The 4 Horsemen of the US Debt Apocalypse: 80 percent of federal government operation costs go to four areas in Health and Human Services, Social Security Administration, Veterans Affairs, and Department of Defense.

- 6 Comment

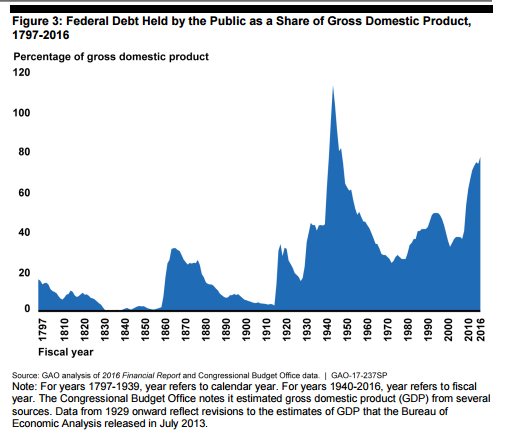

Here is a question you probably won’t find on Jeopardy: what is the actual risk of a U.S. default on its debt? The answer to that is none because the Federal Reserve has the magical power to create new debt to pay off old maturing debt. Must be nice to operate beyond the normal rules of accounting. Yet there is a problem where the debt to GDP ratio is now at a level only surpassed by that brought on by World War II where the industrial powers were literally in full scale war. It is probably worth noting that we have mountains of debt and a large portion of this is being held by China, a nation that is being politically unsettled by words of the incoming administration. We are essentially in a situation where our tax receipts are not keeping up with our spending. So the debt only grows. And four departments eat up 80 percent of all federal government spending: The Department of Health and Human Services, the Social Security Administration, Veterans Affairs, and the Department of Defense.

Spending will only grow

We have an addiction to spending and debt is our crack. The U.S. is in an enviable position where we can spend as much as we want courtesy of the Federal Reserve. Debt is fine to a certain level and you must have enough revenue coming in from the real economy to support this deficit spending. The new administration has already alluded to big spending with tax cuts – which will only balloon the deficit.

Here is how our debt to GDP ratio looks like:

Source:Â Government Accountability Office

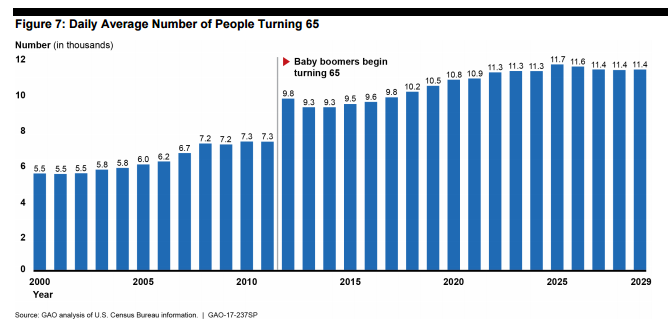

What is interesting in no projected scenario do we see debt shrinking. It only grows and grows extensively. Two departments cater to older Americans and those costs are going to explode over the next few years:

And this problem is bigger than you think because half of elderly Americans rely on Social Security as their primary source of income. Not a good thing when we are running deficits like this. The other two departments are focused on war and large scale weapons and then taking care of the people that serve our country. Sadly, we don’t do a great job taking care of our Vets but do invest a lot in very expensive weaponry. One large reason why the U.S.S.R. went bankrupt was spending way too much on military.

What you won’t see is politicians going after any of these areas. These are political kryptonite. Old Americans and the military. You can’t win by cutting anything here. So you can expect this spending to continue for the near future. But what does this mean in the bigger scheme of things? It means shadow inflation through debt. Things that are financed will get more expensive if more debt devices are injected into the system. Take college tuition for example. It didn’t go down during the Great Recession but kept on moving up thanks to government backing of loans.

Keep in mind all of this is happening without much resistance because the economy on paper is looking good. The headline unemployment rate is low even though 95 million adult Americans are not in the labor force. The stock market is great but only half of Americans even own one stock. Real estate is up but the homeownership rate is down. But here is a fact and that is America is getting older and this is going to be a massive expense on our balance sheet. These four departments eat up 80 percent of federal government spending and will likely continue to do so.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

COLLIN said:

“WICKED DEBT FRAUD” (REVISED) The one and ONLY answer to the debt problem is to declare it null and void because of FRAUD! It is fraud because it is mathematically impossible to repay! It cannot be repaid because the interest is never created on the loan and that is fraud and fraud voids all! If we don’t void all out of thin air debt, the bankers will own almost EVERYTHING! We will be homeless slaves! They have a license to counterfeit! Can I counterfeit the money to repay the loan? Why not? They counterfeited it to lend it to me? If we even attempt to repay an impossible debt (All out of thin air debt) all we do is show our ignorance! The way to fix this mess is so simple a 3rd grader can figure it out! We void the fraudulent debt and everyone keeps ALL the items they have so called debt on! Then we can start to use a debt free currency and / or gold and silver! Then we will have a robust economy like never before — OR WE LET THE BANKERS STEAL EVERYTHING!

