California Lost Decade of Employment: Bulk of Recent Income Gains went to Wealthiest Californians. 76.8 Percent of Adjusted Gross Income Gains between 2006 and 2007 went to the Wealthiest Fifth of California Personal Income Taxpayers.

- 0 Comments

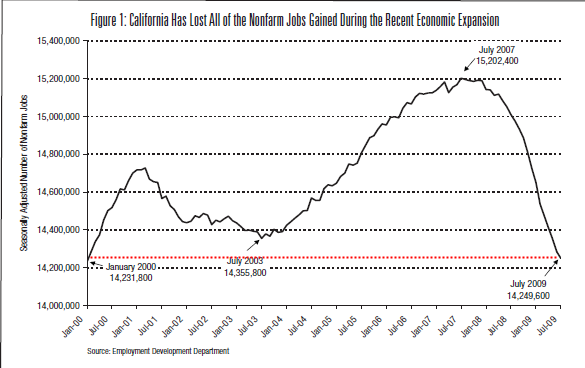

California may now have one of the distinct misfortunes of enjoying a lost decade of job growth. This not only applies to the battered economy of California, but to the nation as well. To put the magnitude of the current recession in perspective, the only other time in economic history to see a contraction wipe out a decade long expansion of job gains was during the Great Depression. Yet somehow in the midst of all these job losses the S&P 500 is now up 56 percent from the low reached in March. You might have missed the fact that we are reaching year highs on the market because the underlying economy is still in tatters. California is home to the same number of jobs from a decade ago even though we now have 3.3 million more workers.

California even after jumping into emergency mode to patch up $60 billion in budget deficits is still largely in the midst of economic contraction. For one, the housing bubble is still in deep trouble. Option ARM products are set to go off in mass starting in 2010 and the bulk of these loans are in the state. First, let us look at the employment situation:

Source:Â California Budget Project

An entire expansion wiped out in three years. That is another attribute of this current recession. The speed in which it is throwing off jobs. Peak employment was reached in November of 2006 with an unemployment rate of 4.8 percent. The current official rate is now at 11.9 percent although this undercounts the underemployed which is a significant number. Nationwide the U-6 rate is at 16.8 percent and the headline number is at 9.7 percent. For California, that means U-6 is now solidly over 20 percent.

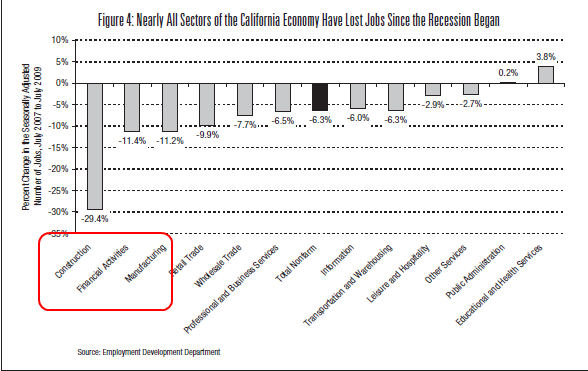

If you want to understand why California is being beaten down so heavily, it is because of its heavy decade long reliance on the housing bubble. California was birthplace to many subprime operations and also a place where people fancied option ARMs and other exotic mortgage products that only had viability in legendary housing bubbles. The tale of the tape is in the industries that have been hit the hardest:

The three hardest hit industries all revolve around the housing industry. Construction, financial activities, and manufacturing have all been pummeled in the state since the start of the recession. Construction has shed an unbelievable 30 percent of jobs since the recession has started. No other industry even comes close to this. When we discuss the $3.5 trillion stealth bailout in commercial real estate being put together by the U.S. Treasury this is what we are looking at. Commercial real estate has little viability in the current market. As we are seeing, lower prices will move homes even in a state with a bubble like California. But there is no need for some retail space making many strip malls and other projects largely obsolete. There is simply no demand. Expect enormous losses in this category.

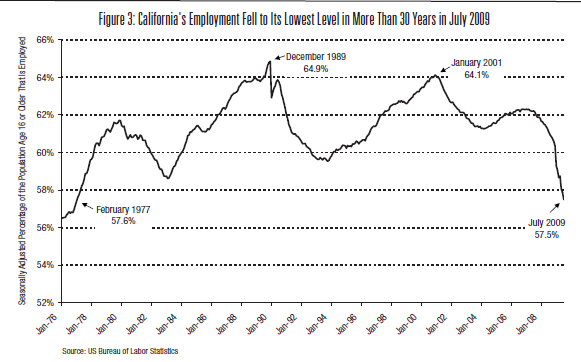

To put the recent employment situation in context, California’s employment rate has fallen to a 30 year low:

This is historical. Even the deep the recession of the early 1980s saw the employment ratio fall slightly below 60 percent. The current ratio is now at 57.5 percent. An interesting point in the chart above is California has never regained the peak employment ratio reached in December of 1989 not even at the peak of the technology bubble in January of 2001.

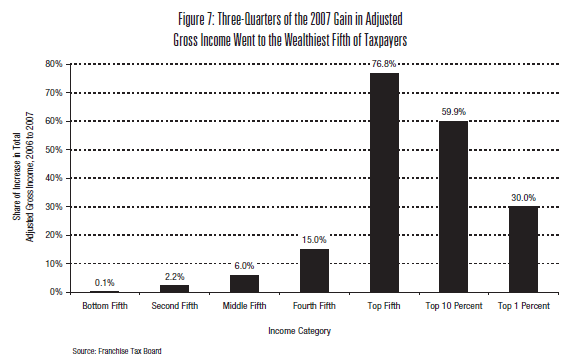

Even in this bubble, all the gains were not equally distributed. Just take a look at where recent income gains went to:

This chart is rather telling. If anything, it shows how many in the upper-income brackets largely benefited from the housing and stock market bubbles. Even though a larger number of the population thought they were getting richer they were only seeing paper gains in their home and with stocks. Once that was wiped out, they had no income (or in many cases jobs) left to show for a decade long mania.

You need to consider who these top income earners were. Many were affiliated with the real estate bubble and acted like P.T. Barnum in pumping up the greatest housing bubble known to mankind. As we now dig through the rubble of the busted bubble, we realize that many people were sold a taste of the sizzling steak and a notion that they were privy to the access of the get rich quick crowd. The 30 year bubble was built on this simplistic notion that everyone would become real estate millionaires by flipping homes to one another. What now seems like a naïve notion, did we forget that advanced economies need scientists, engineers, and doctors to create new industries and products? This belief of easy riches through real estate was so ingrained in the culture, that entire television networks were dedicated to showing average Americans how to flip homes and cash in easy profits with no sweat. This would be like us finding a book showing people trading their entire livestock for tulip bulbs during the tulip mania phase in Holland. Oh wait, that did happen.

Half of the state’s unemployed have been unemployed at least 15 weeks. And if we need any other headline:

The state has been borrowing (again) from the Federal unemployment fund since January of this year. Apparently this is all good news for the stock market which seems to ignore all these record breaking headlines.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!