Commercial Real Estate Problems in Financial Purgatory – $3.4 Trillion Debt Market and Expansion of Interest Only Loans to Finance CRE Deals. CRE Debt Found its way into Pension Funds.

- 2 Comment

The Congressional Oversight Panel put out a daunting report regarding the commercial real estate market. Commercial real estate is an enormous market with $3.4 trillion in debt secured by office space, malls, and apartment complexes to name a few examples. Commercial real estate does a fairly good job as being a barometer for the actual recovery on the ground that most average Americans will feel. If middle class Americans feel ready to spend again and are expanding their consumption, then more and more office space will be occupied. But looking at current vacancy rates we get a diverging picture of the recovery we keep hearing about but seem to escape the grasp of 95 percent of the population.

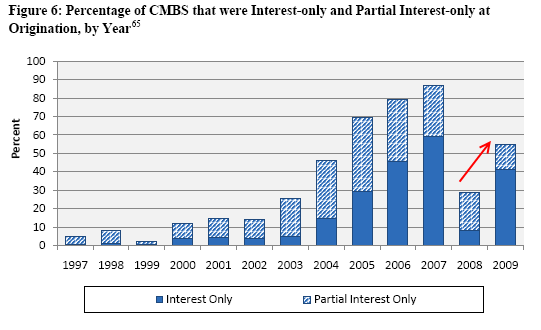

One of the troubling findings in the report is the lax lending found in residential real estate was mirrored in the commercial real estate market:

In fact, the amount of interest only or partial-interest only loans was even bigger in CRE than in the residential market which in itself is a rather stunning accomplishment. In 2007 at the height of the CRE bubble, nearly 90 percent of all loans were interest only or partial-interest only loans. This number is astounding. But what is even more disturbing is the recent ramping up of interest only loans. In other words, banks are rolling over loans with the absolute minimum payment possible to keep borrowers above water. Why does the bank want millions of square feet in empty office space? They don’t so the shift here probably has something to do with that. The commercial real estate market is in a giant form of financial purgatory.

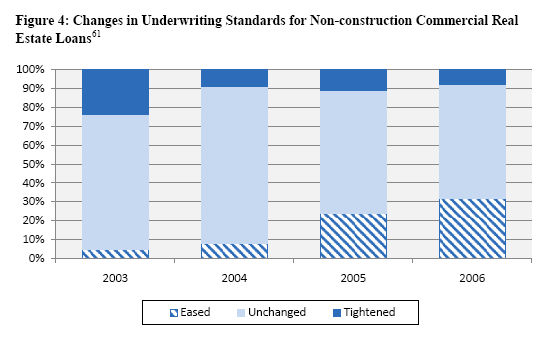

The lax lending standards that came into the CRE market also show that during the boom due diligence was an afterthought on most loans. Keep in mind many of these deals were multi-million dollar deals and in some cases, billions of dollars were at hand. This wasn’t a $90,000 subprime loan, which is bad in itself with weak underwriting, but here you had millions being thrown around as if somehow banks forgot the actual value of a dollar. The standards in CRE deteriorated rather quickly:

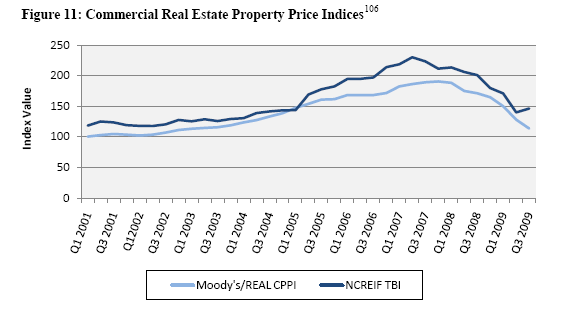

As more and more money bounced around the system lending standards became more and more generous. Of course this led to the massive expansion in CRE space even when demand did not warrant it but has now led us to this current precipice where the market is flooded with too much inventory. As is the case in most bubbles prices have corrected heavily in the CRE market:

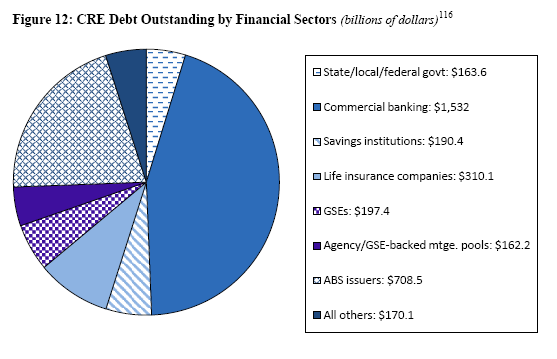

CRE values across the board are down by 40 percent from their peak values, a steeper decline than even the residential housing market. Yet banks holding onto these loans have been spared the stock market drubbing many banks took in 2008 and early 2009. The loans are equally as bad so why then is the market responding so favorably to what seems to be disastrous data? In March of 2009 it seemed the entire financial system was going to implode and finding a bid on any asset at one point seemed to be an act of futility. Now this might have been extreme given how quickly we were approaching zero. But today, the opposite is the case. Many are overvaluing the actual damage that is going to hit the system in the next few years courtesy of the CRE market. This is an enormous market where most of the loans are held by already weak banks:

