$10 Billion a Month Freed up Each Month from People not paying their Mortgage. $1.9 Billion of That is in California so People can continue Leasing their SUV Mercedes and Getting Tans. Thanks Bailouts!

- 5 Comment

Living in California, the central hub of housing bubble mania, I have come to realize that many people that overpaid for homes are now quickly shifting their mindset to one of non-payment revolt. With the 24 hours news cycle and instant viral financial information, many are now realizing that strategically defaulting isn’t such a bad option anymore. In fact, this is now a significant strategy for many. The corrupt bankers and Wall Street have set the example so people figure why shouldn’t they follow the same path? But the problem with that is someone still ends up paying. And that is the prudent middle class. Look at it this way. We have 51 million homes with a mortgage. Over 44 million Americans are paying their mortgage diligently. Yet our economy is screwed because we are bailing out the bankers and Wall Street but also giving incentives to many others to walk away from their home or game the current bailout structure.

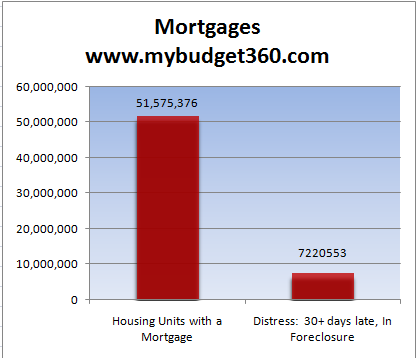

Let us look at the current U.S. mortgage market first:

Source:Â Census, MBA

The latest data tells us that over 14 percent of all U.S. mortgages are either 30+ days late or in some stage of foreclosure. In other words, 7.2 million people are not paying their mortgages. Yet banks are turning out record profits even though they are bleeding in their real estate cash-flow. Now let us run a hypothetical here. The median mortgage payment of those 51 million mortgages is $1,514. This is actual stimulus for people if you don’t pay that each month. If you aren’t paying your mortgage you just relieved yourself of your biggest monthly commitment. So let us run a rough number:

$1,514 x 7.2 million        =            $ 10,931,916,697

So this frees up some $10 billion each month (this is a rough number). This seems close to what Mark Zandi has calculated:

“(Zero Hedge) No, not crazy. With some 6 million homeowners not making mortgage payments (some loans are in trial mod programs and paying something but still in delinquency or default status), this is probably freeing up roughly $8 billion in cash each month. Assuming this cash is spent (not too bad an assumption), it amounts to nearly one percent of consumer spending. The saving rate is also much lower as a result. The impact on spending growth is less significant as that is a function of the change in the number of homeowners not making payments.

I’m not sure I would say this is juicing up spending, but resulting in more spending than would be the case otherwise.â€

Part of the jump in recent spending has come from people flat out not paying on their mortgage. I can tell you of a case of someone that bought a home here in California. They paid $700,000 for a home that is now worth $500,000 (if they are lucky). That is typical. What is also typical is that they took on an exotic mortgage for the full $700,000 amount. Last year, they realized that they wouldn’t be able to sell the home and wouldn’t be able to make their new modified home payment. So once it modified late last year, they stopped paying. Yet they had the money to pay. They explained that the bank wouldn’t deal with them until they missed a few payments. Now, the bank is throwing itself like an obsessed lover to help them “modify†their loan. The terms now seem nice but they want to negotiate for more. You have the banking criminals using taxpayer money to negotiate with people that drive around in a leased Mercedes SUV and BMW. Does this sound like the poor grandma being kicked out of her humble home? Apparently I’m not the only one hearing and seeing this:

“(WSJ) Some borrowers are being helped by the Obama administration’s foreclosure-prevention program and other modification efforts. Irma Bravo, the owner of a cleaning service in San Diego, recently received a loan workout that lowers the monthly payment on her $522,000 mortgage to $1,736 from nearly $5,000.

“It’s a big, big relief,” Ms. Bravo says.â€

Did you get that? A $5,000 mortgage payment was pushed down to $1,736. Now wouldn’t you, one of the 44 million prudent Americans want to have this kind of sweetheart deal? If you want this deal you have to imitate your local crony banker and give them the middle finger and stop paying. Suddenly, they’ll do handstands and back flips to lower your payment. The Wall Street system has perverted the foundation of our economy. Do I begrudge the people doing this? Not really. But what I do resent is the fact that banks are using the trillions of dollars in taxpayer money to make these deals work. If they wanted to use their own money, so be it. But that is not the case. And we have many people that fall in this category:

