3 Underground Real Estate Practices Moving the Market – Short Sale Fraud, Squatter Stimulus, and Buying Before Foreclosing.

- 7 Comment

In the early days of the housing bubble here in California and other bubble states a handful of people were raising alarm bells that mortgage fraud was occurring at unprecedented levels. The housing industry initially came out skeptically stating this was only a handful of wayward people. As it turns out, it was the vast majority of the industry sticking people into the most toxic loans for the highest level of commission. What was good for the borrower wasn’t necessarily what was the best for the mortgage broker’s bottom-line. After the housing bubble burst, we realized the industry was corrupt to the core and that practices that were standard were largely a joke. The housing market became one big free grab bag of money. Some now think that we somehow have stopped this massive fraud but that is a big misconception. The fix is in.

The irony of this bubble is the industry that created the housing mess (i.e., mortgage brokers, agents, appraisers, banks, and Wall Street) are now on the other end offering loan modifications and assistance on foreclosures. Without any actual financial reform, those that perpetrated the crime actually have firsthand knowledge on what went wrong and are now working the other end of the con. Let us first examine how many bad loans exist in the U.S.:

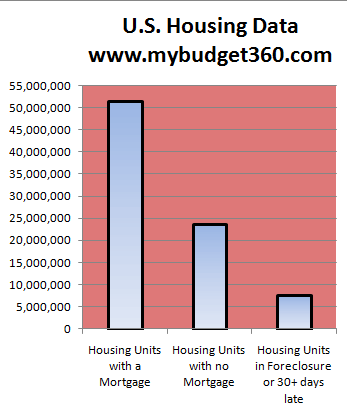

Source:Â Census; MBA

The U.S. has 51 million housing units with a mortgage. Another 23 million housing units have no mortgage. A recent MBA survey shows that 15 percent of all mortgage holders are either in foreclosure or 30+ days late (7.7 million mortgages). So in total over 43 million Americans with mortgages are paying on time but all current policy is guided by ignoring what is good for the middle class. Many of those 7.7 million loans are toxic loans and policy is being guided to protect the bottom line of the too big to fail who didn’t practice an iota of due diligence. This is being subsidized by the prudent and those who are paying even though it is antithetical to what is good for them.

So the crux of the problem is how to deal with the 7.7 million homes in foreclosure or that are 30+ days late. The HAMP program has pushed 168,000 mortgages into permanent modification but that leaves over 7.5 million mortgages in distress (and more are entering foreclosure each month). Leave it to the housing industry experts to create additional levels of fraud to siphon off money from the average American.

Con #1 – Short Sale Fraud

Part of the new “help†coming down the pipeline is HAFA. This program is designed to grease the wheels of short sales this year to get those distress properties moving. The central force with HAFA is getting second lien holders to let go of their rights on second mortgages to allow the first lien holder to sell a property. The low $1,000 incentive will not move the market. Short sales have been a tiny part of the market in the last two years so why are we to expect $1,000 is going to make this a big game changer? Keep in mind that in places like California, those second mortgages can range from $50,000 to $200,000 or even higher so banks would rather pretend that loan is worth the book value instead of forcing a major write down.

But the major fraud in short sales occurs off the balance sheet:

“(CNBC) But here’s what’s not legal and what’s apparently happening quite often recently. Since many second lien holders are getting very little, they are now allegedly requesting money on the side from either real estate agents or the buyers in the short sale. When I say “on the side,” I mean in cash, off the HUD settlement statements, so the first lien holder doesn’t see it.

“They are pretty clear and pretty upfront about the fact that if the first lender knows they are getting paid, the first lender will kill the short sale,” says Brandt. “So these second lenders are asking for the payments off the closing documents, off the HUD statement, usually in a cashiers check prior to closing. Once they receive that payment, they will allow the short sale to go through, which according to RESPA laws and the lawyers that we have spoken to on the topic is not legal.”

This is absolutely illegal. Anyone that has been in a real estate deal realizes that the HUD settlement statement accounts for every piece of cash or like money in the transaction. What the above amounts to is a form of extortion. The second lien holder is saying, “give us money under the table or we won’t allow the deal to happen.â€Â In 2009 it appears that 12 percent of all sales were short sales. How many had fraud involved?

