5 ways that Wall Street and the U.S. Government punish the American saver – Artificial low interest rates, understating inflation, pushing people into the stock market casino, and destroying yield on traditional safe investment vehicles.

- 5 Comment

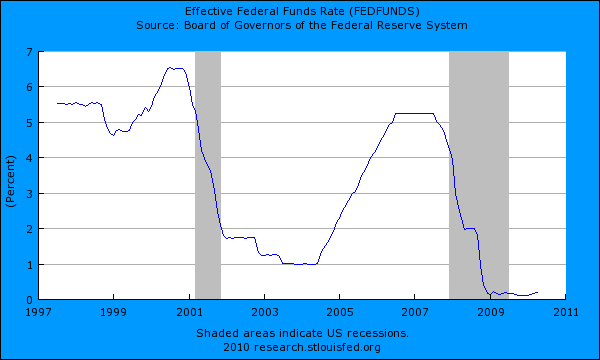

The only savers in the U.S. seem to be the investment banks. Four of the big banks on Wall Street turned out a perfect quarter as they have managed to leverage the zero percent funds from the Federal Reserve into government securities. At the same time, middle class Americans would be lucky to get 0.1 percent at a bank on their savings account. Then you have Social Security coming out stating that there will be no cost of living adjustment since inflation is supposedly under control (except for food, healthcare, and other daily use items). Americans are being punished if they are savers and prudent with their finances. The current system is based on turbo capitalism and the fuel that runs this system is debt.

Punish Saver Technique Number 1 – Transfer money from savers to big banks

The “perfect quarter†for the banks is really an insult to the rest of America:

“May 12 (Bloomberg) — Four of the largest U.S. banks, including Citigroup Inc., racked up perfect quarters in their trading businesses between January and March, underscoring how government support and less competition is fueling Wall Street’s revival.

“The trading profits of the Street is just another way of measuring the subsidy the Fed is giving to the banks,†said Christopher Whalen, managing director of Torrance, California- based Institutional Risk Analytics. “It’s a transfer from savers to banks.â€

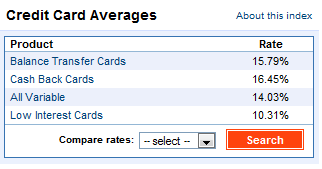

This is a disgrace to Americans that actually bailed out these banks (although the majority did not consent). It was our representatives in D.C., in particular the Senate that have been selling out to Wall Street for decades. We have reached the logical conclusion here. You get 0 percent for savings accounts at big banks that then can charge you 19 percent on a credit card. Next, they borrow at zero and basically buy anything that yields a bit better and you have a system that can’t lose. But middle class Americans have no access to this system and that is why the underemployment rate is still at 17 percent today.

