Wall Street rally based on fantasy valuations and investment banking trading – S&P 500 back to 2007 valuations and up nearly 100 percent from March 2009 trough.

- 1 Comment

Wall Street has a way of sucking people back into a money losing vortex. With hedge funds using high frequency trading boxes the public has no chance in competing with these organized and sophisticated gambling casinos. It is amazing how quickly people forget. It was only in March of 2009 that the S&P 500 hit 676. The incredible part of it all was that many stocks were still over valued at that point. Since that time the Federal Reserve has juiced the system up with trillions of taxpayer dollars. As we brought up in our first analysis the average American only has $2,000 saved for retirement so this rally isn’t because of them. Most of the financial wealth in the country is aggregated with the top 1 percent of Americans. The stock market is a betting parlor for the rich and incredibly many people are now being sucked in yet again with the S&P 500 hitting 1,329. The S&P 500 is a few points away from having a 100 percent increase from the March 2009 trough. Is this a new bull market? Not likely if we actually pay attention to earnings.

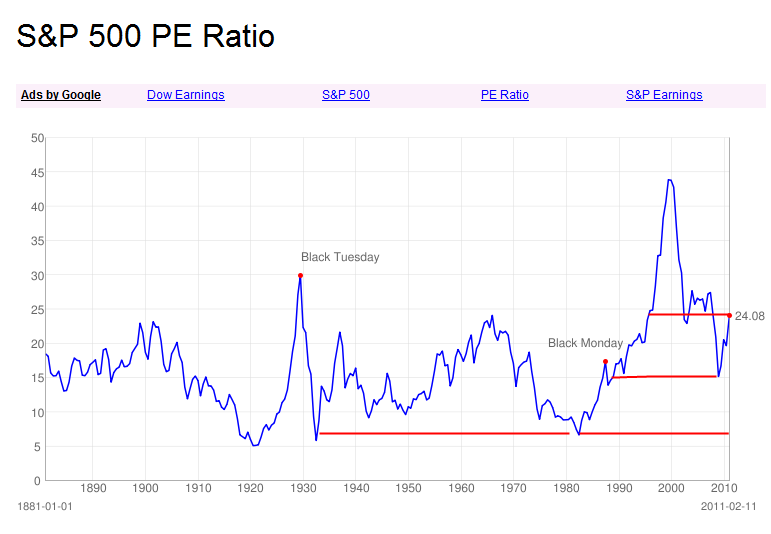

S&P 500 Price/earnings ratio

Source:Â Multpl.com

There is no one metric that will tell you if something is priced right like a thermometer. Yet the price to earnings ratio is a good indicator of stock value. Today the S&P 500 has a P/E ratio of 24. This is very expensive and takes us back to valuations of 2007 right before the market started its descent into the abyss. What has changed over these last few years that gives rise to a stock market being valued by 100 percent more? Unemployment is likely to remain elevated for years to come and the average American makes $25,000 a year or less. Where is the new money going to come from to keep stocks inflated? We already know that investment banks are largely a big part of the recent rise. Instead of using bailout funds to lend to small businesses or Americans banks have decided to go back into the stock market and gamble with taxpayer money. Since Wall Street is disconnected from Main Street it is no surprise that the P/E of the S&P 500 is so inflated.

I ran a quick analysis on the average P/E ratio for the S&P 500 dating back to 1881 and received the following:

P/E ratio S&P 500 average from 1881 to 2011:Â Â Â Â 16.39

In other words the P/E ratio would need to come down by 31 percent just to get back into the historical average. You can see from the original chart the era of mega bubbles with the tech and real estate bubbles going back to back dominating two entire decades. It is interesting that even wealthy individuals like Mark Cuban are questioning the stock market:

“(Blog Maverick) The greatest lie ever told used to be Wall Street telling main street to “buy and holdâ€.  Of course thats what they told you every chance they got. It’s not what they did.  The holding period for stocks dropped from 8 years in 1960s to 2 years in the 1990s and 8 months in the 2000s.  Today, stocks are bought and sold in milliseconds.  Which is one of the big reasons you don’t hear much about buy and hold any more. That and the fact it didn’t work.  I think individual owners of stocks  finally came to understand that old saying “Fool me once, shame on you. Fool me for 50 years, shame on me.”