Another fraud with short sales occurs with the real estate agent doing a quick flip. Say for example a home has a mortgage of $150,000. The agent negotiates with the bank a $100,000 short sale but has a buyer willing to pay $140,000. He then brings the property under contract for $100,000 then quickly flips it for $140,000. This of course is highly illegal and many buyers don’t even realize this happened unless they carefully scrutinize their records. During this housing bubble how much due diligence occurred? Short sales are designed and setup for massive amounts of fraud. Since we haven’t had any sensible regulation in virtually any industry expect this con to go on for some time.

Con #2 – Squatter Stimulus

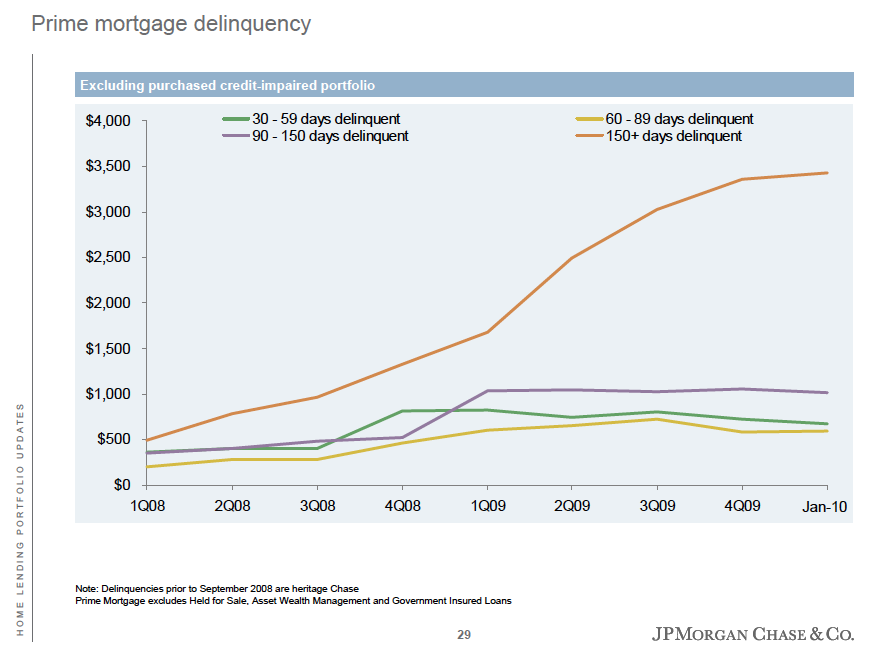

It isn’t just toxic loans going bad but also prime loans. Outside of Wall Street the economy is in bad shape:

Source:Â HousingWire

Loans are going bad across all categories. And as many Americans struggle with the reality of 17 percent underemployment making the mortgage payment is becoming harder and harder. But there is something dubious going on. Banks are no longer going through with the foreclosure process in any stated timeline. In fact, you can live rent free for many months:

“(HousingWire) What the above chart should call attention to is the aging of loans in the default pipeline. Again using LPS data, for all loans more than 90 days in arrears, the average days delinquent is now at 272 days—up from 204 days in early 2008. For loans in foreclosure, the aging numbers are even more staggering: loans in this bucket average 410 days delinquent, up from 260 days delinquent in early 2008.

Ponder those numbers for just a second. On average, severely delinquent borrowers have gone more than 9 months without making a mortgage payment—and yet foreclosure has not yet started for them. For those borrowers who are in the foreclosure process, it’s been an average of 13.6 months—more than one full year—since they last made any payment on their mortgage.â€

Now think about that. The average foreclosure timeline is now 13.6 months. Imagine what this does. Let us say you bought a home in California for $500,000. It is now worth $250,000. Your mortgage payment on your toxic loan is $4,000. You don’t qualify for HAMP or any other modification. You decide that you will strategically default. Now, you’ve freed up at least one year of no housing payment. This will give your balance sheet a new cash flow of $4,000 for whatever else you want to do. Even renters have to pay something. It is interesting that banks seem fine with this because the majority of Americans who are paying on time and bailed out Wall Street are subsidizing this kind of action (remember mark to market being suspended?). Aren’t you glad your tax dollars are going to things like this?

“(WSJ) Mr. Fernandez says he made four attempts to modify the larger of the two mortgages on his home, which add up to $423,000. Ultimately, he was offered a monthly payment that, together with back taxes, was higher than what he had been paying. Today he’s working to partially reimburse his lenders, IndyMac Bank (now OneWest Bank) and American First Credit Union, by selling the home, which he expects to fetch about $300,000.

