The chicanery between the Fed and ECB – twin balance sheets near peak levels and many European nations back in recession. Methods of understating US unemployment rates.

- 0 Comments

The Fed and ECB (European Central Bank) have taken notes from the exact playbook in dealing with the global financial crisis. People tend to believe that these are somehow fully set government agencies but in reality, they are designed to protect their number one constituency group. The Fed and ECB have the primary mission of protecting select financial institutions. At their core they are where the bankers bank. I was examining the balance sheets of both the Fed and ECB and from 2008 onward their reactions to the financial crisis have been nearly mirror images. But ask most Americans and Europeans if their trillion dollars of asset maneuvers have worked out. To the contrary, many of the European nations are back in recessions while in the US the unemployment rate only falls because people are dropping out of the workforce or being shadowed out in colleges with massive student debt. The central banks have succeeded in allowing the financial system to essentially transfer the waste onto the backs of the public.

Fed and ECB balance sheet look like financial twins

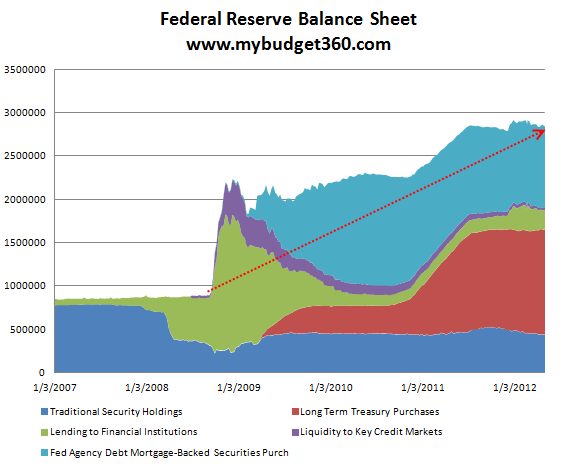

If we look at the balance sheets of the Fed and ECB we realize that they are still holding onto peak levels of questionable assets. First, look at the Fed balance sheet:

Not much has changed and the number of “assets†held by the Fed are still near peak levels. Keep in mind that we already know some of these items included failed luxury hotels, strip malls, and gambles that bankers took in the real estate bubble. You need to ask how does this help working and middle class Americans? Nearly five years later we know the answer is that it does not help the public but rather subsidizes the risky bets of the banks in toxic real estate deals.

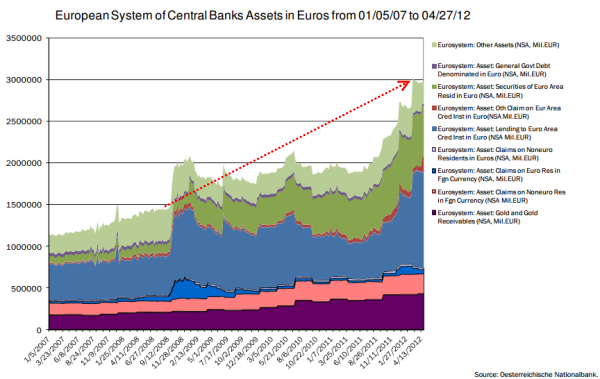

This only happened in the US with the Fed right? Actually, the ECB essentially followed down the same path:

What is different in the ECB is that they continue to expand their debt holdings. How many loans can be given to economies with 20+ percent unemployment rates? This is an issue of solvency and not liquidity. The Fed and ECB essentially are playing out the same pattern which is useful for the connected too big to fail institutions but just look at the employment situation and wages for those in the US and Europe and a different story emerges. There is a cost to all of this.

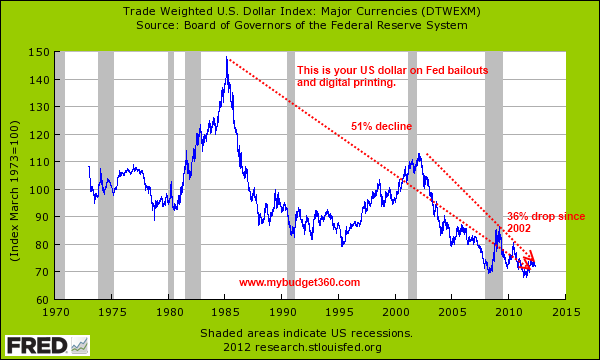

US dollar crushed over last few decades

The US dollar has been crushed over the last few decades:

The US dollar has lost 51 percent of its purchasing power since 1985 and 36 percent since 2002. Is it any wonder why we are seeing creeping inflation in the cost of daily goods? The falling dollar also is reflected in the higher prices for energy. As usual there is always a cost to actions taken and debt does matter. The “deficits do not matter†mentality is completely wrong and the shadow bill is being paid by the working and middle classes of the two largest economic blocks in the world.

