Too broke to leave home even at 35 years of age: Over 30 percent of young adults under the age of 35 living at home. Home ownership rate of young adults continues to plummet.

- 2 Comment

Young Americans are so broke, they can’t leave home. That might sound like the line of a really bad joke but this is the unfortunate situation in our economy. Many young Americans are saddled with mind numbing levels of student debt. Younger Americans are carrying the heavy burden of the $1.2 trillion in student debt outstanding in the United States. At the end of the day, many already have a mini-mortgage before they even go out and house hunt. It should come as no surprise that sales volume is downright anemic in the housing industry because new households are simply not forming as they did in the previous generation. Younger Americans have lower wages, more college debt, and massively reduced benefits compared to the previous generation. The idea of buying and staying put in one location for 30 or more years simply does not fit in with the economic conditions of many younger households. In fact, we have the highest number of young Americans living at home today compared to any other time in US history. Even through the recovery, the number of young Americans living under the roof of mom and dad has increased dramatically. In essence, young Americans are too broke to leave home.

The boomerang generation

It should be abundantly clear that last year’s jump in housing values was largely due to a few unsustainable factors:

-1. Artificially low rates courtesy of the Fed

-2. A reduced level of inventory thanks to banking bailouts and accounting rules that allow banks to hold off on putting inventory on market

-3. A big demand from Wall Street in suddenly being a landlord

Yet all of the above are unsustainable and don’t draw on healthier reasons for a stable housing market. What you want to see is stable and new household formation. To the contrary, we see young Americans are staying at home into older age because they simply cannot afford to go out and rent, let alone buy their own home. Take a look at this data:

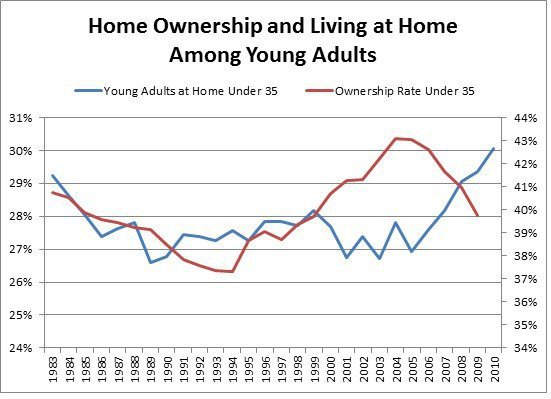

What is interesting is that even as the housing bubble was growing in 2005, 2006, and 2007 many young Americans were buying with massive debt. This chart highlights the horrible timing for young households. Many bought at peak prices right before the bubble burst. As you can see, since that period the homeownership rate for younger households has plunged while those living at home has surged. Over 30 percent of those under 35 live at home.

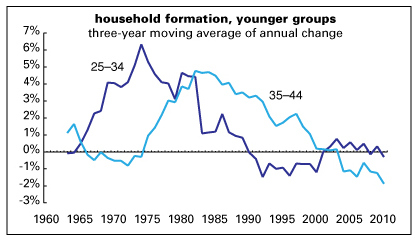

This pattern is unfolding also with older cohorts. For example, those 35 to 44 are also not forming households as they once did:

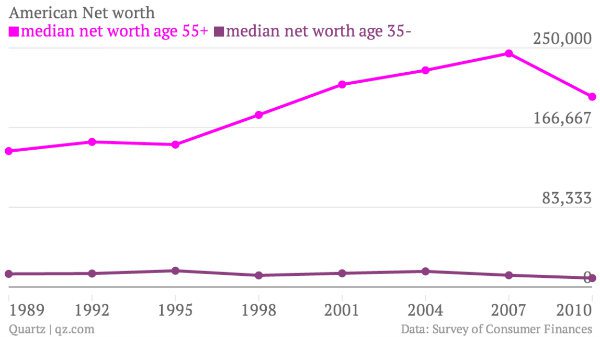

Those 25 to 34 and those 35 to 44 have seen weak household formation growth. Some argue that this is pent up demand but given that the net worth of these households is close to zero, I would argue something bigger is at play:

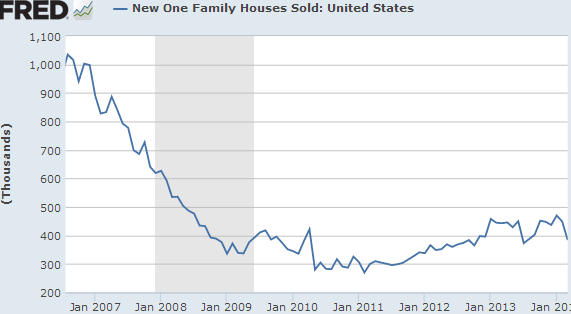

Young people are massively in debt with student loans and also have massively reduced wages and benefits with the jobs they are finding. This is simply part of the low-wage recovery we are seeing. So it should come as no surprise that home sales are weak:

No recovery in new home sales. These are usually targeted to new young households that have a good income. Yet take a look at the chart above. Where is the demand? Interest rates are incredibly low and the employment situation has improved since the recession ended in 2009. Yet the new jobs being added for the most part come in the low-wage category. These younger households have no way of competing with Wall Street money for properties. Many are too broke to even rent. So what we see is rents and home prices going up only because inventory is controlled by banks. Ironically other investors with ties to banks are buying up the few available properties in an incestuous circle jacking up prices for regular households. In the end, more money is consumed by housing and this is simply a consequence of this debt based inflation.

Many Americans are simply too broke to leave home. Forget about buying, many young Americans don’t even have the funds to rent a place. Sure makes the word “recovery†take on an entirely new meaning.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

jhpace1 said:

There is one aspect to the multi-generational home not being taken into account: those parents with homes also finding out their own retirements are not what they were promised. Many Baby Boomers are expecting 401(k)s and IRAs with stock plans allowing them to retire at $100,000/year income. Thus they can still “take care” of any adult children underemployed in their homes.

The reality is much starker: Social Security and retirement plans only adding up to $40,000, even with both spouses working until 70, and the adult child only adding $10,000 to that income, at most. Add in healthcare increases, property tax increases, and food inflation and you have a Middle Class nightmare.

May 1st, 2014 at 7:52 am -

Nichole said:

Hi, I completely agree with this article. Although, I cannot substantiate the data I can say as a millennial I have noticed my peers are renting or simply living at home with parents. Our generation is so “mismatched” in our careers. Highly educated people are working as bartenders. How can our society advance with a group of individuals just working brainless jobs to pay their bills? The money system is broke. We really need to start leveraging our technological skills to solve this exchange gap.

I also believe that because we have a highly educated group of people with a lot of free time on their hands that they are more aware of our nations problems then we are giving them credit for perhaps? Maybe they see no point in working for money as the value and/or exchange rate of their labor is being devalued little by little everyday.

The people at the top are so out of control. The only way I see to ascend from this is to reform our own local economies that have multiple exchange methods both online and off.

We will have to assertive and vigilant. Lastly we just have to believe this can be done and get to work, ignoring the silly little laws we break.

May 2nd, 2014 at 10:37 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!