The $1 trillion student loan market begins to implode – Department of Education shows two-year default rates at for-profit colleges up to 15 percent. Student loan debt increasing at a rate of $170,000 per minute.

- 12 Comment

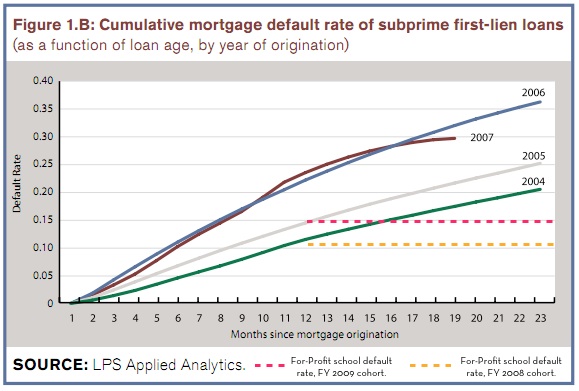

We seem to have entered an era of perpetual and unshakeable financial bubbles and the next ripe bubble to burst is in the student loan market. Student loan debt has become the fastest growing debt sector throughout the economic recession. Growth at for-profit colleges has been incredible and tactics used at these institutions reflects patterns seen with the subprime mortgage operators. They target low income markets and exploit government backed loans and pump them through local area lenders. It is a bubble of mammoth proportions and it is no surprise that data released by the Department of Education only a few days ago reflects a default pattern reminiscent of the subprime crisis. Default rates on student loans at for-profit institutions are absolutely abysmal.  There is no question now that the student loan bubble is now the next market to pop. What will be the consequences of the $1 trillion student loan market contracting?

For-profit student loans the new subprime

Source:Â RortyBomb

“(Department of Education) The U.S. Department of Education today released the official FY 2009 national student loan cohort default rate, which has risen to 8.8 percent, up from 7.0 percent in FY 2008. The cohort default rates increased for all sectors: from 6.0 percent to 7.2 percent for public institutions, from 4.0 percent to 4.6 percent for private institutions, and from 11.6 percent to 15 percent at for-profit schools.â€

This rate is horrifying. The ways these are measured are reflected by two-year default cohorts so you have 15 percent of the entire group defaulting within two-years! The real default rate is much worse if we tracked these out for the life of the loan. In other words, you have many going to for-profit paper mills and coming out with very little job prospects but with the added burden of massive student loan debt. Clearly the student did not benefit but the profits at these institutions are enormous. The government backing is the only way these lenders and schools even survive. If a bank had to lend their own precious money you think they would give someone $40,000 or even $100,000 in student loans to pursue a degree at an unranked paper mill? Reminds you of people buying tiny condos in Florida for $500,000 with no verifiable income.

The above chart is startling. Take a look at the yellow and red lines. That rise is simply the increasing default rates that we are seeing and we still have yet to see 2010 data which is likely to be even worse. And keep in mind student loans are still expanding in this crisis. While every other sector of debt is contracting this is the only area growing. What is worse is that the earnings for recent college graduates doesn’t reflect the higher costs of college:

Source:Â BusinessWeek

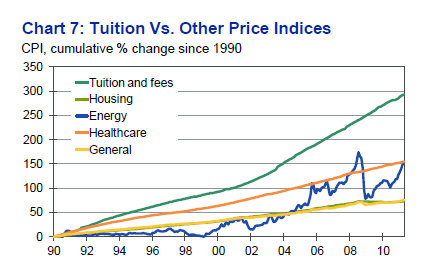

Take an open look at the above chart and align it with these stats:

Since 2000, in real terms college costs are now up by 23%

Since 2000, in real terms real pay for college graduates is down by 11%

More debt and less earnings is a recipe for disaster. Of course many of the for-profits are simply leveraging federal government loans to rip off students. The symbiotic relationship between banks, government, and con artists seems to be a large part of our economy for the past decade. In the past, the for-profit sector was a tiny part of the market making up 1 to 2 percent of all college going students even just a decade ago. Today it is up to 10 percent and is rapidly expanding. There is now a brewing crisis here and we are looking at a $1 trillion student loan market. Just like subprime, this will also impact other areas of the higher education model.

