The Expanding Economics of Austerity – Home Equity Loan Ads Replaced by Brown Bag Ads. Breakfast Sales take a hit as more Unemployed Avoid eating out.

- 6 Comment

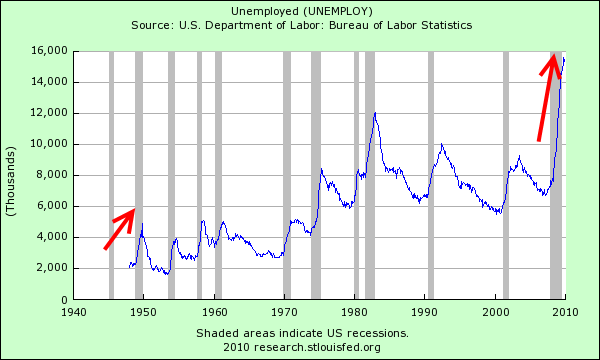

The middle class of America is adapting to the new austerity taking hold. Many are changing their habits to live in a market where credit is less accessible but others are having a hard time giving up the artifacts of the debt boom decade. However you slice the numbers average Americans are confronting a leaner balance sheet. Much of this has to do with the job market that doesn’t seem to have the direction to create additional jobs. Since the recession started in December of 2007 we have lost some 8.4 million jobs. This is a 6 percent decline in our employment base and the last time we had such a stunning reversal was after World War II and demobilization occurred.

I think most Americans have noticed new methods of austerity all around them. For example, I’m sure many of you have seen the Wal-Mart ad that talks about taking lunch to work. They even break down the numbers to show you how much your budget will save by doing this. Contrast that ad with this one below talking about taking a home equity loan while having a couple in a speed boat cruising in the background:

Source:Â YouTube uploaded on June, 2007

When you contrast the two messages, one of easy money and endless excess and the new ads talking about brown bagging your lunch to work, we realize that average Americans are finding it much harder to saddle on more debt. Some might try to recall the last decade as a wonderful time but the economic data shows otherwise. Much of the spending and consumerism was built around easy access to debt. People weren’t buying new automobiles with cash, they were financing it with 5 or even 7 year loans. Want a new surround sound system but are low on cash? No problem, just take on an extra credit card and charge it up. Now, the ads highlight a very different economic climate.

I stopped by a local dollar store to pick up some items for the house and noticed that first, the parking lot was full. A few years ago the parking lot was two-thirds empty. This trend has been going on for about two years since the recession hit. After entering the store I noticed that people for the most part were buying groceries. Now this area is one that I wouldn’t consider poor but more along the lines of middle class. Yet this is the new reality for the middle class. There is no sharper contrast than seeing a women load her leased Mercedes full of dollar store groceries. Austerity doesn’t happen overnight.

On Monday we received news that some of the most egregious practices from credit card companies will need to change now that legislation is in effect. Yet credit card companies have already adapted by hiking up rates, charging annual fees on good customers, and other methods of front loading earning before the law came into effect. So Americans who have relied so heavily on credit cards will now have to be extremely cautious when using these items of consumption. Even the tried rule of paying off your balance every month may not save you from the annual fee that some companies are now imposing.

Casinos Lose Money for Second Time in History

In another clear example of changing habits of the American middle class, Casinos in Nevada lost money last year for only the second time in history:

“(Las Vegas Sun) CARSON CITY – For only the second time, Nevada casinos posted a loss – but this time it was the biggest.

The state Gaming Control Board today released its “Gaming Abstract†for fiscal year 2009, which ended June 30, showing a net loss of $6.7 billion among the 260 major casinos in Nevada.

Clubs along the Las Vegas Strip, which makes up 53 percent of the gambling revenue in Nevada, registered a $4.1 billion loss. The only bright spot, from a financial standpoint, was that people drank more. Sales of booze rose by 2.5 percent while revenue tied to casinos, rooms and food dropped. But 36 percent were recorded as “comp†drinks.

“It was a horrendous year,†said Bill Bible, president of the Nevada Resort Association, which represents several casinos on the Strip. He said many of the casinos had three and four waves of layoffs to cut cost during this national recession.â€

I find it really telling that the only “bright spot†was that people drank more booze. Self medication for the realities of the new economy. Gambling whether it is in Las Vegas or through lottery tickets is a form of escapism. I think many people in places like Las Vegas go to strike it big. The irony of how the city has morphed is a large part of their revenues now come from other sources outside of gaming. These include boutique stores and high end restaurants. I was in Vegas only a few months ago and strolled down some of the shops and the higher end stores were very empty. A few years back, these places were bustling with people. It is a microcosm of the new austerity in our country. Contrast the $100 t-shirts versus the Wal-Mart ad highlighting the benefits of taking your lunch to work at the cost of a few dollars per day. Things are shifting out of a practical necessity.

And this isn’t simply a function of discretionary spending like trips and gambling. Even in more practical aspects of daily life this is changing and evolving.

