the bottom 90 percent of households. This is why many families need to go into massive debt to simply keep up the artifacts of middle class life (i.e., homes, cars, etc). Is this a positive development for the country? Probably not and most Americans underestimate how far back we have gone with this kind of economic growth.

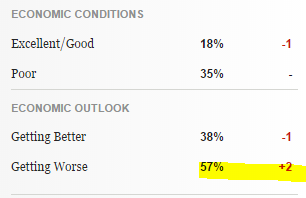

This is why when people are asked about current economic conditions, 57 percent of Americans think things are actually getting worse:

Source: Gallup

It is rather clear on the income front that most Americans are not doing well. But the stock market is near a record high and Wall Street continues to throw off money in all sorts of areas. The only issue is the financial system has deeply disconnected from the well-being of those on Main Street USA. Most Americans own very little in stocks and that is why this boom in the stock market is seen from the nosebleed section for most people. You are watching a family eating a 10 course meal while you struggle to find crumbs.

There is a deep capture between our financial system and government. The current system is working well for some but not for many. Keep in mind that for many companies, profits are up on cutting wages, benefits, and using the slack in the labor force to negotiate aggressively. You also have easy money flowing into areas that are largely unproductive but making tons of money for those able to access the pool. The most egregious of these areas has to be with Wall Street’s recent hunger for single family homes. Since 2008, Wall Street figured out another way to make large amounts of money on housing. This time, it was with borrowing cheap and gaining access to cheap properties while most Americans were put through the cleaners in the Great Recession. The end result? These large buyers now control a substantial number of properties and have hiked up rents and caused housing inventory to dwindle.

Many Americans feel poorer because in many ways, they actually are. For Wall Street, this is simply a regression back into human history.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

torabora said:

$100 cable bills, $300000 HOUSES $14 MOVIES$, $4 gas, $30000 cars and on and on it goes. People are broke on the treadmill because of the stuff they gotta have.

September 29th, 2014 at 8:30 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!