The cost of going to college has far outpaced the cost of virtually every other sector in our economy. The reason when we look back and see greater earnings for those who go to college is the reality that many never came out with so much debt. Decades of data are being used and applied to the current rip off and high cost model that has never been seen in the past. Plus, you had a tightly regulated market and for-profits were nearly unheard of. That has now changed. We now have legitimate institutions competing with organizations that run more like a subprime operation. The bottom line is that not all college degrees carry the same weight. You dilute the quality of the degree yet you charge more because of the access to debt. This is the big difference in the last decade. Just like the housing market, banks have figured out another way to become predators on the public and turn a once stable market like higher education into another giant bubble.

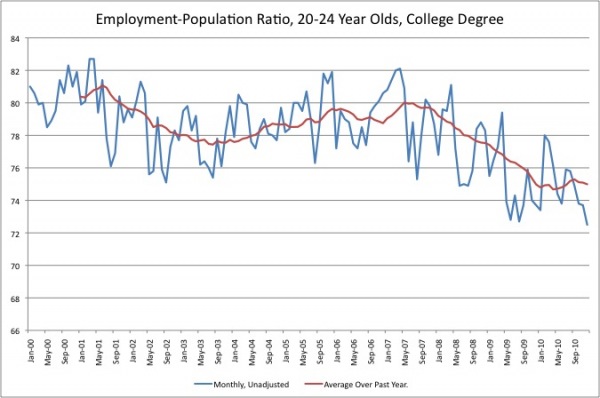

The employment data is not pretty for recent graduates:

Source:Â RortyBomb

Why charge more when the results are not being reflected in the real world? The reason why this is occurring is like what occurred at the end of the subprime bust. These institutions have already picked low hanging fruit and are now getting more aggressive in who they go after. At this point however the employment ratio is going lower and lower as the chart above highlights. Part of this is the weak economy and part of this is coming out with worthless paper and massive amounts of debt. Get ready to hear about this over and over for years to come because this bubble is only starting to burst. If you run the numbers you get this:

According to FinAid.org a site that tracks student financial aid student loan debt is increasing at an alarming rate of $2,853.88 per second. This is a stunning rate of $171,180 per minute. At the current rate we will hit $1 trillion in student loan debt in 2012 since we are adding $89,972,208,000 in student loan debt per year.

Do I hear another bailout in the making?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!12 Comments on this post

Trackbacks

-

Terrance Stuart said:

The article is likely right on target. I personally have encountered people who have accumulated debts all out proportion to their earnings. One person went to a private for profit institution to learn to be a veternarian assistant. She racked up an $8 per hour job and a 20K plus student loan debt. Another person went to a well known college and racked up 80K in debt enroute to an unfinished history degree. Unless this person plans on coaching if and when the degree is complted teaching in a K-12 environment is questionable. On a scale of ten being high history majors rate 1 for hireability in the school system. A quick trip to the Dept of Labor website http://www.careeronestop.org tells how many of what is needed and the expected pay scale range in today’s dollars. For many, college is a scam because they enter into it with little clear knowledge of their objectives, and because colleges have no desire to restrict enrollment in a rational fashion, outside their own rational desire for continuity. Students and parents need to be more discriminating.

September 13th, 2011 at 2:33 pm -

Donnie said:

We sent all our jobs and opportunities overseas. What what anyone expect?

September 14th, 2011 at 4:53 am -

CLARENCE SWINNEY said:

THANKS TO STAFFERS. AS USUAL SUPERB. LOVE THE CHARTS

September 14th, 2011 at 8:25 am -

tyler said:

Really good article as somewhat shocking as it is. You’ve done your research on a topic the media and government don’t want people to know about. They want to keep the myth going. I’ll give them the benefit of the doubt and say they just don’t know because their brain dead, especially judging by what they consider news worthy.

September 14th, 2011 at 1:30 pm -

Dumbfounded said:

I don’t get it. Why are we a bunch of dolts when we have invested a trillion dollars in “higher education”? Perhaps it is because our education system is devoid of knowledge and wisdom much like our fast food industry is devoid of nutrition.