Fast-food Breakfast Slumps with Fewer Workers

You know things are tough when even low cost fast food is taking a hit:

“(WaPo) The nation’s high unemployment rate has thrown millions of people out of work, scared shoppers away from stores and threatened the economic recovery. Now it’s taking a bite out of breakfast.

Breakfast sales had grown at a ravenous pace during the boom years as busy workers scarfed down sausage biscuits on the way to the office, fueling a $57 billion business and accounting for as much as a quarter of sales at some fast-food chains. Chains opened earlier and expanded their morning menus to accommodate the traffic as lunch and dinner sales flatlined.

But as the jobless rate hit 26-year highs fewer people headed to work, and even those who did worried about their spending. So they poured bowls of cereal at home or simply slept in, putting breakfast on the back burner.

“Typically, if you’re unemployed, you’re not getting up at six and not going through the drive-thru,” said Jeffrey Bernstein, an analyst at Barclays Capital. “There is a direct correlation between unemployment and breakfast sales.”

It is hard to even comprehend that breakfast sales accounted for $57 billion in revenue. However, with more people out of work many are skipping breakfast or eating at home. On my early morning drives I will always see cars pulling up to McDonalds or Starbucks for that early morning purchase. The lines seemed a lot shorter and looking at the data it is part of the new frugality that Americans are having to deal with:

Source:Â Washington Post

And this recession is shaping how people view their future and what they expect out of it:

“(New York Times) See that,†she said, spotting a man dressed as the Statue of Liberty. Standing on a sidewalk, he waved at passing cars with a sign advertising a tax preparation business. “That will be me next week. Do you think this guy ever thought he’d be doing this?â€

And yet, she would gladly do this. She would do nearly anything.

“There are no bad jobs now,†she says. “Any job is a good job.â€

That person dressed up as the Statue of Liberty is a very common vision especially with tax season here. 2010 is a very different world from 2007. I wonder what lady liberty would think about how we are spending our tax dollars in bailing out banks while average Americans are forced to tighten their belts?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

6 Comments on this post

Trackbacks

-

McNamys said:

Who could have thought that the American public would go to new heights in austerity, yet the Federal, State, County, City or village budgets go to new heights in spending and taxing and not cut back.

Only in government is a budget just an outline…

I have been saying for over a year and will say it again, Frugality is the new Reality.

People are increasingly fed up with having to do without and yet see the government and their unions break the taxpayer bank[and back]. The anger simmering will indeed boil over, prepare accordingly

February 23rd, 2010 at 6:15 am -

Tom said:

Live for today, for tomorrow is but a dream.

Starvation ain’t so bad.February 23rd, 2010 at 1:24 pm -

Tristan said:

” Some might try to recall the last decade as a wonderful time ”

Not I. In all my 40 years, the 00s were by far the worst decade in my life. This was mostly due to the nausea I felt every time I heard or saw W and his minions, collectively the worst disaster that has ever happened to this great country.

But back to the thread: My economic reality has actually not shifted very much in the last few years. I still don’t own real estate. I still don’t have enough money left over to fund a retirement account. I still can’t afford private health insurance (I’m self-employed and the sole bread-winner for a family of four).

Oh wait, one thing has changed since ’07: I’m now in deep revolving-credit debt! (Ok, I admit that some of it was due to satisfying material desires, but the great majority of that debt was incurred due to the need to pay rent and buy groceries when I wasn’t getting any contracts.)

I’m a reasonably intelligent guy with a four year degree with nearly 15 years experience in a professional field (user experience design). I don’t gamble. I don’t have any drug addictions. I don’t have any criminal record. I’ve always paid my taxes and bills on time. So why does financial stability elude me?

For a long time I thought it was my fault, that I just didn’t have the acumen to succeed. Or maybe I just have “issues” around money, and have a hard time attracting it to myself (in New Age speak). But now it’s becoming clear that my problem is indeed not MY problem.

It’s in fact a systemic problem with our society. Somehow, we collectively agreed (or were suckered into believing) that the corporatocracy is the most natural, normal thing in the world.

February 23rd, 2010 at 5:26 pm -

Julie said:

Tristan, my nausea over the sight of Obama and his pack of lying thieves trumps your nausea. Bush did alot of things wrong, but he didn’t hire ardent Socialists and Communists to “fix” our country. Woe to us in the next several months/years with this bunch of Gangstas in charge.

February 26th, 2010 at 8:24 am -

Robert said:

Food will be the next currency.

February 26th, 2010 at 1:36 pm -

JP Merzetti said:

Austerity has a funny flavor, when compared to brand new 18-wheelers being trashed for want of an oil filter over in the middle east. Perspective offers something to spice up the bland leftovers.

Austerity also always was a common sense approach to fiscal management, except it got mixed up with the overconsumption that kept the economy going…1 part for the working classes, 10 parts for the ruling classes.

Austerity is that rude reminder about what it is that we can really afford….and what we can’t. (Dollar store groceries packed in the trunk of a Mercedes should be an oxymoron – yet it sums up nicely the reality shift, doesn’t it?)

March 12th, 2010 at 6:35 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!