FDIC Broke and Selling Real Estate: How $13 Trillion in Assets is Protected by no Deposit Insurance Fund. FDIC Selling Properties to Replenish Fund and Collecting Early Fees.

- 3 Comment

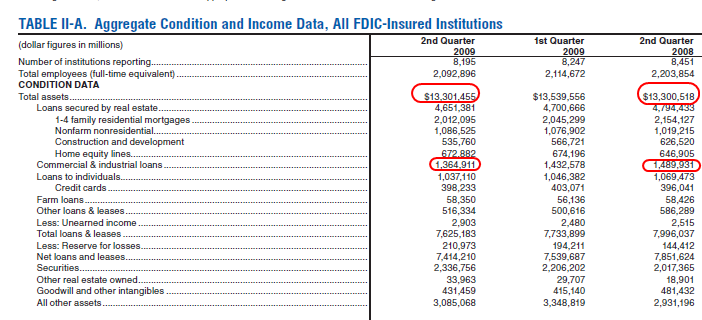

The FDIC, that enigmatic seal of security on your bank entrance, is virtually bankrupt. The FDIC provides deposit insurance to over 8,000 banks that collectively hold $13 trillion in assets. We can question what those assets are really worth since many of these institutions hold $3 trillion in commercial real estate loans and defaulting residential properties. The big problem with the FDIC is that it is protecting institutions with assets the size of U.S. GDP with no money. The FDIC at this point is a giant paper tiger. If we look at the asset side of the equation, we will see that FDIC backed institutions are still claiming assets are worth bubble prices:

Recent reports show that commercial real estate has fallen by 40 to 45 percent from its peak values. But if you look at the change from Q2 of 2008 to Q2 of 2009, CRE values only fell by 8 percent. It is the case that the peak was reached in 2007 so not all the losses have occurred in only this time period but one thing is certain and that is the FDIC is being overly optimistic in what insured institutions are claiming as assets. This translates into further losses and more bank failure Fridays.

The FDIC holds $9 trillion in deposits. This figure is stunning because the deposit insurance fund (DIF) is insolvent. We are trusting banks with no insurance fund to guard $9 trillion in our deposits. It has been made clear that the U.S. Treasury and Federal Reserve will bailout the FDIC if needed. The FDIC has tried to replenish its fund by charging early premiums on institutions to raise an additional $45 billion. Front running premiums are only a stop-gap measure in plugging the profound hole.

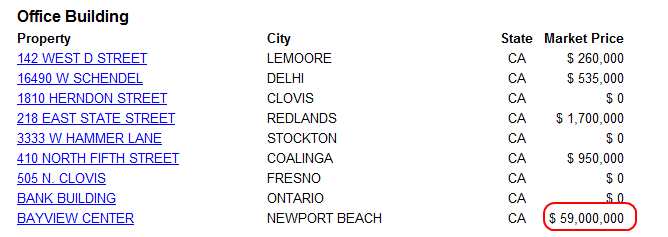

Another way the FDIC can raise money is by selling real estate it has in its possession. Â Â Take a look at some office buildings in California:

Anyone in the market for a $59 million office building in Newport Beach?  Now of course, the FDIC will need to sell a lot of real estate since market analyst are expecting commercial real estate to cost banks anywhere from $500 billion to $1 trillion in additional losses. The FDIC was never designed to take on so many losses all at once. And the evolution of mega too big to fail banks has setup a system where small banks are failing in large numbers but one big failure can be the equivalent of 100 small banks.

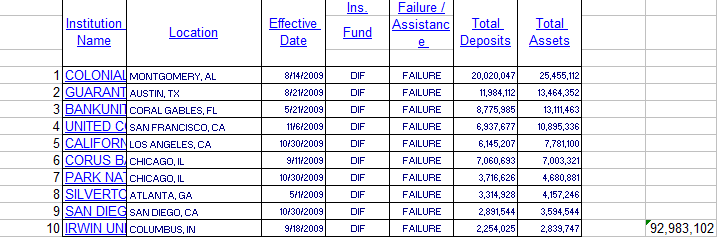

Take for example the 124 bank failures in 2009. The top 10 bank failures collectively had $92 billion in assets:

The other 114 banks had assets of $48 billion or roughly half of the top 10. That is how the system is currently structured on a flimsy foundation made of financial sand. The raw number of failures is of little guidance because there are so many large banks that can push the FDIC further into the red.

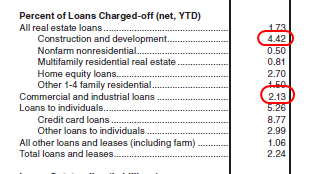

People should be worried about commercial real estate because these are already some of the worst performing real estate loans:

The worst performing loan category is with credit cards. The average American is using up all that he can in order to stay solvent. But even with that said, commercial loans are defaulting in high numbers yet banks are failing to reduce their asset value in the balance sheet. So we have zombie buildings still being valued at peak levels.

If Americans would stop and think of the implication of having an insurance fund with no money backing up $9 trillion in their deposits, they would probably pause for a few minutes. And just because your money is sitting in a bank account doesn’t mean that it is safe. The U.S. Treasury and Federal Reserve is on a war path to devalue the dollar so even though your money is nominally the same, in real terms you have gotten a lot poorer. The dollar has fallen by over 15 percent since March. This is an enormous amount but given the policies we are following, it is no surprise.

