The Novel Depression: How the US is going to see Great Depression Unemployment in Record Time.

- 4 Comment

The unemployment report today was widely acknowledged as being incorrect even by the mainstream media when “only†700,000 jobs were reported lost last month. We already have data that approximately 10 million people have filed for unemployment benefits in the last couple of weeks. This upcoming recession, the Novel Recession, is largely one that is being brought on by a global shutdown to prevent the spread of the COVID-19 outbreak. Yet the speed in which this recession is coming just goes to show how fragile our economy really was and how many Americans were already living on the financial edge.

The Novel Depression Expands

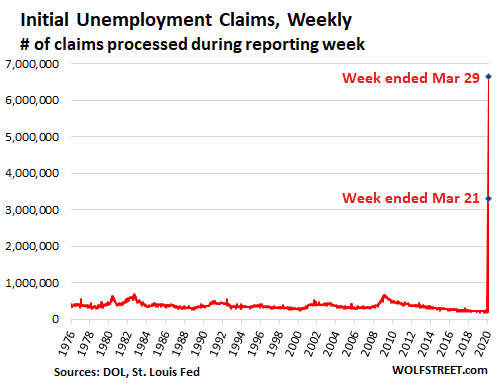

It cannot be overstated how fast the unemployment figures are growing and we are only a couple of weeks into the shutdown. The BLS report that came out today is lagging in a big way what is happening on the ground. Already at the very least 10 million people have lost their jobs:

Last week, initial unemployment claims came in above 2 million. This week they came in close to 7 million for nearly a total of 10 million filings within a couple of weeks. Yet this does not tell the entire story. We know from countless news stories that unemployment benefits websites across many states are being slammed and many people are giving up filing since they cannot get through. So the figures are actually worse than they appear and next week they will be worse as more people get through to file.

