New York City Housing Prices Holding Strong: Will the Financial Collapse Bring Prices Down?

- 0 Comments

New York City is a unique city for many reasons. It is the heart of the United States financial system and now, the target of much of the blame being heaped onto Wall Street. Before we look at actual raw numbers for the city and zip codes, let us first do a quick analysis of the financial industry in New York City.

Approximately 185,000 people work in the securities industry in New York and those entrenched in the Wall Street world of investment firms, banks and hedge funds stand to make hefty salaries. The average income for this group is roughly $365,000 with of course top performers making millions a year. The above is simply an average. Those in the broader financial community of banks and insurance firms average about $228,000 a year.

This stands in contrast to the average salary of $85,000 for the entire city. Keep in mind the average is skewed upward because of the heavy hitters in finance. But New York City is now facing a cash crunch and many firms are now cutting back and laying off people in full force. The state is heavily dependent on the financial industry and Wall Street for tax revenues and those are horrifically off for the year. These will impact real estate in New York for 2008.

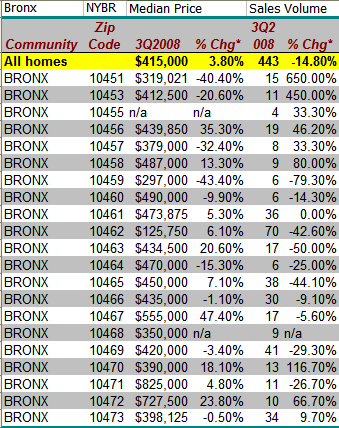

Let us now look at the startling data. We will start out with the Bronx:

The Bronx which is a more working class area of New York still posted positive gains for the third quarter. The median home price for the third quarter is $415,000 showing a 3.8% jump from a year ago. That is right. The Bronx is actually up. But keep one thing in mind. The above data is for the third quarter which includes July, August, and September. It could well be that September will start skewing data lower and certainly the collapse of October will show up in the forth quarter data. You can rest assured this will be negative in the next update. But if you look closer at the data, some areas are down 40% and 43%. Certainly, there is some pain to be found.

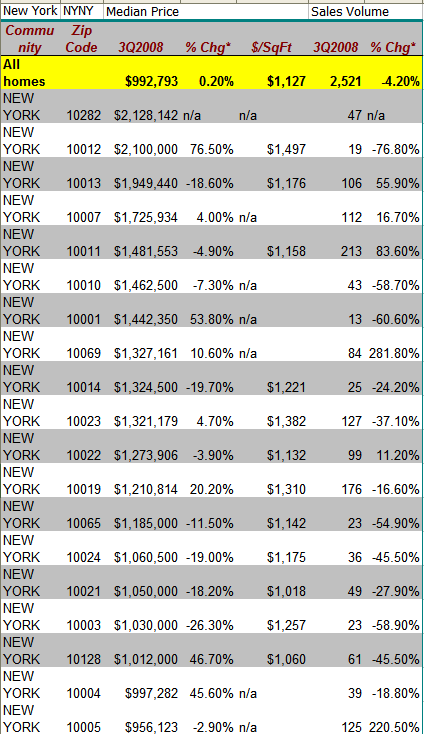

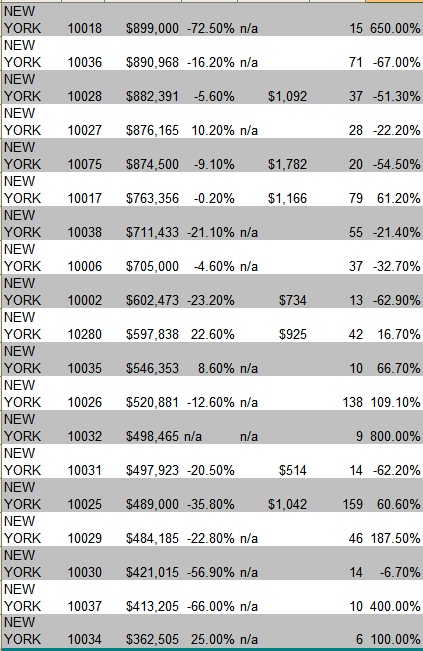

Let us now look at other niche markets for those classified under the New York, New York zip codes from 10001 to 10282:

The first thing you’ll notice is that the median price is nearly $1 million for this area. The actual median price is $992,793 and is actually up on a year over year basis by 0.20%. More of a technical caveat but it is still in the green. Sales have declined slightly by 4.2% but that is not a significant sign. You can rest assured once the issues of September, October, and November start filtering through this number is going to start breaking to new lows. The most expensive zip code of 10282 only has 1,624 residents. It is a small area although 47 homes did sell in the third quarter here. That is a decent size of movement at this price level. But there is some pain in here.

Take a look at the Upper East Side zip code of 10021 which saw a year over year price drop of 18% and sales off by 27%. 49 homes sold in this region in the third quarter. The median price for this zone is $1,050,000.

Let us look at the top 10 zip codes with the number of households that have more than $2 million in income-producing assets:

10021: Upper East Side  (1,361)

10023: Upper West Side (836)

10024: Upper West Side (689)

10314:Â Prince’s Bay, Staten Island (666)

10025: Upper West Side (624)

10022: East Midtown (581)

10028: Upper East Side (577)

11234: Mill Island, Brooklyn (571)

10128: Upper East Side (558)

10312: Prince’s Bay, Staten Island (540)

Many of these areas have a large population dependent on a strong and vibrant Wall Street. Given the massive global crisis and the coming regulation, we can rest assured that many high salaries will be chopped down or wiped out completely. That is, real estate will then follow suit. Prices will decline as they have in any other prime areas around the country. New York is no different.

And you thought your neck of the woods was expensive.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!