Inflation is Eroding Purchasing Power and Hurting Millennials the Most: Exploring the Cost of Two Important Items from 2000 to 2020.

- 0 Comments

While we are still dealing with the fallout brought on by Covid-19, the group most impacted by the pandemic is young workers. They are disproportionately shouldering the hits that have come from the pandemic. Many are unable to telework and others are employed by industries that tend to pay less and have largely shut down because of the pandemic. Yet they are also paying record levels of college tuition for remote learning and many did not enjoy the record runup in the stock market because very few younger Americans own any stocks. While it might be difficult to track everything that is happening right now, inflation is eroding the purchasing power of younger Americans and we can see this in the data when we compare the cost of a few major items from 2000 to 2020. Â

College Tuition

The price of going to college has soared in the last 20-years. Even this year when many colleges have gone remote, tuition has stayed the same or increased at some schools.

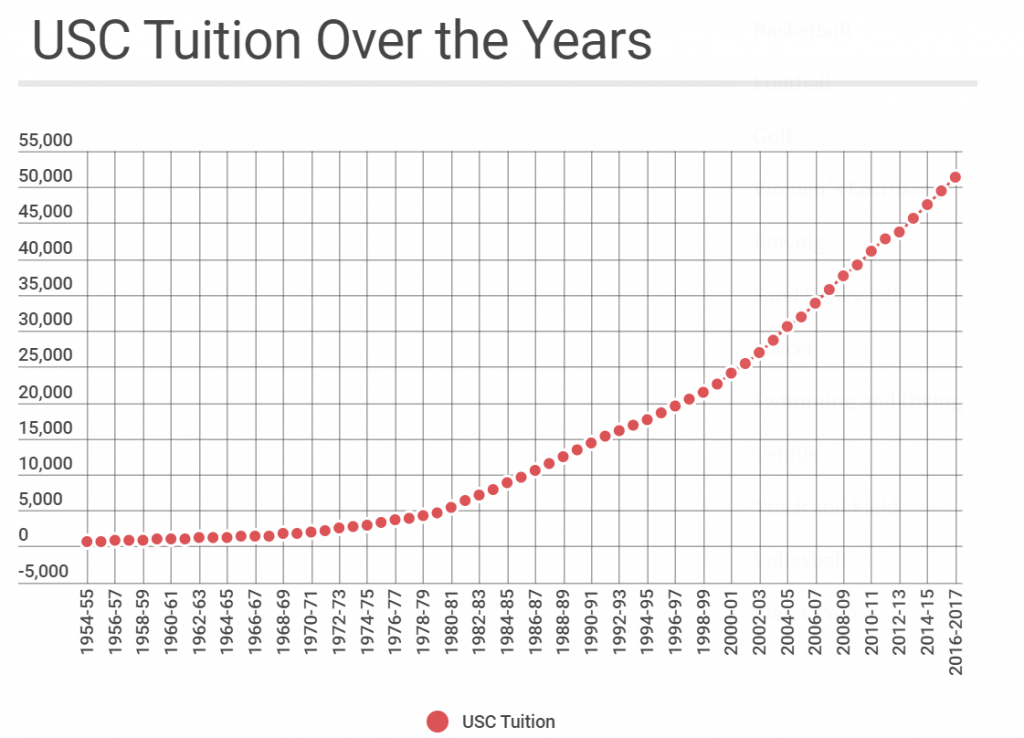

Let us look at one example here by looking at historical data for tuition at the University of Southern California (USC):