What can save this nation from utter collapse? Or have we collapsed already?

God help our stupid species.

September 15th, 2011 at 6:37 pm -

clarence swinney said:

Go public

The North Carolina University Systen has 16 Universities

Highest annual cost is $5000 at UNC-Chapel Hill.

My private alma mater six miles away $24,000.

Wonderful, marvelous, sensational Grandaughter goes to out of state at $25,000. She lives 18 miles from UNC-Chapel Hill!!!!September 27th, 2011 at 5:04 am -

Michael Speck said:

Robert Applebaum and others at Forgive Student Loan Debt have warned about this for a couple of years.

He may be too kind to say “I told you so”, but I don’t suffer from that infirmity.

We told you so.

It’s not too late to address the problem, forgive student loan debt.

October 18th, 2011 at 6:48 am -

Dorothy said:

What did they expect? The loans are compounded, capitalized, fee’d and charged, which are also compounded and capitalized, and THEN any payments go to interest, fees, and charges before they EVER hit the principal! On top of that, student loans are NON-DISCHARGEABLE in bankruptcy, exempt from Fair Collections, exempt from usury laws, and exempt from any statutes of limitations. And to top it off, they can revoke your professional license so you can’t get a job, garnish Social Security, garnish Disability, take your refunds, garnish your (low) wages since you can’t get a job in your field and snag your life-insurance death benefits from your children if you still have any insurance. Student loans are LIFE-TIME DEBT SLAVERY and the securities (SLABS) they sell are considered totally SAFE because you can NEVER GET RID OF THEM even if you DIE.

October 18th, 2011 at 7:52 am -

Sandy said:

How can any 18 year old project what their income will be once they graduate? No one could predict that we would now be in the worst recession since the Great Depression. Student loan debt is now higher than any other consumer debt. These borrowers are the ones that will not be able to borrow for mortgages, cars or to invest in their own children’s futures.

If someone is part of that 1% then good for you. You managed to get that one in a million job and keep it. You are not one of those who got hurt in the housing bubble either. Your home price did not fall. It’s all connected though, the housing market, student loans, credit cards. If you think that the student loan bubble will not affect you then think again. This one is going to be bigger, much bigger. So if you want to save your life styles with the ye holy 1% higher than thou attitude then you might want to think about how quickly and drastically home prices dropped when the bubble burst. Students who can’t find jobs in this current market will be choosing food over paying on student loans. They will borrow only so much on their credit cards until that is maxed out.

They might not be able to rely on parents who co signed either. Considering that the price of housing has dropped and continues to drop the parents can’t get second mortgages or lines of credit. Guess what happens then? The parents are on the hook for the student loan. Of course they will and do take it out of their social security checks, so don’t worry ye holy 1% higher than thou folks, you can pass the plate at church knowing that you did your utmost to stop this train wreck.

October 18th, 2011 at 8:35 am -

Skyward said:

There is a part you are all forgetting in this. NO student with these massive debts can get a business loan, ever. Business loans create wealth, and JOBS. And they wont get a HOUSE, where the equity could be used to fund a business, and hence…jobs (again). You are looking at the slow death of the United States of America, courtesy of the greedy university officials along with student loan companies and their cohorts in congress.

January 13th, 2012 at 6:43 pm -

jotheomas said:

what do you expect..what the hell does everyone say? oh you better go to college to get a good job..well there is no more jobs..the schools are just as much as fault in this matter to raise tuition 400% books went up 400% what did trees go up 400% also(i think not) then what do we get for presidential canidate..i freaking robber..someone that buy companies and sells them off in pieces..look folks its a safe loan..they will get there money..and the banks are eager to loan the money

November 26th, 2012 at 5:49 pm -

joel thomas said:

hey lets not forget the greedy schools raising tuition 400% and books also 400% oh what about those nice things in the schools like stadiums and other worthless things that have nothing to do with and education.. this was a lopsided article..lets forget our loving members in congress that sold us to china long ago

November 26th, 2012 at 5:53 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!