Markets Face Worst October since 1987: Dow Jones Industrial Average on Pace for Worst Year to Date Record since 1931.

- 0 Comments

At the start of Monday, the Dow Jones Industrial Average was down 36.83% for the year. How bad was that? Let us put it this way, the only two years with more Shakespearean tragic one year performances were in 1907 and 1931. That is how significant this crash is. Even with the amazing recovery of 11.29% this week which again, massive market volatility is a sign of an incredibly unhealthy market, the Dow is still down 29% for the year. The 29% market decline currently places the Dow at the 6th worst year in history. We would have to go back to 1931 during the Great Depression to find a year with poorer performance.

First let us examine a chart depicting the accelerated drop in October for this year:

(Click for a clearer picture)

The obvious and clear trend in the chart is that the Dow was already heading lower until the markets came unglued at their edges in October. Like a rollercoaster reaching the apex and then suddenly falling at full velocity. This week was unprecedented in terms of it jumping up 11.29% but even with that, the markets are still down. In fact, this week the overall fundamental news on the economy was poor. Consumer confidence came in at an all time record low, American Express talked about cutting 7,000 workers, gross domestic product contracted, and the initial unemployment claims are at recessionary levels. Earnings were disappointing for the most part so this massive jump was simply a technically based run up and nothing based on the fundamentals of the economy. Just wait until next week when people take a look at the their monthly October 401(k) performance. It will be scarier than any costume that Hollywood can design.

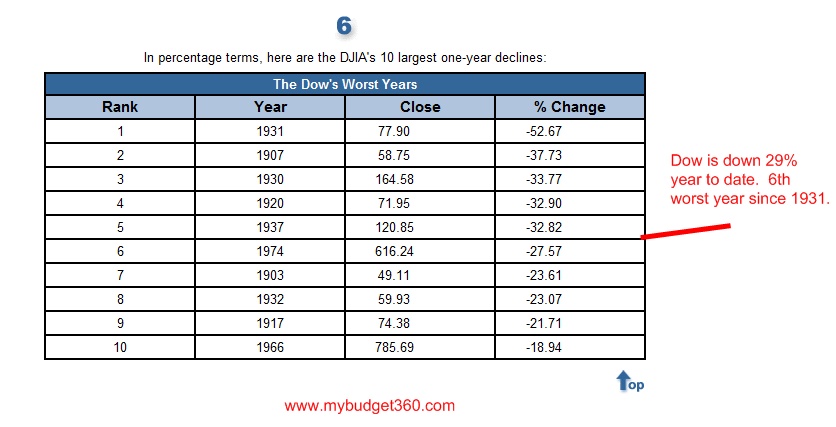

Let us take a look at the historical record of the Dow seeing the worst years on record:

It shouldn’t come as a surprise to anyone that 3 of the top 5 worst Dow years came during the Great Depression. We also have the 1907 crash and the 1920 crash. These were significant events in their time and should put the Great Depression in perspective. But if we look at where we stand currently, if the Dow is to stay at 29% it would come in as the 6th worst performing year in history.

If you really think about how low we actually got, the Dow was flirting with having the 2nd worst year ever. That is no small matter. And if you look at the near term at economic fundamentals the news will not be good:

(a)Â The unemployment report next week will once again show the employment sector contracting based on current unemployment claims and company job cut reports.

(b)Â Just as troubling, the consumer sector is contracting at the worst possible time, right before the holiday mob shopping season.

(c) Many of the Dow components are in industries that will have horrible earnings. Take a look at how heavy they are in finance: American Express, Bank of America, Citigroup, and JP Morgan Chase. Many of the others are directly related to massive consumption: Hewlett-Packard, Intel, and Walt Disney to name a few.

And if you think the Dow isn’t a good measure of the economy take a look at the S & P 500 and NASDAQ:

The S & P 500 and the NASDAQ are off 34% and 35% respectively. The S & P 500 at the low point reached on October 27 was down a stunning 45% in one year. These are epic drops. Looking at how quick and sudden the fall came, it is understandable why the technical figures do not show a recession. That is, we do not have 2 consecutive quarters of declining GDP. Most people looking at the fundamentals knew even at the peak in October of 2007 that something had to give. A recession was all but baked in.

It doesn’t help that currently outstanding there are $10.5 trillion in home mortgages in the United States and $2.55 trillion in consumer credit. Â Our national debt is now running side by side with home mortgage debt at $10.5 trillion and will soon grow with the implementation of the massive bailout program.

It is hard to imagine how the markets do not fall anymore in the forth quarter. All the fundamentals through the year will be tough. Roughly 72% of our economy is consumption based and this pulling back during this time in the year will prove to be a very tough holiday season.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!