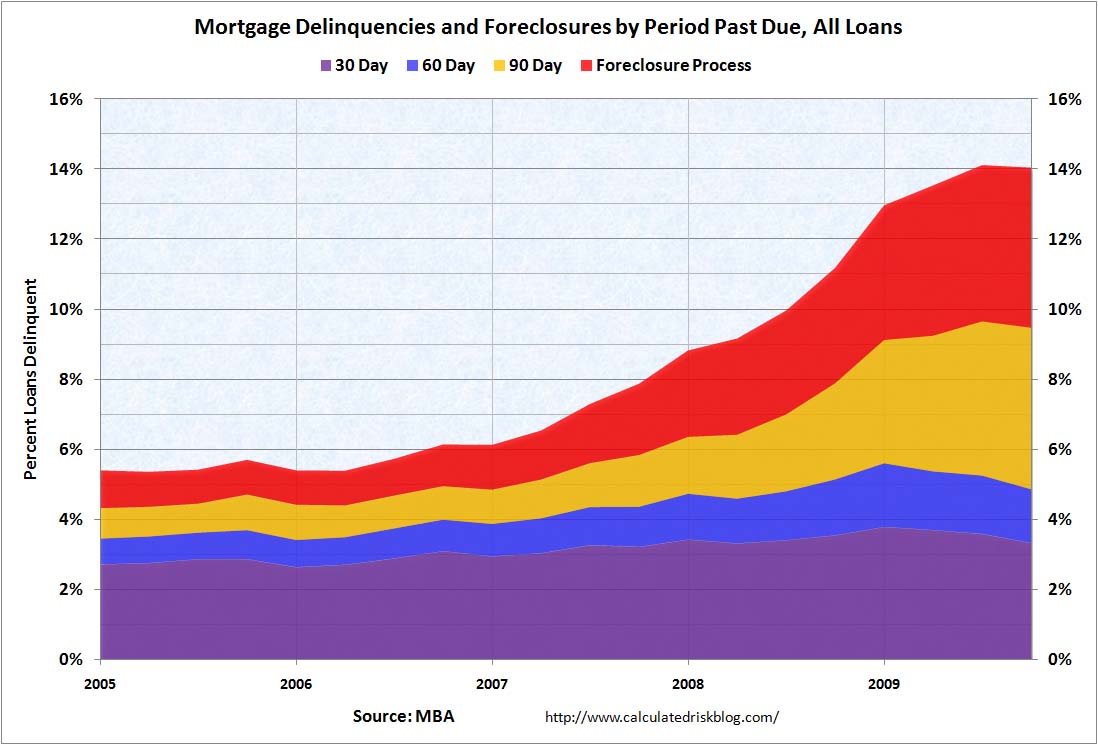

Source:Â Calculated Risk

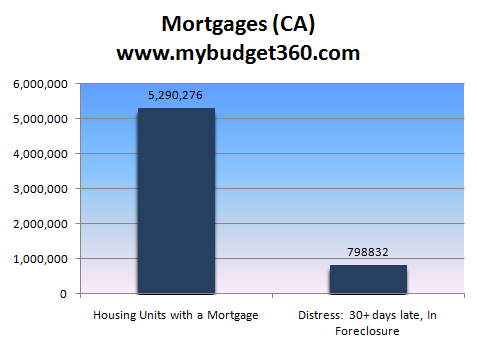

I also wanted to get this data specifically for California:

So today you have roughly 798,000 California mortgage holders not paying their mortgage for a variety of reasons. Clearly the main reason is the economy is horrible. But a large number are taking advantage of the situation. The median home payment in the state is $2,384. Let us do the math:

$2,384 x 798,832 Â Â Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â $1,904,414,716

So of the $10 billion in non-payer stimulus, California receives roughly 20 percent of the cut. And what are people doing with this money?

“(CNBC) The person had an $1,880.00 monthly mortgage payment on which they’d defaulted, but said person’s monthly bank statement showed payments to a tanning salon, nail spa, liquor stores, DirecTV bill with premium charges, and $1,700.00 in retail purchases from The Gap, Old Navy, Home Depot, Sears, etc.â€

Well I’m glad some people have their priorities straight. The fact of the matter is the bulk of Americans, the middle class, are being screwed by the banks, Wall Street, and also the current bailout structure. The median home price in the U.S. hovers around $170,000. Why not cap any bailout help to mortgages at that level or less? Do you feel good that the folks I talked about (who make over $100,000 a year by the way) in California who have a Mercedes and BMW and continue to live in a nice home rent free are able to do so because of your taxpayer money? This is exactly what is happening. No wonder why many Americans must feel like fools.

The name of the game is simple. Get into massive debt, so much so that when you fail, you will then be able to negotiate lower terms because the government enjoys rewarding horrible behavior. Things like this won’t last long because eventually, the public that is being ramrod into bailouts wakes up and revolts. Yet this could be a few years or much longer before any of it happens. Things have gotten so absurd that people are now calling up credit card companies and blackmailing corrupt banks saying they won’t pay on $50,000 on debt unless something changes. In many cases, credit card companies are changing terms if you sound convincing enough. Otherwise, if you are one of the majority who honor their debt be prepared to pay higher fees for the smaller group that are milking the system. This is an absolute war on the middle class. And why save when banks offer close to zero percent because of the Federal Reserve cartel?

$10 billion a month freed up from not paying mortgages. No wonder why retail spending has jumped up recently.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

SoYouThink said:

Great post and I love the site. As you say, the system really is perverted beyond belief at this point. The more the government intervenes in the market, the more capital is misallocated. Now that government stimulus efforts are beginning to wane, taxes are rising and bills are coming due, this blip of a rebound that we have had in the past year is ripe for a takedown.

April 22nd, 2010 at 10:42 pm -

Larry Maloney said:

Fantastic article! Who wrote this? Very insightful, and well written! SUPER KUDOS!

April 22nd, 2010 at 11:35 pm -

OTR Tire Guy said:

Really, people are just out to get theirs. The people who didn’t overbuy on their housing, will be the ones left paying the increasing property taxes, to make up for the defaults.

America has ceased to be a meritocracy. We are 1 step away from mass looting, once these entitled people have burnt through all their money.

April 23rd, 2010 at 6:14 am -

C said:

Credit card delinquencies are pretty bad, or maxed credit cards also means time to use cash. You can pay your property taxes with credit card.

April 23rd, 2010 at 9:14 am -

Jan Parker said:

No mortgage, no car payment, no credit cards, no student loan…no credit of any type. Freedom…Priceless

April 23rd, 2010 at 4:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!