With gold at an all time high of $1,150 an ounce we are starting to see some strange behavior in the markets. The last time we had such a deep banking crisis was during the Great Depression. This is what was seen back then:

The fact that the FDIC is broke makes you wonder what the next steps for the banking system are. If it can’t make it with trillions in bailouts, what will the government do to backstop the entire system?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ross Wolf said:

Obama has reason to know his recent nationalization of the home mortgage market will both destroy housing as an appreciating investment and evaporate equity in homes belonging to millions of Americans. The Treasury Dept. recently removed a $200 billion cap on aiding Fannie Mae and Freddie Mac providing each company a taxpayer Blank Check to cover mortgage losses. Because the two companies secure 70% of new home mortgages, that will leave only a tiny number of private mortgage lenders. Meanwhile Rep. Barney Frank is again advocating loans to unqualified-home buyers foreseeable to cause more foreclosures, forcing down home prices and values that support $Trillions in bank mortgages: U.S. taxpayers just spent $billions to prop up banks after the sub-prime mortgage crash. Dropping home selling prices are already causing local governments to collect less property tax, forcing layoffs of government employees. Consequently CA and other States are raising income taxes to recover lost property taxes.

Making it even more difficult for Homeowners to save their property from foreclosure, now HUD Wants To Make It Almost Impossible for Home Sellers to provide “seller financing†To Get Out Under A Mortgage or Sell their Home, with Seller Financing†Even When they Own it Free and Clear. Not allowing owners to carry back part of the selling price in seller financing on non-occupied homes sold will force federal gain taxes on Citizens.

This 2/14/10 Alert! Was Received from:

Citizen Assemblies | 685 Placerville Drive | Placerville | CA | 95667HUD Wants Your Fingerprints – or ElseAgency Seeks to Outlaw ALL Owner Financing On All Non-Owner Occupied Homes. Demands That Property Owners Become Fingerprinted, “Licensed Mortgage Originators”Rules Apply to Owners Who Own Their Property Outright Creates New Class of Outlaws and Could Force People to Finance Through The Federal Government.

February 16 Deadline for Public Comment,Dear Citizens:

In its latest attempt to control Americans capital HUD has proposed stunning, private property busting rules in Docket No. FR-5271-P-01. http://www.citizenassemblies.com/HUDdoc1.pdf

This proposal provides a window into the minds of your federal employees who have clearly decided that your property rights must be lassoed for “your own protection.” Like most new regulations, these rules create new legislation without legislation being proposed by your representatives. In this case HUD has been granted authority by the Secure and Fair Enforcement Mortgage Licensing Act of 2008, signed into law by President Bush, to do whatever it pleases to enforce the general spirit of the Act. A few highlights of the proposed regulations:1) Outlaws ALL unlicensed owner financing unless the owner occupies the property. 2) Requires mortgage originator licensing if you seek to finance your property to someone – even if you own the property outright.3) You cannot receive a license if you’ve committed any felonies – ever – meaning you’ll never be permitted to self-finance your property under any conditions if you’re a felon of any kind.4) Mandates fingerprinting to finance your own property.5) Threatens a $25,000 penalty for owners who fail to obey HUD’s Rules. 6) Forces owners to complete 3 hours of Federal Law training. 7) Mandates owners complete 2 hours of federally approved ‘ethics’ training. 8) Requires that owners complete 2 hours of lending standards training. 9) Puts upon all self-financing owners and their prospective buyers dramatically higher costs and decreased opportunities to engage private property transactions.10) Stops you from exercising your own constitutionally protected private property rights until the government approves your conduct – and charges you for it.11) HUD grants itself authority to summon you any time it chooses for a host of reasons. 12) I could go on, but you get the point.Irrespective of what the document claims, the primary purpose of this legislation is to force more lending and taxable transactions to pass through federal hands. But of course, this and the endless rules and regulations steamrolling our society are for our own protection… right? You may make your opinion known to HUD regarding this proposed legislation (disguised as a “rule”) by following the instructions on page 2 of the document. I encourage you to contact your local real estate professional who might be able to explain how these rules will affect all property holders – and those who seek to become property holders – in one fashion or another.FORWARD this email to all people who value their private property rights. More alerts coming over the next two weeks as some legislation and rules are “sliding” under the radar.

Thank you, Edward Whittaker

FounderRescueUS Project dbaCitizen Assemblies

530-622-6598Defend

Your Personal Liberty

http://www.citizenassemblies.com/join.htmFebruary 15th, 2010 at 10:34 am -

TruthSetsYouFree said:

Good article! Except there is one important point missing. When that 13 Trillion was sucked out of the economy, where did it go? Money does not evaporate on CDS trades, there is a winner and a loser. Go look at the charts on the dollar back in mid summer 2008. The dollar spiked like it has never done before. Who ws the winner of that trade? Your government! ? Who was the loser (who happened to be betting against American) ? J P Morgan! Who is not nor ever been a benevolent malafactor, so no love lost there. However, the US govt made the 13 trillion on the deal which happens to be same amount we keep hearing about somebody somewhere is short. So, not being able to pay, JP had to be bailed out by the government backed Joe taxpayer bailout, and who gets to pay for that? Joe taxpayer. So, the government made 13 trillion, got paid, then loans fiat hot off the press money to the loser of the trade, and we get to pay both the bill and the defalation from the trade. The governement wins on the front side and the backside, the bank lives to see another day, and Joe taxpayer foots the bill coming and going. What a deal. Economic weapons of mass destruction have been unleashed and are heading for a small governemnt, auto manufacturer, bank, whatever they choose near you. Go to CAFR1.com and get educated then get your pitchforks.

February 15th, 2010 at 5:07 pm -

Sage said:

Anybody with money in the bank that thinks it is going to be covered by FDIC, like the media tries to make everybody believe, is going to be in for a rude awakening should their bank go belly up.

But, since you can’t tell a lot of people anything these days, they will be forced to learn the hard way, and then the crying will begin, in earnest, with hand wringing and “oh no, why didn’t somebody tell us?” Well, we tried to, chump change; you thought you knew everything, so now live with it.February 15th, 2010 at 5:13 pm