I was in about the third grade when the news was talking about the national debt and I asked my dad “who do we owe money to? And who could possibly be richer than the United States? And where did they get the money?” And then my dad took a gulp off his beer and said “we owe it to ourselves!” I said “that’s the dumbest thing I’ve ever heard of!” That’s like me borrowing from my right pocket and setting fire to the interest and putting the rest in my left pocket! This was about 1972! But Dad was wrong! We owe it to international Bankers running the biggest Ponzi scheme on earth called The Federal Reserve System! And yes it really is this simple! The bankers have a shoe-in on ALL loans they make! All they have to do is stop lending and then start foreclosing on ALL debts! -meaning they now own everything that has a debt by having a license to counterfeit! So we #1 keep getting fleeced by continuing to pay this fraudulent scheme! OR #2 We declare ALL out of thin air debt NULL AND VOID because of FRAUD! And we keep everything we have so called debt on! MOST people don’t get this part! Every car, boat, house, machine, tool, farm,etc. has already been paid for by the fraudulent paper! So no one loses! (except the fraudsters) WE sure as hell can’t give it to the banksters! (let them steal it) AND IT DOESENT MATTER IF THE BANKERS FORGAVE THE DEBT BY 99% ITS STILL UNPAYABLE! (BECAUSE THE INTREST DOES NOT EXIST ) So when we void the FRAUD This will be the ultimate FRESH start for everyone! Share this if you want THE solution to the WORLD’S problems! If not, everything will continue to get worse until we have HONEST DEBT FREE MONEY and / or GOLD AND SILVER! And there is plenty of gold and silver! Just Divide the paper money (FRN) by the gold /silver and you have the value of them! NO MATTER WHAT IT COMES TO per OZ! Then we would be happy to work for SAY A ONE OZ. SILVER COIN A day ! Because a one OZ. silver coin (REAL MONEY) will buy what $100 – $200 or more did before the reset! THINK ABOUT IT! This is what Scripture calls the jubilee! “WICKED†Debt And the amount and size of the debt has nothing to do with it being mathematically impossible to pay! This fraud is so “WICKED†that even a $10 loan is a Ponzi scheme here’s how it works! I’m the new banks first customer, I borrow $10 @ 1% interest I now owe the bank $10.10 but ALL the money in the world is $10 the .10 cents doesn’t exist (BECAUSE THE INTREST IS NOT CREATED) so some one else has to borrow some so called money and I have to find a way to get .10 cents from them so I can repay my loan! Now say they borrowed $10 also now I somehow get .10 cents from them to pay my loan back! But now he is short .20 cents to pay his loan! Now you can see how a $100,000 house that will cost you $265,000 to pay off because you have to pay $165,000 in interest (THAT DOES NOT EXIST) is a GIGANTIC PONZI SCHEME! Now multiply that by millions of people in the U.S. and you can see how It turned into the monster debt we see today! And for the loans that do get repaid multiple people have to default on there loans for you to pay off your loan! NOW you can understand why we have a rapidly growing homeless problem! Now that is a WICKED debt money system that we must declare Void! -NOW WATCH ALL WARS ARE BANKERS WARS https://www.youtube.com/watch?v=5hfEBupAeo4&feature=em-share_video_userJanuary 22nd, 2017 at 10:26 am -

Bill Mantis said:

Since Japan is running a debt that is upwards of 220% of GDP with no apparent ill effects, I’m not convinced the US—with a ratio less than half of that—should be concerned.

Economists from the Modern Money Theory school of thought (James Galbraith, Warren Mosler, L. Randall Wray, et. al.) all argue that the ONLY threat high deficits pose (to governments that issue their own currencies) is the threat of inflation. And since the US’s rate of inflation is below even the 2% rate the Fed would like to see, perhaps a larger deficit would be in order. The caveat here would be how the larger deficit were created. Tax cuts that go primarily to the wealthy, for example, typically show a multiplier effect of well below 1. Whereas tax cuts to the poor or infrastructure spending have a multiplier above 1.

Of more concern to me is the sub-optimal employee participation rate. Which would also argue in favor of a larger deficit.January 22nd, 2017 at 1:14 pm -

Riddle me This said:

How is it that college tuition went up dramatically because of government backing of loans? They have been backing loans now for decades.

It’s because states keep cutting support for their public universities. And salaries keep going up in public and private schools.

Sure, cut out the government backing of loans, but some private enterprise will step in and fill the void. When you pull the rug out from subsidizing tuition at state schools, guess what happens?

January 23rd, 2017 at 11:47 pm -

roddy6667 said:

If the Fed were only printing more bonds to replace maturing ones, that would be manageable. That is not the case. The size of the debt increases by trillions every year, increasing the amount of bonds to be issued every year.

January 25th, 2017 at 9:38 pm -

doh you don't know! said:

“How is it that college tuition went up dramatically because of government backing of loans?”

The same way prices in the housing market went through the roof. You flood the market with easy money that anyone can get and is backed by the govt. where the govt. takes it on the chin if they default and banks will give the money to anyone (NINJA loans in housing market and with college people going to school for degrees that are not worth the paper they are written on). The free/easy money makes the prices skyrocket because you are flooding the market with it. Banks that do student loans could careless if you found a career/job that pays good when you get out of school or in your major, you could be working at McDonald’s the rest of your life they don’t care. Because, they know you CAN’T default on the loan or try to bankruptcy your way out of it.

January 28th, 2017 at 9:17 am -

Ambrose Bierce said:

answer is direct monetization, adding money to the economy raises GDP and provides added tax revenue. rinse and repeat, its obvious the private sector cannot be trusted to keep the business cycle going. also it much easier to tax the 99% who have no lawyers, and no offshore tax shelters, just H&R block. the real problem is policy, and here again government is better at judging the correct rate of growth for the economy rather than throwing their fate to the wind. besides policy there is corruption, political mostly, but that loophole could be closed if pres Trump enacts campaign reform (did you forget, or did he?) the implementation of a centrally planned economy requires a shift away from pork barrel politics to sustenance, food shelter and transportation, and leave the bridges to nowhere, and the various military appeals to national self aggrandizement, out of the budget.

January 30th, 2017 at 9:41 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â