A spokeswoman for OneWest Bank said the bank “offered Mr. Fernandez the lowest payment possible under the [Federal Deposit Insurance Corp.] loan modification guidelines.” A spokesman for American First said the company always seeks to help clients stay in their homes.

With an income of about $8,300 a month and a rent of $2,200, Mr. Fernandez says he now has the wherewithal to do things he couldn’t when he was stretching to pay the mortgage. He recently went to concerts by Rob Thomas and Mat Kearney. He also kept his black BMW 6 Series coupe, which has payments of about $700 a month.â€

Loan Modifications at Work

Now when was the last time your bank offered you a modification for paying your mortgage on time? We must be happy that we are allowing some of these poor homeowners to keep their BMWs. Your tax dollars at work.

Con #3 – Buying Before the Foreclosure

Another big issue in areas where prices have fallen includes buying before the foreclosure. Many already know they are purposefully going to strategically default. They also realize their credit will be damaged for a few years. So what is done is this. Say this person bought a home for $600,000 at the peak. These properties are now selling for $300,000. The owner already has made up their mind that they are foreclosing but like their area. So what they do is they purchase the second place for $300,000 while their credit is still good and then let the first place default. End result? They now have a mortgage obligation of $300,000 and that $600,000 property goes back to the bank (which is subsidized by the trillions in bailouts). These are the kind of cons that simply are not reported and are happening more than you would expect.

Conclusion

What we should learn about this housing mess is that people need to come in with a sizeable down payment of their own money. When I say sizeable I mean at least 10 percent of actual saved cash. The big game in town now is FHA insured loans that now make up 4 to 5 loans out of every 10. And these only require 3.5% down but with the current buyer credit, many are buying with zero down. And what a shock that these are now going bad:

“NEW YORK (CNNMoney.com) — The recent spike in the number of delinquent Federal Housing Administration-insured loans has some people worried that taxpayers will eventually have to bail the agency out.

Seriously delinquent FHA loans, those 90 days or more late, jumped 62.1% in the past year to 558,944, or 9.4% of FHA loans, as of the end of January, according to agency statistics released on Friday.â€

And this will setup even more cons like the cases we described above. If you bought a place for say $200,000 and you had to put $20,000 of your hard earned money in, you would think twice about leaving. Plus, you have a nice equity cushion. But say you go with a 3.5% (down payment $7,000) but the current buyer credit is $8,000 so you are paying zero when all is said and done. You will be more apt to walk. But again, this is a Wall Street subsidized con game and the majority of the prudent average Americans are getting taken for a walk on both ends of this crisis.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

7 Comments on this post

Trackbacks

-

GeekGirl said:

The thing that gets missed here and in most of the articles I read is that the values on these homes only went up BECAUSE of the fraudulent loans that were driving prices higher during the entire period of the massive control fraud. When someone buys a home that is over-valued by 30, 40 or 50 percent the idea that they should stay in it and pay on it when it is a con in the first place is what makes no sense.

Why should someone keep paying on a mortgage that is twice the value of the home? Why is that a con if they stop making payments? The con is the lender who over inflated values with toxic loan products and cheap money.

There is a fatal disconnect here when you blame the borrower and fail to make the connection that the ONLY REASON these loans existed was to get people into overinflated contracts so that they could be foreced to pay money that was never a real guage of the value of the property. The whole thing was based on the FRONT END PROFIT and to say that the people who got conned into going along with the stupid idea that real estate would make them wealth if they just got in the game is to miss the bigger picture.

Why shouldn’t Joe borrower keep his damn car? He is paying for it. If he figures out that the house they sold him at 600K is worth 250 or 300K then he should be smart like any banker would be and dump it. Fast. Just as JP Morgan dumped their high rises in San Francisco…

The name of this game was and always will be how to lock borrowers into insane contracts and make it pay. It did for a while. But then it all went bust BECAUSE it was based on tying people up in contracts that were UNSUSTAINABLE.

They KNEW that. To pretend the bankers did not know that and that this was all asurprise to them is what you do when you say that the homeowner is deceitful for figuring out that this game will not work. It’s not because the borrower is evil, crooked or fiscally irresponsible. It is because the CON was to get these people INTO these loans in the FIRST PLACE.

As William Black points out in his work, in 2004 the FBI was REPORTING THAT THERE WAS MASSIVE MORTGAGE FRAUD BY LENDERS THAT IF NOT CHECKED WOULD LEAD TO ECONOMIC CRISIS. VOILA. Here we are. The economic crisis is the INFLATIONARY BUBBLE IN THE PRICES THAT WAS BASED ON FRAUDULENT LOANS.