This is absolutely correct and you need only look at the proliferation of high frequency trading. Wall Street tells the public this folksy wisdom of buy and hold yet they are trading faster than a blink of an eye. Over the last decade you would have done better investing into certificate of deposits with no risk as opposed to going into the stock market. Yet the people that have some money to set aside still believe in this ability of Wall Street to make you rich even if they don’t understand what they are investing in. Many are simply being suckered away from their money. You might as well play blackjack.

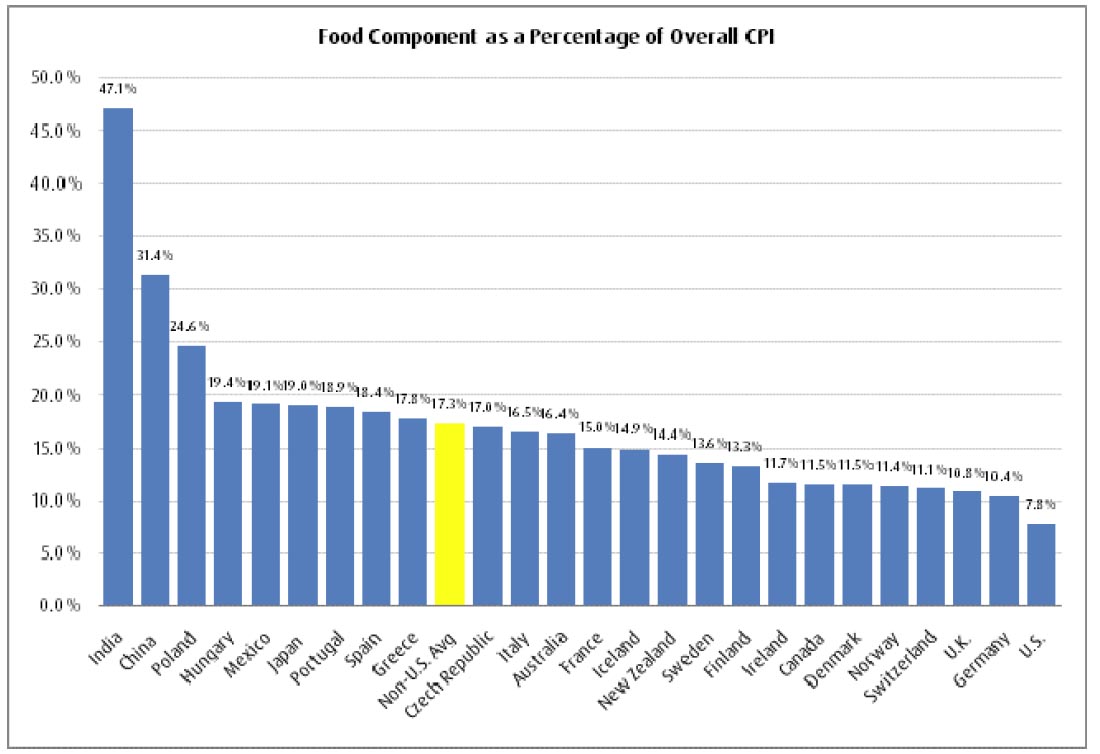

The Federal Reserve is likely to keep the easy money going for awhile given the distorted nature of our CPI numbers. Just look at how little food makes up in the CPI:

Source:Â ZeroHedge

Food prices have soared in the last few years and have caused political turmoil in many countries. Here in the US we haven’t seen this impact the CPI. We have millions and millions of Americans that live on Social Security and food is a big line item. Yet only 7.8 percent of the CPI is food even though this is rising solidly. What this means is that inflation in other countries like China and India will be rampant while in the US the Federal Reserve will point to low inflation numbers as a reason to keep the peddle on the US dollar printing press.

What this likely means is that the stock market is likely to become more volatile in the near term. It has gone up nearly 100 percent since March of 2009 even though unemployment has shot up off the charts, our national debt is ballooning, and the housing crisis is still years from clearing out. There is no reason for stocks to be valued at what they currently are but this is by design to lure more people in before exiting right. You always need buyers right? Of course just like in housing, it will be America who is left with the bill from Wall Street.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Sundar said:

Great post to illustrate the volatile nature of Wall Street. Analyzing chart trends and numbers do not help an ordinary investor in any sort of way because of the gambling games occurring at a high level.

The Fed lives in denial regarding the actual CPI and inflation, which is understandable because they want to keep bloating their balance sheets and the only legit way to do that would be to fudge the numbers.

This whole charade is running because of one word – ‘trust’. when this is gone, SHTF for sure.

February 12th, 2011 at 8:45 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!