The large amount of this debt is held in commercial banks. These are the same commercial banks that are backed by the insolvent FDIC fund. The FDIC now lists over 700 banks as “troubled†but it is very likely that when this crisis is over (which can be years away) we will have at least 1,000 bank failures. Most of these banks now have CRE loans that are not being serviced or are being serviced at lower levels that don’t even cover principal and interest. To paraphrase, if you owe the bank $1 on credit card debt that is your problem, but if you owe the bank $10 million in CRE debt it is the bank’s problem. Many banks are in a position where they are now realizing that the borrower is calling the bluff of the bank. You want your CRE back? Go ahead and take it! So banks would rather let the borrower hold onto the CRE even if it is bleeding on a monthly basis instead of forcing actual write-downs on their books.

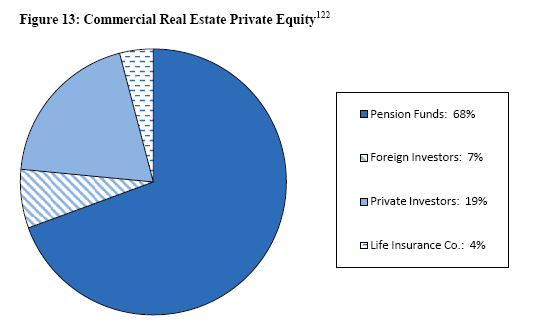

And what is troubling is that many so-called conservative investment funds ate up this toxic waste:

So you might be thinking, “I don’t own any CRE so why should I care?â€Â You might not own any of this CRE debt but your pension might. Now when things get this systemic, it is bound to roil the system just like subprime was the fuse that lit off the economic crisis. Today, no one thinks that subprime was the cause of this entire crisis but was merely the most obvious first domino to fall. CRE is equally as toxic but it seems that the market has chosen to ignore the problems inherent in the system. Eventually the system will have to realize what is going on either through a market correction or by funneling more bailout funds to inefficient components of the economy.

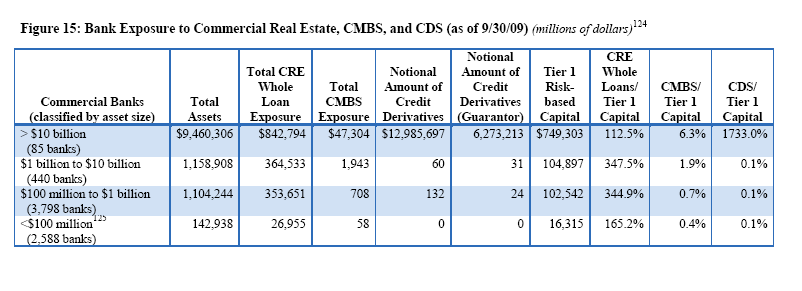

The market is probably mispricing the actual problems in the system because it assumes that the bailouts of the banking industry will protect the problems with this mess. Yet someone will be paying for this. Wall Street is simply assuming it will be the middle class yet again. Take a look at the concentration of CRE debt with the too big to fail:

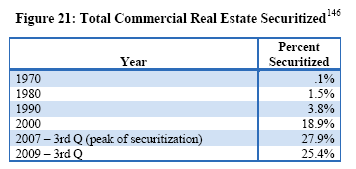

At the core of this problem was the shifting of debt to the global markets by securitization. To repeat an often misused quote, real estate is local. So how can an investor in Norway really have a good sense of CRE in Houston Texas? They don’t and clearly this is the same inefficient spreading of risk (and gambling) that led us into this crisis:

For 40 years securitizing debt was only a Wall Street trader pipe dream. Suddenly in 2000, this was the way to make mounds of money on what used to be boring real estate debt. CRE was only another asset class that was once relatively stable and suddenly became another slot machine in the Wall Street casino. It is no mistake that over the past decade the middle class in America have lost ground seeing wages stagnant while a smaller portion of our economy goes to those in the government sanctioned casino knows as Wall Street.

Expect bigger problems to hit in the CRE market. From the report:

“(COP) Between 2010 and 2014, about $1.4 trillion in commercial real estate loans will reach the end of their terms. Nearly half are at present “underwater†– that is, the borrower owes more than the underlying property is currently worth. Commercial property values have fallen more than 40 percent since the beginning of 2007. Increased vacancy rates, which now range from eight percent for multifamily housing to 18 percent for office buildings, and falling rents, which have declined 40 percent for office space and 33 percent for retail space, have exerted a powerful downward pressure on the value of commercial properties.â€

In other words, get ready for more bailouts or dollar devaluation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Robert Dougherty said:

This website is superb. Abosolutely and consistently the best source of financial information on the internet.

I continue to wonder who is the responsible for creating the site and who authors these excellent articles.

March 2nd, 2010 at 4:11 am -

Luke C said:

I have to agree… Fantastic information and no wild hand-wavy analysis. Bookmarking this now. Thanks for the great stuff!

March 3rd, 2010 at 12:43 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!