Punish Saver Technique Number 2 – Beat those on fixed incomes

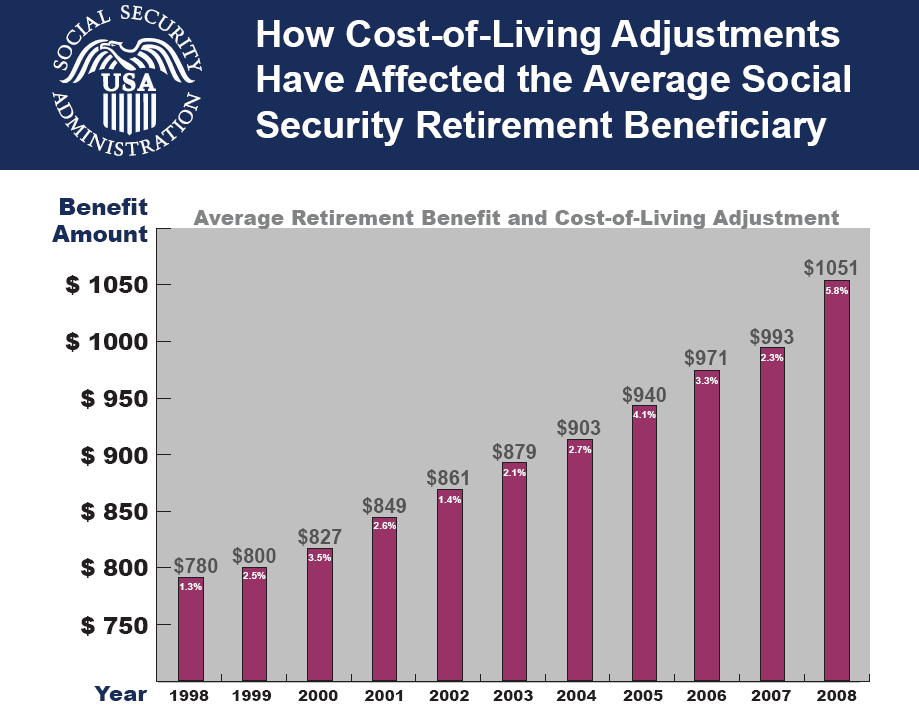

In 2010 Social Security offered no cost of living (COLA) adjustment to the millions that receive benefits:

Now many middle class Americans actually depend on Social Security as a primary source for their retirement. No adjustments yet daily goods keep going up like food. Many retirees might own their home outright and as local government scramble for money, they hike up taxes. For example in California sales tax rates are getting close to 10 percent in some areas while those on fixed incomes have no adjustments.

Many on fixed incomes don’t have the timeframe to gamble in the Wall Street casino so they want to minimize risk. They usually stick their money into banks that offer 0.1 percent rates on savings accounts or if you are lucky, maybe 1 percent on a CD. In other words they basically have the same return as stuffing money into a mattress.

Punish Saver Technique Number 3 – Push folks into debt serfdom with credit cards

Even though the Federal Reserve has pushed rates to near zero for big bank borrowers, they are still charging absurd rates on their credit cards:

They justify this move by recent spikes in defaults and the added risk in their borrower pool. But they are using taxpayer money to make those daily profits! It would be one thing if banks were lending out their own money. Then it would be understandable if they charge high rates. But they are using the Federal Reserve as a money launderer for cheap taxpayer money. Anyone that can borrow at zero percent can take on absurd amounts of risk:

Don’t you wish you had access to zero percent rates? That was the case for a few years during the debt bubble and consumers went crazy with vacations, cars, and buying homes they had no ability to repay. But not everyone bought into this nonsense. We know this is bad idea. But somehow giving this same privilege to banks is supposed to turn out better?

So as the economy is still in the dumps, Americans have turned to their credit card to pay for daily necessities or even higher healthcare costs. The credit card has allowed many to consume today what they will earn tomorrow. Roughly $850 billion in credit card debt is outstanding. At a high interest rate, how much are banks making here from the new debt serfdom?

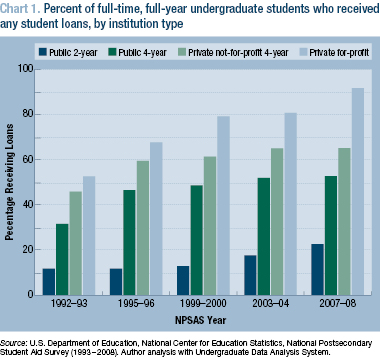

Punish Saver Technique Number 4 – Student loan gimmicks

One incredible statistics is that for-profit schools make up 10 percent of the going college population but make up nearly 50 percent of all student loan defaults. Instead of encouraging people to pay for part of their college, these for-profit schools leverage government debt and stick students into schools with no verifiable student outcomes. So once these students finish, they come being worse off than poor. They now come out with a degree one notch above a paper-mill and $40,000 of debt or more. In fact, the trend in higher education has been more and more debt:

Over 90 percent of those at private for-profit schools depend on loans for their education. So instead of educating students to be prudent with their finances, right off the bat we are teaching them that saving is for chumps (after all, they are taking on immense amounts of money to pay for college which is a good thing, right?). Take a walk around any college and you’ll see banks pushing credit cards at a place where students probably already have a student loan through them!

