The largest pension fund in the country CalPERs continues to underperform: Weakest return since 2008-09 financial crisis.

- 0 Comments

The two largest public pensions in the U.S. are Calstrs and Calpers and collectively they oversea $484 billion for public workers in California. Pensions have a hard time surviving in a low return world. For example, these pensions seek out a 7.5% annual return which is simply unrealistic to do in a market that is volatile (by definition, markets are meant to be unpredictable). Not only is the market volatile but we find ourselves in a low return environment. Pensions trying to seek out guaranteed returns are going to have a tough time finding a sure bet when bonds are producing such a low return. Unfortunately these guarantees become contractual and the shortfall needs to be closed by the taxpayer. It is no surprise that pensions have become a rarity in this market. The 401k model of investing was supposed to help workers transition from this guaranteed return to a more market based approach. The only issue with that is most people never save on their own and make bad investment moves. When you are dealing with high frequency traders and other advanced investment techniques, the regular family stands no chance. Recently Calpers posted a dismal return, the worst since the 2008-09 financial crisis.

Calpers missing the mark

Calpers just announced that their annual performance was the worst since the 2008-09 financial crisis. What makes this even more troubling is that this announcement comes when the markets are hitting near record levels:

“(WSJ) Ms. Frost’s comments came days before Calpers said that its fiscal 2016 return was 0.6%, the slimmest gain since the 2008-2009 crisis. Calpers has a funding gap of roughly $112 billion, according to the most recent available data. As recently as last year, Calpers Chief Investment Officer Ted Eliopoulos said in an annual letter that the plan was “reassured by our 20-year investment return of 7.76%,†which exceeded the internal target of 7.5%.

Now, “it is a struggle to have a positive return,†Mr. Eliopoulos said in a media call last week.â€

When you expect past results to foretell future results, you have a big problem especially when it comes to investing. The 2016 fiscal return of 0.6% is a far cry from the 7.5% target they have set. And the problem is the models are built off 7.5% continual returns. We have yet to see even a slight market correction since 2009 so it is safe to say that any correction may have a deep impact on pension returns. That $112 billion shortfall can explode even larger.

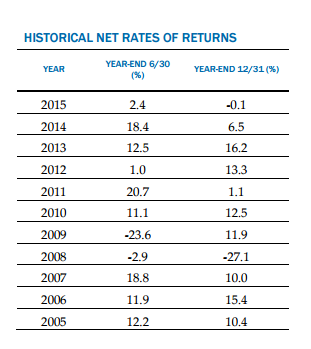

It is easy to see why Calpers is confident that things will be back to normal soon. Look at recent returns:

The only recent bad years came in 2008-09 and that was due to the financial meltdown. But what is the reason this time? Why is it underperforming even against the overall market? For the most part, active management tends to lose out to passive management through a diversified portfolio. But how can that be justified when Calpers has this to work with:

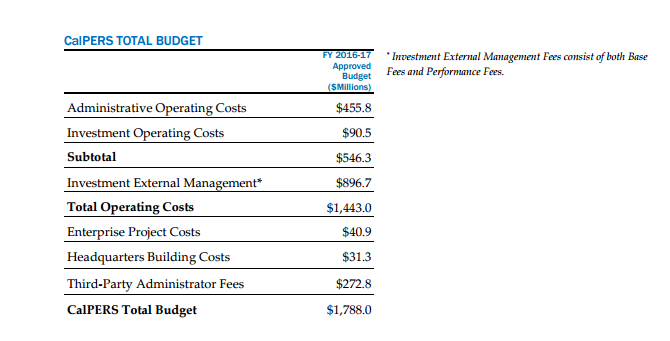

Calpers has a $1.8 billion operating budget. You are going to have to make some aggressive investments to make a 7.5% return and be able to payout those overhead costs. Ironically a diversified portfolio of the market would outperform Calpers over the last few years. But the difference here is that retirees are paid based on a formula so any shortfalls need to be made up by the state.

“Those long-term returns have dropped below expectations due in large part to two recessions over the past 15 years and a sustained period of low interest rates. Pension funds invest heavily in fixed-income securities, so the loss of a few percentage points of bond yield hinders their ability to post steady returns.

Funding shortcomings often mean taxpayers or workers are asked to chip in more to account for rising liabilities. Every one-percentage-point drop in investment returns represents an increase of 12% in liabilities, according to the Center for Retirement Research at Boston College.â€

The above equates to a bad investment strategy. Taxpayers are going to pay up even more and if a minor stock market correction hits, good luck.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â