The Financial Battle for the Middle Class – Underemployment at 20 Percent, 38 Million Americans on Food Stamps and Little Hiring. Can it be a Recovery with no Jobs for this Long?

- 5 Comment

For most Americans a jobless recovery is an oxymoron. After all, the vast majority of Americans who pump money into the economy through consuming what they earn, typically find it harder to spend if they don’t have a job to draw an income from. It is understandable that there is a lag between a recession and when companies start to hire. But over the last four decades each subsequent recession seems to add more and more months of so-called jobless recovery. Part of this has to do with the amount of exports we bring in. When spending goes down in the U.S. the actual contraction goes beyond our country and hits many of our trading partners. Yet the middle class in the U.S. has fallen behind both in nominal and inflation adjusted terms for over 40 years. Part of this has to do with the structure of our banking system and our heavy reliance on debt spending. Today, as talk of a recovery permeates the media outlets we have 38,000,000 Americans on food assistance and nearly 20 percent of Americans are registering as underemployed.

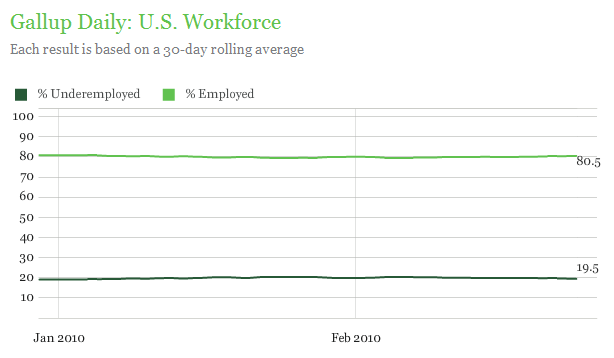

Let us first look at a Gallup poll registering underemployment:

Source:Â Gallup

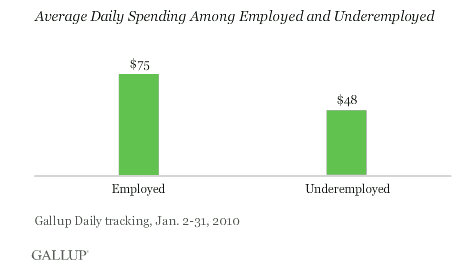

Now the Bureau of Labor and Statistics usually measures the above through their U-6 rate. This rate measures those that are working part-time but would like to have a full-time job. There is something psychological about this that makes it seem a lot better than full unemployment but the repercussions on the working class is deep and profound nearly as deep as full unemployment. First, if you are working part-time you have less money to spend and this showed up in the survey clearly:

Source:Â Gallup

This is important in understanding that even with a 6 percent growth rate in GDP last quarter that many people still feel this recession deep in their pocketbooks. In addition, that latest GDP number is based on companies cutting their top line item, employees and also inventory restocking. But these are usually one time measures. What we want to be seeing is GDP growth because of additional consumption and growth through hiring. That is the real nature of a healthy expanding economy. Cutting and firing middle class workers isn’t exactly the recipe for a longer-term recovery.

Americans are having to do more with less and are facing new measures of austerity. Many are adapting and many are simply unable to cope with the radical changes taking place. Even in the past decade, many Americans came to rely on credit cards and home equity as some kind of embedded ATM for most households. For over a decade this seemed to be the case. Even many that relied on this deep down realized that something just wasn’t right when home prices kept going up by double-digits while their salaries remained stagnant. Any lack of wage growth was made up by additional borrowing. Banks were willing to lend out this money.  But now that the bubble has burst, Americans are filing for bankruptcies in record numbers, losing jobs, and losing their homes through foreclosure. At the same time, the banking industry has kept their practices going thanks to taxpayer bailouts. The middle class is bailing out the same industry that was largely at the center of this financial crisis and their practices still largely remain the same.

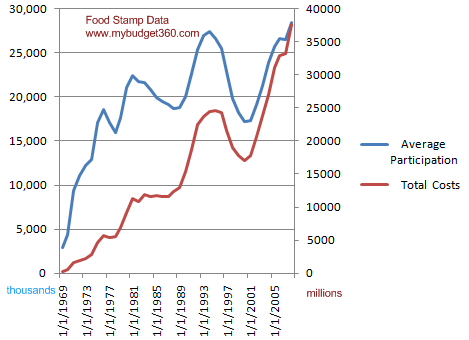

This struggle to maintain the middle class is going to be the story of the next decade. But beyond that headline, we now have over 38,000,000 Americans receiving food assistance in this country:

Source:Â SNAP

The most prosperous nation in this world has over 12 percent of its population receiving food assistance. It is tough to see fellow Americans in such difficult times. You can see on the chart above how quickly the rate has risen in this recession. Clearly in every recession the rate will go up but in this recession the number has struck many more Americans. In fact, the length of unemployment is a large reason for this as people eat into emergency funds. Beyond that, we now have the largest percentage and number of Americans working part-time in history:

