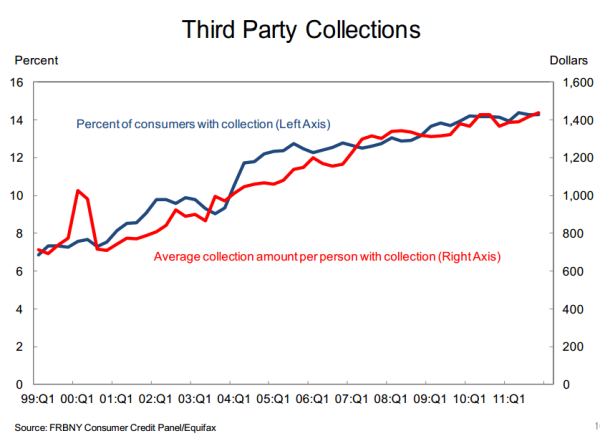

Educating students to debt – Student loan debt now second largest sector of household debt approaching $1 trillion. 14 percent of consumers have one account in collections.

- 1 Comment

College debt is fueling the out of control higher education bubble. The Federal Reserve tracks most household debt sectors very carefully including mortgage debt, auto debt, and credit card debt. You would think that they would follow student loan debt carefully. That was not the case until recently. More disturbing however is that student debt is now the second biggest debt sector for US households nearly reaching $1 trillion. Most of this debt has been taken on since 2000. Those who argue how valuable college is look at the aggregate figures of those working with college degrees that likely went to school when there was no higher education bubble. Those figures no longer hold true especially when we examine the figures of younger Americans who are facing crushing blows when it comes to employment but also wealth accumulation. One thing is certain and that is the student loan market is in one giant bubble.

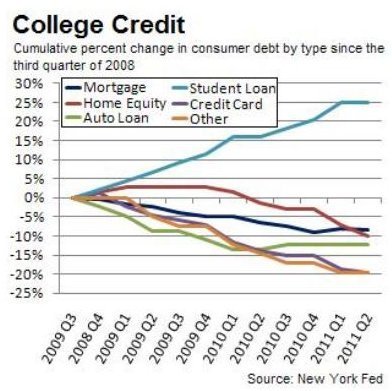

Student debt only sector to massively grow since 2008

Since the financial crisis struck with full force at the balance sheet of American households the only sector that has grown at an unrelenting pace is with student debt:

While every other sector has contracted in the great deleveraging, more and more Americans are diving into student debt. The reason for this is the notion that all college degrees are created equal and the massive propaganda sucking students into for-profits and expensive private institutions. It is amazing that the typical household in the US makes $50,000 a year and this is the cost of attending college at one of the private US institutions for only one year. We are not even talking about one of the elite private schools but one of your second tier universities. How is this possible with weak incomes? Take a page out of the toxic mortgage playbook. Massive amounts of debt.

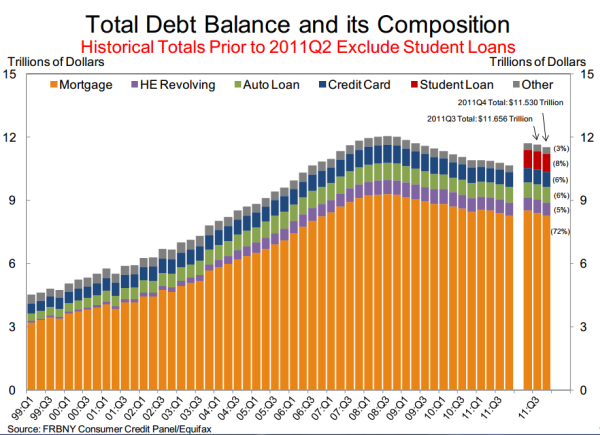

Since income is not a prerequisite for college debt this sector was primed for growth during the deleveraging. Student debt is now the second biggest household debt sector:

The Federal Reserve now is finally including student debt figures into their quarterly reports. How odd that a sector now approaching $1 trillion and largely backed by the government never made it into these reports until recently. The Fed is the bank of the banks and they didn’t have this data readily available? Since the Fed with Alan Greenspan was core at the housing bubble, did they want to keep this other brewing bubble hidden until it become too large to control? At this point, 8 percent of household debt now is composed of student loan debt.

Diminishing returns of a college degree

While many parents and prospective students make the decision to go to college, the benefits of a college degree are being diluted:

Source:Â Business Week

You’ll notice that in 2000 real tuition and fees have continued to soar while the real earnings of full-time workers with a college degree have gone down. The student debt bubble is largely affecting younger Americans that seem to be caring the largest part of this burden. When you hear politicians say “future generations†that time has now come. The bill is now come due. It turns out the Pied Piper has come in a graduation cap and gown.

Compared to other sectors college costs have far outstripped everything in the economy:

This even makes the housing bubble pale in comparison and is still ongoing. So we hear horror story after horror story of students saddled with unsupportable debt levels. Even as talks of a recovery leak out we see that most of the new jobs being added are in lower paying employment fields. We have 46,000,000 Americans on food stamps, an all-time record. We also have the largest number of accounts in collections today:

Does this look like a healthy economy or one that is being educated into debt slavery? Over 14 percent of all consumers have accounts in collections! No one is going to argue that becoming educated is valuable. Yet when someone goes to a for-profit paper mill and receives a piece of paper and little knowledge for $50,000 in debt, what use was that? What about someone going into $100,000 in debt to study art when they could have learned the same at a state college for a fraction of the cost? There is no doubt there is a bubble in higher education and it is only a matter of time before this pops and causes another crisis in the system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Hillary said:

It is for these reason why I am glad I don’t have loans from school.

April 17th, 2012 at 3:30 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!