Debt keeps on growing

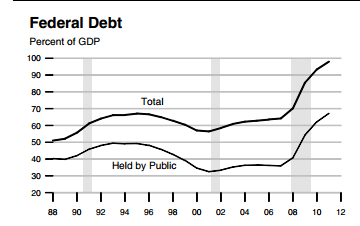

Part of the hit being taken by the dollar comes from unsupportable levels of debt:

Total federal debt is now on par with annual GDP. When we look at total credit market debt we realize a sort of transition point is being had. The Fed and ECB keep on piling questionable assets onto their balance sheet and inject liquidity into banks but these banks are choosing to use this funding to invest in other global markets or to dish out large bonuses to their banking overlords. There was never a mandate on how the money was going to be used once banks took in junk loans in exchange for liquidity to the banks. Banks have enormous excess reserves but choose to keep the money or invest globally in other markets for their short-term profits. What more would you expect? This is a form of social welfare for the banking sectors of the US and Europe.

“While the public is forced onto an austerity diet the bankers are gorging their stomachs with easy money from these central banks.â€

Global markets stalling out

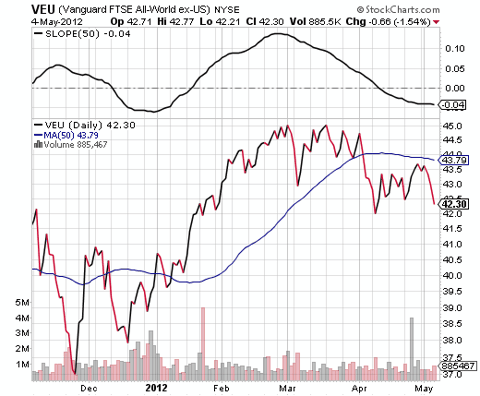

The global market is facing a tougher challenge ahead and of course spillover effects are likely to hit:

The Vanguard FTSE All-World index excluding the US is now trading below a 50-day moving average. This is largely being brought on by the problems being faced in Europe which as a whole is the largest economic block in the world. To think this will not have larger impacts around the world is hard to see. There will be repercussions and the Fed and ECB simply continue on focusing their bailouts and smoke and mirrors to protect their banking allies. So far the results have been rather poor for working and middle class Americans and Europeans.

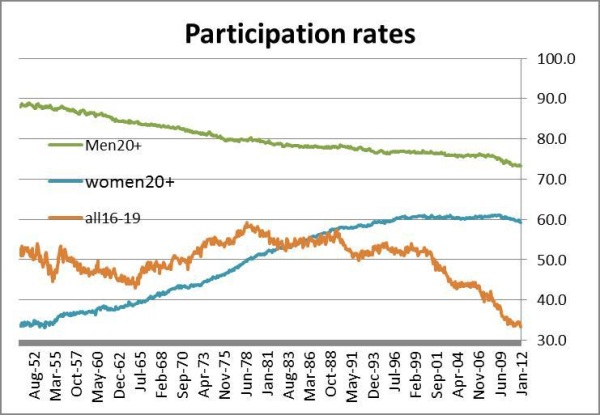

US participation rate

The headline unemployment rate in the US has now become a horrible measure of the true economy. Participation rates are nearing all-time record lows:

Source:Â Seeking Alpha

Of course if more people drop out of the workforce your headline rates look good. What is missed is:

-Students in college who would be working but instead are amassing massive student debt

-Discouraged workers that simply have stopped looking for work

-Large numbers of underemployed workers showing up as full-time employed

-A growing number of low-wage jobs for Americans

People are starting to realize that the Fed and ECB have only so many tricks in their bags.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!