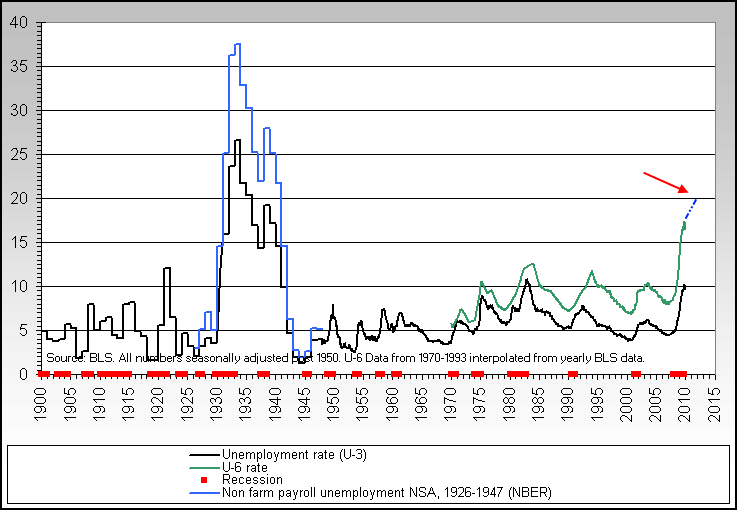

Source:Â Itulip

In fact, the large number of underemployed has been a shadow to how deep this crisis really is. For example, the headline unemployment rate nationwide is 9.7 percent. That seems bad but nothing historical. But just look above and add in that underemployment rate. In reality, we can understand why middle class Americans are struggling so much with daily financial life. Think of someone that lost their job and is now working at Wal-Mart as a greeter. Sure they aren’t part of that 9.7 percent but they probably would think so:

“(The Atlantic) Over lunch I spoke with one attendee, Gus Poulos, a Vietnam-era veteran who had begun his career as a refrigeration mechanic before going to night school and becoming an accountant. He is trim and powerfully built, and looks much younger than his 59 years. For seven years, until he was laid off in December 2008, he was a senior financial analyst for a local hospital.

Poulos said that his frustration had built and built over the past year. “You apply for so many jobs and just never hear anything,†he told me. “You’re one of my few interviews. I’m just glad to have an interview with anybody, even a magazine.†Poulos said he was an optimist by nature, and had always believed that with preparation and hard work, he could overcome whatever life threw at him. But sometime in the past year, he’d lost that sense, and at times he felt aimless and adrift. “That’s never been who I am,†he said. “But now, it’s who I am.â€

Recently he’d gotten a part-time job as a cashier at Walmart, for $8.50 an hour. “They say, ‘Do you want it?’ And in my head, I thought, ‘No.’ And I raised my hand and said, ‘Yes.’†Poulos and his wife met when they were both working as supermarket cashiers, four decades earlier—it had been one of his first jobs. “Now, here I am again.â€

We are in a deep struggle and fight to preserve the middle class of this country. What has made this country strong has been a compact between the government and the citizenship between work and some semblance of financial protection. Yet right now with the banking system in power, it is all about that bottom line and they have no idea what is happening in Main Street USA. They are happy with GDP going up by 6 percent even though this was based on restocking lost supply and firing workers. But how is this really good for the middle class?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Clyde Ankle said:

Obama wouldn’t tie his shoes without asking Mitch McConnell first. He’s useless and so are the Democrats

February 26th, 2010 at 4:39 pm -

Vic Anderson said:

CCC(P)’s Baaaack! The whole DEM county’s being converted to a Civilian Concentration Camp where “Arbeit Macht Frei”!! (i.e., DIE!!!)

February 27th, 2010 at 2:57 pm -

sharonsj said:

Could we at least blame the Republicans and Bush for turning a surplus into a deficit? Can we at least blame Bush for getting us into a war while cutting taxes on the very rich? Or have you forgotten so soon?

On C-Span an expert said there were 14 million unemployed, 8 million underemployed, and 8 million who had given up looking. That’s 30 million people who cannot find a job.

We need to take back the bank bailout and bring back our troops, so we can use the money to help our own citizens. And the financial crooks need to go to jail!

March 4th, 2010 at 2:51 pm -

jake38 said:

What our economy is dealing with is a continued energy shock that had struck when imported oil hit over 148 dollars a barrel in 2008. Without growing cheap energy supplies the conventional economy will continue to struggle and contract.

March 5th, 2010 at 9:33 am -

Darvin Dowdy said:

Great article. One thing needs more emphasis. The author paints a picture of the underemployed as “part-time”. If that were true at least one would have more free time. Less pay, true, but more free time. But in most cases these days underemployment translates into working full time with much lower pay. This adds frustration, anxiety and “anger” into the mix. Those that were working for $18 ph and are now having to work harder and longer for $9 ph are not happy campers. We’re talking a seathing, simmering anger. DD

August 21st, 2010 at 12:23 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!