Is the Chinese stock market bubble finally bursting? Shanghai composite and Shenzhen composite down 7.4 and 7.9 percent respectively in one day.

- 2 Comment

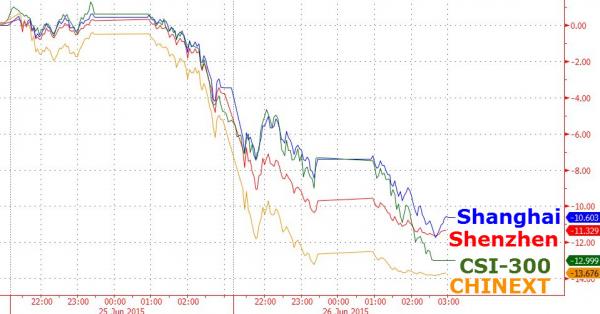

The Chinese stock market has been one of the hottest tickets lately. The US stock markets might seem overvalued but in comparison to China with relatively new financial checks and balances, the US looks like a conservative old timer. Stocks in China are already deep into ridiculous pricing territory. You have an army of uneducated investors diving in hand over fist trying to get a piece of the action. In the US, there is little activity in the stock market from our massive low wage labor pool. In China, from poor to wealthy stock speculation is now taking the baton from the boring correcting real estate market. On Friday, all stock markets in China took it on the chin. The two largest exchanges with the Shanghai composite and the Shenzhen composite fell hard, 7.4 and 7.9 percent respectively. How bad is that? Imagine the Dow Jones Industrial Average losing 1,300 points in one day. That is how bad it was in China on Friday.

The big hit in Chinese stocks

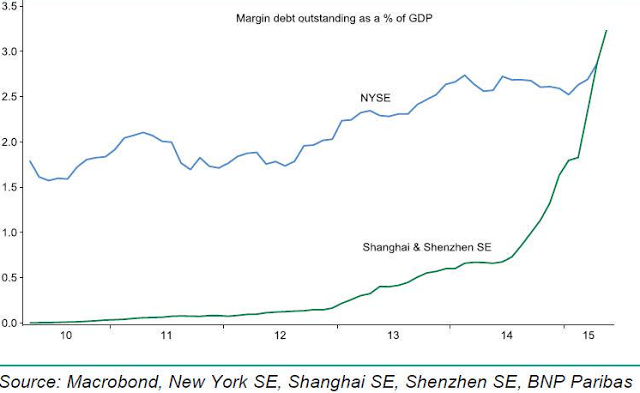

Even with this recent drop stocks in China are massively overvalued. Speculation is running rampant and margin trading has surpassed that of the New York Stock Exchange. What is more troubling is the seemingly disregard for values and fundamentals. People are racing into the market to make a fast buck. In Chinese newspapers you hear about street workers saying “it is easier to make money in the stock market than actually doing real world work.â€Â That is true. The casino money is moving fast and furious.

But what comes up so fast can come down very quickly:

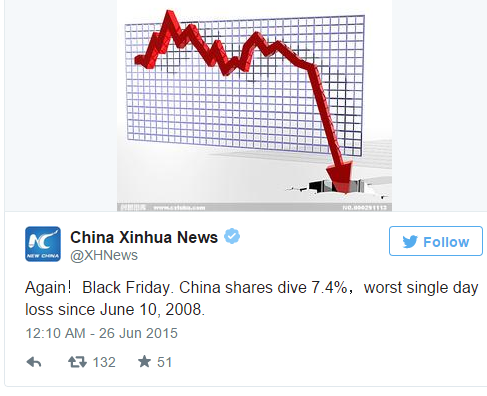

This was a coordinated fall. Within local media the fall is being echoed:

When you have people like this opening accounts and day trading you have some challenges:

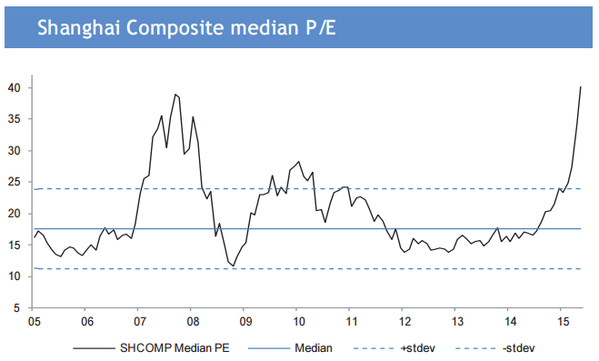

The problem is that bubbles run away and forget about one very important thing, and that is valuation. Values are fully outstripping any semblance of sanity. Typically stocks are viewed by their potential earnings per share. It is a good way to value something. How much are you going to get back for putting your money at risk? Typical PEs of 10 to 15 seem reasonable in the US and in companies with potential growth. What do things look like in China?

The current PE ratio is more than 40 and this is higher than things were before the 2007 and 2009 world financial collapse. More troubling this time around is the volume of margin trading:

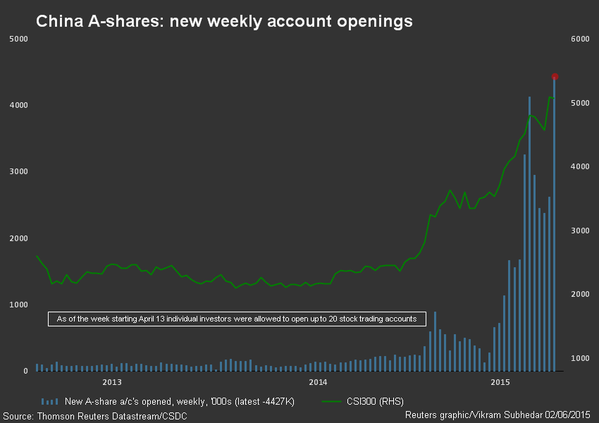

That is not good. With margin trading, you can actually lose more than you started with causing financial and banking houses to collapse. No one seemed to be thinking about this because stocks only seemed to be moving in one direction. There is now this unchecked idea that nothing can slow down the Chinese economy and it seems to have permeated throughout the population. Take a look at new accounts being opened:

This reminds me of the tech bubble of the 1990s where everyone just had to get a piece of the action. In the US, the low wage and entry level worker seems to have very little money to gamble with and are weary of the stock market. That doesn’t seem to be the case in China.  Right now the perception is that if you sit on the sidelines you are going to miss out on easy money. The water is nice and warm right now, or at least that is the message. No, the water is at a boiling point.

The Shanghai composite is up 218 percent from 2000 (compared to 45 percent for the S&P 500). Easy come, easy go. Too much easy money is flowing through the system and this is simply a consequence of greed flowing into various bubbles. Is this the tip of the iceberg of a deeper correction? We will soon find out.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Harryflashmanhigson said:

The central bankers will just throw more money at it till it all sorts itself out! Until there is a co-ordinated fall in all world markets it just doesn’t matter, not big enough of a problem to worry about…

June 28th, 2015 at 5:29 am -

Eric said:

The Chinese seem to have a genetic predilection for gambling and they found a new casino.

July 3rd, 2015 at 9:06 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â