Punish Saver Technique Number 5 – Encourage 401k and stock market casino for retirement

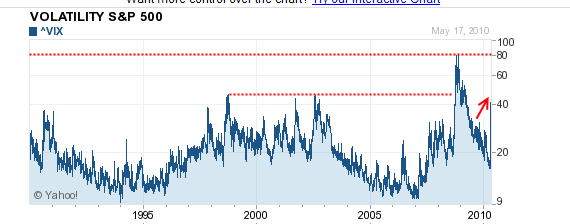

Notice how volatile Wall Street is getting again? Remember that nearly 1,000 point drop a few days ago which amazingly hasn’t been explained? Take a look at this volatility:

This is not normal. A near 1,000 point drop in one day, and then swinging back up 600 points in the same day is not normal. It is astounding that the American public has yet to have a solid explanation as to what occurred. Yet this is another way savers get punished. Those that want to save prudently and merely want a basic yield have access to very few investment vehicles. Savings account? No. CDs? Hardly any yield. So people go after stocks. But even today over 50 percent of trades are done by computers. Some have joked around that Wall Street is essentially Skynet and it is gaining consciousness to how easy it is to rob taxpayers.

Even if you personally choose to avoid the stock market, you might have your company gambling away in high flying investments. CalPERs, the biggest public pension fund of California lost billions of dollars in horrible real estate deals. That money will never be recovered.

In the end it is prudent savers who get punished. The current system is failing because it has been running on pure consumption and gambling on Wall Street. What do we need? Break up the big banks. At the very least this will stop those absurd perfect quarters. Force the Federal Reserve to increase interest rates. They claim this will hurt the housing market. Oh really? So 4 million foreclosures a year isn’t bad? This is a giant gimmick to hide the fact that they are basically robbing the American public blind. The U.S. government has blocked full-fledged audits of the Federal Reserve. By doing this, they have given Wall Street full reign on easy money without any kind of oversight. Even Elizabeth Warren has fought valiantly to get a full audit of the TARP funds and this is only one piece of the giant $13 trillion in bailouts, back stops, and artificially cheap money Wall Street has gotten.

The mattress didn’t seem like a bad place for saving from 2000 to 2010 and it didn’t cost us trillions of dollars.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

William said:

What a breath of fresh air this article is! Sorry it took me so long to find it.

I have always felt 401k plans are a means to make people feel they have some vested interest in the stock market. So that when legislation comes up that will help Wall Street, people go along with it out of greed.

December 15th, 2010 at 2:27 pm -

William said:

What a breath of fresh air this article is! Sorry it took me so long to find it.

I have always felt 401k plans are a means to make people feel they have some vested interest in the stock market. So that when legislation comes up that will help Wall Street, people go along with it out of greed.

BTW, “2+2=5” not 4.

December 15th, 2010 at 2:28 pm -

rw said:

Number 3 seems a little off-base. While I completely agree that banks should not be able to get a 19% spread on credit card debt, the true saver has the option not to play their game.

Simply pay off your credit card in full each month and you will not pay any interest. Period. If you cannot pay off your debt then you are living beyond your means and you are not really a “saver”.

Once your debt is paid off, then start saving and investing.

September 9th, 2012 at 9:35 am -

Victoria said:

Better yet, don’t use credit cards at all. All in all, this was a great article.

February 5th, 2017 at 12:11 pm -

Eric said:

This isn’t turbo capitalism is a weird socialism.

Too big to fail. Socialism for Wall StreetAlmost 50 billion $50,000,000,000 in bailout money AFTER 2008 to Bank of America. Thee biggest welfare recipient in US history.

4 billion a year to big oil. To keep other forms of energy from being priced competitively

GM got 100,000,000 tax return

Many of their smaller outfits like Oldsmobile & Chrysler make ugly junky cars that don’t sell the year they’re made.How is this capitalism? Free markets based on competition & government handouts for price advantages can’t both exist.

Democrats & Republicans did this. They both serve the .01%

July 30th, 2019 at 12:16 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!