It is remarkable to me that people who are so smart can get this so wrong. It is so easy to blame the homeowners – to say they are pulling a con when they are simply figuring out how to get out of the mess they got into be deceit on the part of the lenders.

How many homeowners in the last 10 eyars or so got more than one phone call a DAY pushing them to refinance? How many new borrowers were solicited DAILY by people trying to sell them a home at zero interest? How many buyers bought $1 Million worth of house for $1500 a month and a promise that the payments could be adjusted in 2 years before they new fixed rate set in and tripled the payment?

The con is that the banks are still in business at all and all these loans have not been wiped out as frauds and fakes and the people of this country paid back for all the money they have wasted paying interest to banks who do not even have any skin in the game because they are creating the money out of thin air using the Promissory notes of the borrowers as their “collateral”. As Nathan Martin would say, “It’s the DEBT stupid!” and the whole point of this exercise was to create debt slaves out of as many Americans as possible as quickly as possible and at the most ridiculous terms possible.

Game over.

To pit the ‘honest hard working mortgage paying public’ against the ones duped by this massive fraud is just another cheap shot that fails to take in the reality of the big picture. Shame on you; you should know better.March 21st, 2010 at 4:05 pm -

Tom said:

Whats all this about fraud? You mean if you lie and distort, thats bad? I don’t really know because in my education I was told its all relative. I’m not sure they knew what they were talking about but apparently morals and ethics are passe. I’m pretty sure this is at least part of what was going on in Sodom and Gomorrah just before it was destroyed (besides all the buggering). Besides, starvation in America won’t be such a bad thing.

March 21st, 2010 at 7:07 pm -

JC said:

Good article, but you left out several other cons:

Con #4 – Paying Bank Employees to Delay Foreclosure Proceedings and/or the Processing of Your Loan Modification.

Con #5 – Short Sales to the Same Home Owner.

Con #6 – Banks Allowing Delinquent Mortgage Holders to Remain in House to Maintain It While Foreclosure Is Extended.

Con #7 – Paying to Have Mortgage Reclassified as “Uncollectable”.

Con #8 – Paying to have Mortgage Balance Reduced.

Con *9 – Lobbying to Have Foreclosures and Bankruptcies Forgiven.

Con #10 – Lobbying for Larger Home Purchase Government Subsidies.

March 21st, 2010 at 7:46 pm -

Credit Girl said:

Inflation in the housing markets has become a huge problem yet people are still buying. It’s really unfortunate that we, the citizens, have to make up for the losses of mortgage brokers and Wall Street financiers that partially brought our economy into the ground.

March 22nd, 2010 at 2:45 pm -

JP Merzetti said:

Well spoken, Geekgirl.

They’ll look pretty cute with their pants down…caught in their own greedy game – thing is, for every scammer weaseling away from their own folly there’s a dozen others who were just following the script……..the numbers are too big to be anything else.

It’s astounding, to watch everyone sit around now watching prices slowly cave in, tickling the edges of sly whispers as to where they might have to be for wages to ever afford the sad dears again.

They haven’t arrived yet; in some parts of the nation, probably won’t for years……and in the meantime? That’s where the fun is.Good old ingenuity will figure out survival tips as time goes by, and people will get by, one way or another. Big money hates to lose.

But remember – nobody knows nothin’…..until such time as they’re forced to cough up a little bit of 20-20 hindsight (emphasis on the hind part) because they’d otherwise have to admit how shrewd their stupidity was…and if that sounds like an oxymoron – put the emphasis on the second syllable, and that should be about right.

March 22nd, 2010 at 8:37 pm -

thomas said:

Real estate is a big industry that is why there are always fraud cases

March 23rd, 2010 at 3:57 am -

Peter said:

Here’s another con… People opt out for a short sale once they realize they can’t pay for their home. So as stated previously, they have 13 months rent free. Then when a new buyers offer is accepted by the bank and announced to the current owner, the current owner gets one of his buddies to put in an offer that is higher than the one that has worked through the system for say 5 months. That deal is now killed. Now the current owner’s buddy has only to say “I think I will have to back off from the offer” an the current owner has another 6 months of free rent. Keep in mind that the deposit is kept by the bank, but the owner can give that money to his buddy (along with something on the side for his buddy) and voila… the perfect scam which can go on for years rent free (well aside from the something something for his buddy and the deposit).

January 17th, 2012 at 10:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!