Dear Government Officials and Economic Policymakers: Every American Doesn’t deserve to be a Homeowner.

- 1 Comment

Dear Government Officials and Economic Policymakers:

I think many responsible Americans are thinking why is it such a necessity or right to make every American a homeowner? Homeownership has become somewhat of a third rail in economic policy and political talk. If you really think about it, not every person deserves or can own a home. The epic foreclosure crisis is demonstrating that. This doesn’t mean that someone isn’t able to have adequate shelter. On the contrary, in extremely expensive areas like in California or New York, many people choose to rent in more desirable areas instead of purchasing a home simply because it is cheaper.

In Los Angeles County for example, the majority of households, 52.1 percent actually rent. At a certain point we need to really examine whether massive homeownership is a good policy overall. Shouldn’t we be encouraging first that people save and budget and understand finances before encouraging them to make the biggest investment in their life? We are seeing many people get an unfortunate lesson with the current and extreme market volatility.

I keep hearing rhetoric like, “we need to keep people in their homes” or “we need to preserve the dream of homeownership” yet I never hear anyone saying, “we need to crack down on fraudsters and those that deliberately gamed the system.” Well, maybe you’ll hear some lip service but the majority of policy still reinforces this everyone should own ideology. I know this economic crisis goes beyond the housing market but at the heart of the matter is real estate.

Majority homeownership wasn’t always the status quo:

For nearly 3 decades from 1900 to 1930 homeownership rate stayed steady around 43.6 percent. This number dipped during the Great Depression only to see a gigantic surge with the baby boomer population. From the late 1950s to 2000 the rate remained roughly around 60%. That is until easy credit flooded the market and the homeownership rate shot up to a peak in 2004 of 69.2%. Again, why is it such a necessity that 100% of the population own a home?

Not every country has a desire for high homeownership rates:

In fact, a place like Serbia has an 88.2% homeownership rate. Slovenia has an 82% homeownership rate. Having a ridiculously high rate of people buying homes is not necessarily good economic policy. Even Spain at 85% has a bigger housing bubble than the United States in proportion to GDP and worker incomes. The U.K. with a 69% homeownership rate is seeing the aftermath of a bursting housing bubble. Germany and France with homeownership rates at approximately 50% isn’t seeing the massive amount of people losing homes like we are in the United States. I’m just saying.

Since the peak of 2004 we are now back to 2002 homeownership rate levels. Given that it is estimated that 3,000,000 people will lose their homes this year because of foreclosure, it is very likely we will fall to pre-2000 levels.

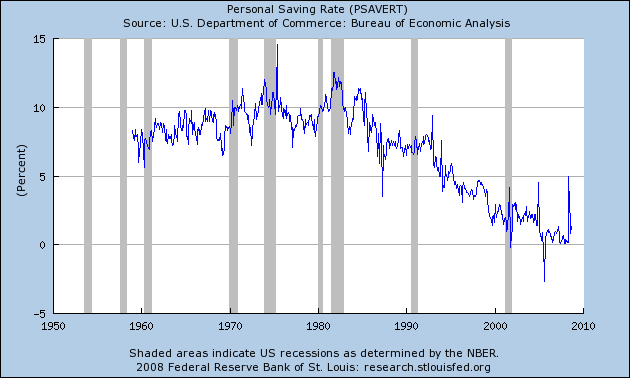

If you are really concerned about homeownership in this country, maybe you should focus on policies that will create good and higher paying jobs? The median family in the United States makes roughly $46,000 a year. When the median home price across the country surged to over $200,000 and wages remained stagnant, it should have come to your attention that many were simply buying homes on deeper debt and not actual savings. This would have also shown up in the savings rate which is horrible:

During the 1970s the savings rate shot up over 10%. Even up until the mid-1990s the savings rate was never under 5%. During this past decade we had a negative savings rate! But what can you expect from people when instead of encouraging savings you operate under a shop till you drop mentality? Have we not learned our lesson?

The fact of the matter is most Americans that do own their home, pay on time and are diligent. That is a fact. One-third of Americans own their home with no mortgage. It is a small subset, that group that was pushed into buying a home because of family pressure, social norms, fraud, greed or whatever reason that pushed the homeownership rate up.

There is without a doubt, many people in foreclosure due to job losses or medical reasons. Most Americans are sympathetic in these cases. But why should we help someone that took out $50,000 from their home equity to spend it on upgrading their kitchen or adding a Jacuzzi in the master bathroom? Or what about the flipper with dreams of making a fast buck only to see the market fall out? I doubt that most Americans would have any sympathy for the person that bought a $700,000 home in California with a $100,000 a year income. In fact, these are the people we are seeing in trouble going to the government window for handouts via their ailing lenders.

It is disturbing that we make no distancing between the honest homeowner and the greedy homeowner. Â The bailout if it were done right, would include the following:

(1)Â Force any participating lenders to write-down the mortgage to current appraised market values.

(2)Â Any borrower participating in the program, would need to share any upside with the government. Â Only fair since they are getting saved.

(3)Â One time fee from lenders to create an insurance fund.

During the Great Depression, even after the Home Owners Loan Corporation (HOLC) many homes went into default even after the government stepped in.  We shouldn’t expect anything different this time. But the important part is made when the initial mortgage is purchased.  That is where the taxpayer stands to lose an incredible amount or a small amount. People keep pointing to the success of the HOLC but it didn’t turn a profit for over a decade. Plus, there wasn’t a legendary bubble like the one we just had.

So I ask you that you please consider this “everyone should own” philosophy and maybe consider a “everyone should save” philosophy. Â Maybe it is time we encourage people to be prudent with their finances and I would ask that we start with you.

Thank you,

Concerned Citizen

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Danilo said:

The fact that Serbia has 88% home ownership rate, and Slovenia has 82% probably stems from the fact that most people owned their apartments in communist Yugoslavia (until 1990): if they didn’t, when they get a job, they’d soon enough be assigned one.

The other reason is that investing in anything other than real-estate in Serbia is very risky and people tend to “save” by buying more apartments (and then, when the children grow up, simply reassigning apartments to them).

Both of these have led to a cultural expectation of owning a house, which means getting it as soon as you are able to. I am sure the rate would be similar for Croatia as well.

(Got here looking for the rate of home ownership in Serbia, convinced it was very high 🙂

October 25th, 2012 at 6:32 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!