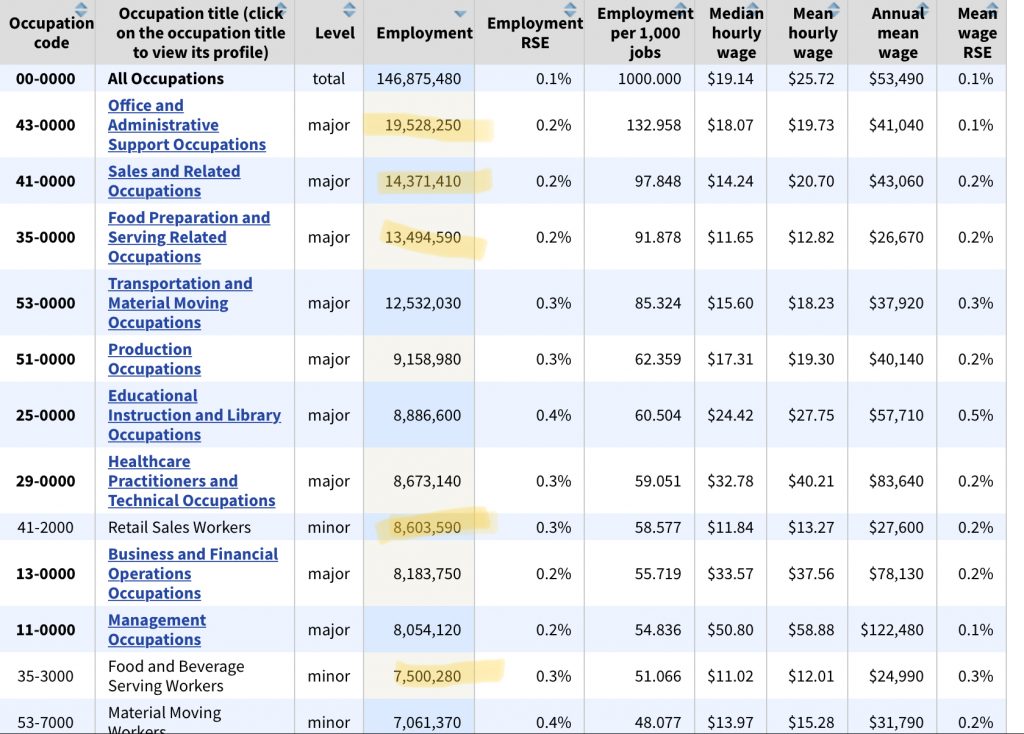

Why do we suspect this will be worse than the Great Depression in terms of unemployment figures? The Great Depression at its peak had a 24.9 percent unemployment rate. We are going to get there if we stay at this rate within a couple of months. To project this, just look at how many people are employed by industry:

You have 19.5 million Americans working in “office admin support†roles that are largely paid on an hourly rate. You have 14.3 million in sales (hard to do sales when you are unable to get out with clients). You have 13.4 million in food preparation which is clearly been cutting aggressively. Another 8.6 million are retail sales workers (most are not working and not getting paid since most are hourly). Another 7.5 million in food and beverage serving work that are not getting paid. That is 66 million jobs with extremely high risk of being out of work based on the shutdown guidelines. Of course the other occupations are also working from home to some degree and many will be laid off if this continues.

To get to the peak of the Great Depression level of unemployment we would need to hit 36.3 million workers out of a job. The country already has 10 million filing for unemployment benefits within two weeks. At this rate, come June or July we are going to see high teens and into the 20s in terms of the unemployment percentage.

What is troubling is that half of the country was already living paycheck to paycheck before this coronavirus hit. A record in the stock market, a historically low unemployment rate, and easy access to debt simply covered the grim reality that we are now experiencing. That reality is that there wasn’t much there for the average worker already to begin with. Two weeks is all it is taking to send millions of Americans off the financial deep end. People are going to miss mortgage payments, car payments, student debt payments, and this will rippled into the financial system.

This Novel Recession is going to be painful. Some expect a V-shaped recovery but that doesn’t seem likely. Once the economy opens, up it is likely to open up slowly. If you look at China, many places are opening up but everyone needs to wear masks, some places have temperatures being checked, and other places have strict social distancing guidelines. Will people take their families to movies once they open up or to crowded locations knowing how contagious this virus is?

This is going to be a painful recession and the virus is accelerating the already deep economic frailty in many economies. Let us hope this doesn’t last longer than a few months.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

4 Comments on this post

Trackbacks

-

Dennis said:

Agreed, this will not be a V-shaped recovery.

Both households and corporations were not in very good shape going into this crisis.

Numerous surveys have shown that half of households could not come up with $1,000 unless they borrowed some money.

78% of households live paycheck-to-paycheck

25% of households with $150,000 income also paycheck-to paycheck.

80% surveyed worried about affording retirement.

Vanguard: Median 401k balance is about $62,000

Public pensions in dire shape.

All these observations were made before the Corona recession. So, the situation will now be vastly worse for many people.April 4th, 2020 at 7:54 am -

laura ann said:

The deep state is ushering in a police state and a third world lifestyle under agenda 2030. This is ongoing, no recovery.

April 4th, 2020 at 3:28 pm -

Steve said:

In this article for every word “recession”, please replace it with “depression”.

This is going to be a painful depression.

Thank You!

When my neighbor loosed his job it’s a recession.

When I loose my job it’s a depression.

Our A**Hole Gov committed economic suicide.April 8th, 2020 at 6:13 am -

Jen said:

I discovered your website today. It is great and your articles are very informative. Thank you for that.

Seeing that we are heading into a depression, I wanted to ask you a question about the housing market. I am a millennial that signed a contract to buy a new build in northern california (not bay) in early February. Now i have to deal with figuring out whether i should pull out (and lose 5k earnest) or ride through this wave. Do you have any advice on this? Job is relatively stable. It is not much cheaper nor more expensive to rent. I don’t know if I should say goodbye to the 5k and just await for the market to ‘drop’ as expected?

April 10th, 2020 at 2:46 pm