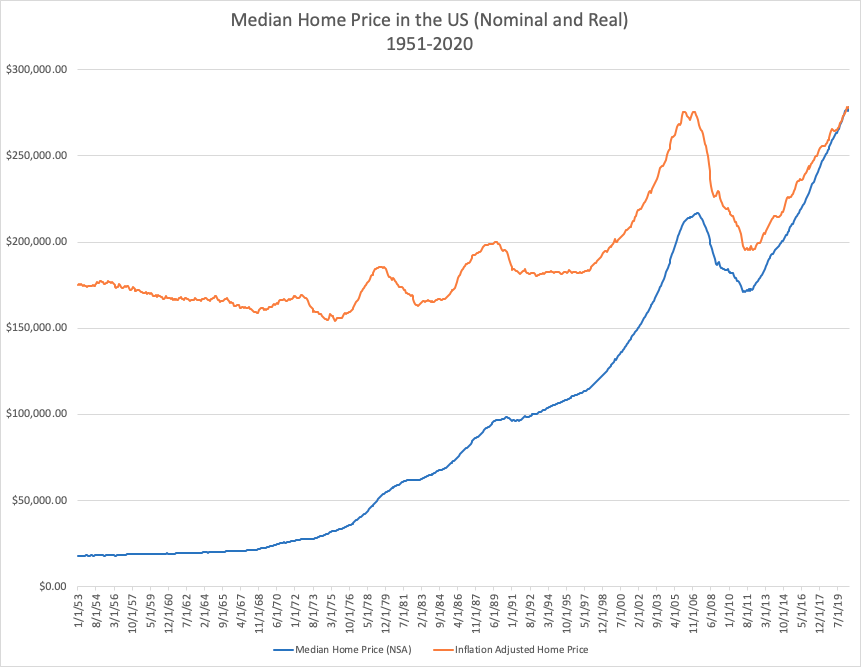

In 2000 the cost of tuition to attend USC was $22,636. The cost of attending USC today is now $59,260:

That is a 161% increase over this period. At the same time, the Consumer Price Index (CPI) has gone up 54% over this period. USC is not alone in seeing this type of soaring costs. This is rather typical for most colleges across the United States. So how are students affording this if they do not have parents that can shoulder the cost of sending them to college? They are not and that is why we have $1.64 trillion in student debt outstanding. This inflation in college tuition is largely coming because of massive debt that is now on the radar of millions of Americans.

Yet inflation is also creeping into an area where many young Americans are struggling as well, and that is in buying a home.

Cost of Buying a Home

A record number of young Americans are living at home because they are unable to purchase a home. This is troubling in many ways because the largest asset for many Americans is their primary residence. A home for many is like a forced savings account and many are not starting this journey. It also serves as a hedge against inflation but without being able to buy, many are losing time in building this wealth.

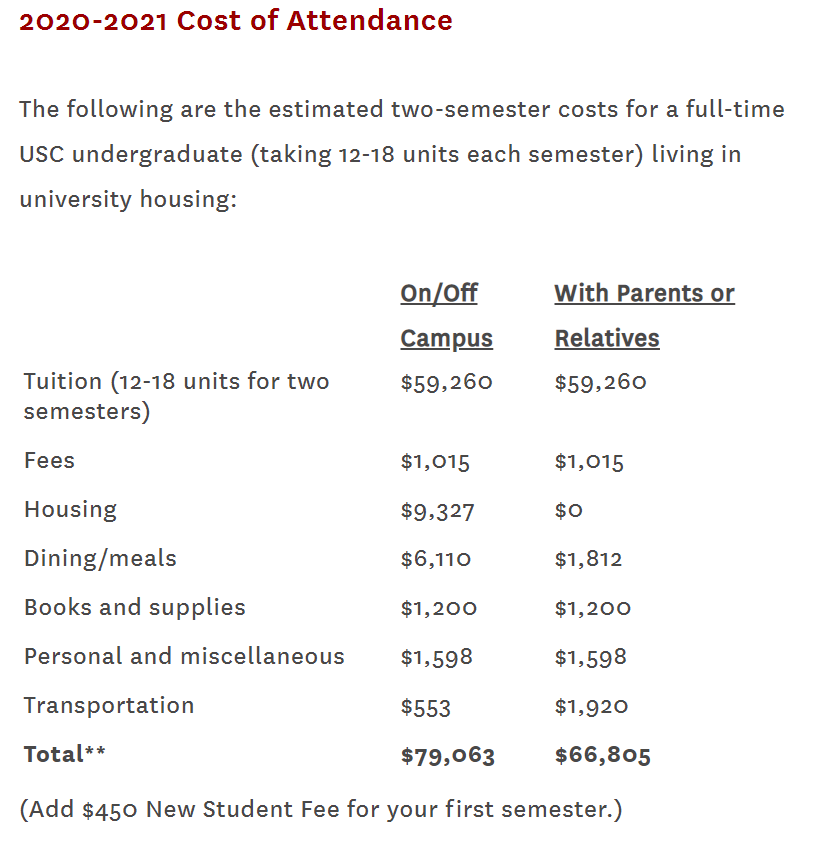

So let us first look at the price of a home in 2000 and 2020:

2000: $132,049.31

2020: $278,621.25

This is a 110% increase over this period. Once again, the overall CPI change has been 54% during this time. So young Americans are having a tougher time buying a home because homes overall are much more expensive for this generation when adjusting for inflation and looking at wage data.

And this is a problem with inflating our way out of a crisis since it benefits those with the majority of assets (baby boomers and older Americans) and largely “taxes†the young to fund this transfer of wealth. So if younger Americans want that college degree or to purchase that first home, they need to go into massive debt which many are doing. Yet saddling young Americans with back breaking debt does not seem like a wise long-term move.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!