How to bankrupt a generation of young Americans in four steps – young Americans living at home surges by 50 percent from 2005.

- 5 Comment

The viable pathway for success for many young Americans seems to have gotten very narrow in the last decade. The opportunities for many young workers have become mired with an economy that is largely in a deep recession with limited quality positions. Many are saddled with debt and taking on employment positions that may not even utilize the very expensive college education some have taken on. Education is important but doing it intelligently has become tougher since we are living in a student loan bubble. Many young Americans have been forced to move back home to live with mom and dad because of the shoddy economy even if they have a job. Each point of data suggests that we will have a less affluent generation coming forward yet this is the generation that is largely going to shoulder the burden of unsupportable government debt? The bill is largely coming due but many younger Americans are already starting with a negative net worth.

Step 1 – Access to higher education saddled with massive student loan debt.

The outsourcing of many blue collar jobs is not a new thing. What is new however is that for the viable white collar jobs a college degree is nearly mandatory. Yet many are being lured into student loan debt by subpar institutions and are finding themselves in unmanageable debt:

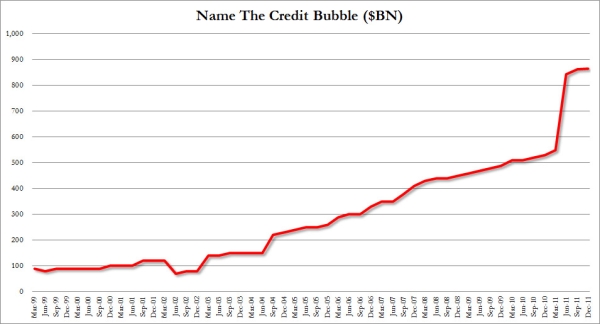

Source:Â Zero Hedge

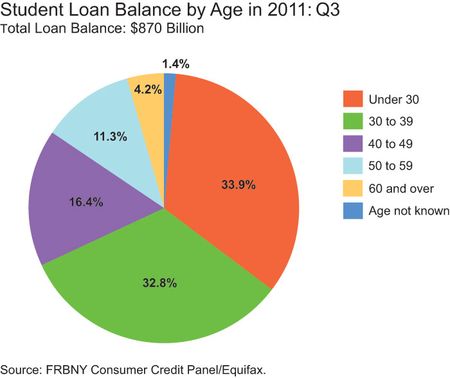

This isn’t exactly a chart you want to be seeing especially when incomes have gone stagnant for younger Americans. The issue as well is that most of this debt is being saddled on the backs of recent graduates:

This is not a good alignment. High student debt and fewer job prospects. In other words, the higher costs are not being reflected on a return on investment (ROI). You have young Americans entering a very weak economy with massive levels of debt. This leads us to the employment side of the equation.

Step 2 – Very few jobs in current economy

If we look at the employment side by age, we see a recession for older Americans and a near depression for young Americans:

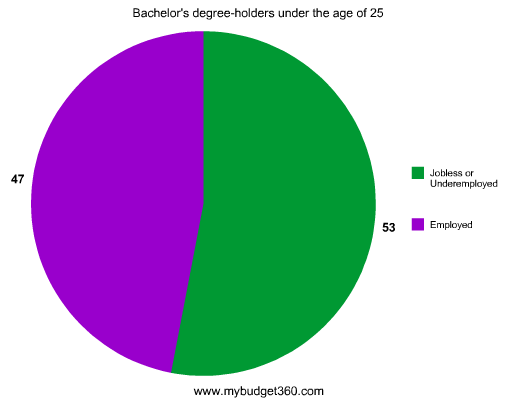

This is a troubling chart and shows that the brunt of the recession in terms of employment losses were shouldered by the young. Many of those with jobs are not even utilizing the full potential of their college degree:

53 percent of those with college degrees under the age of 25 are either jobless or underemployed (working in fields that do not even require their expensive college education). Part of this is occurring because older Americans are holding onto positions more tightly but also have experience in certain fields to build professional knowledge. A young worker each year they are not working or not utilizing their degree will only put them that much further away from making it into the middle class. Many are simply taking on massive student debt and drop out of the statistics for employment.

Step 3 – Balance entitlements of older Americans on poorer young Americans

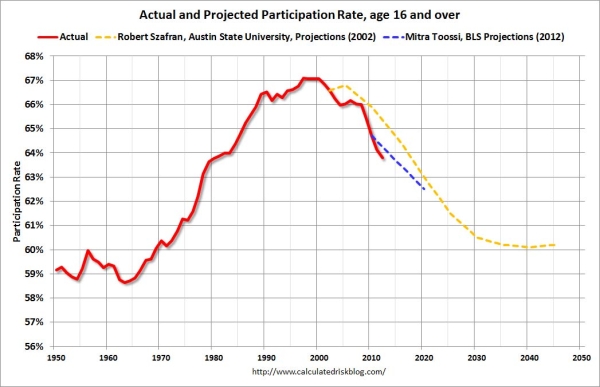

The problem with some of our major expenses coming down the pipeline (for example, Medicare) is that we are facing a smaller pool of workers earning less money yet the expense side is going to soar because of retiring baby boomers:

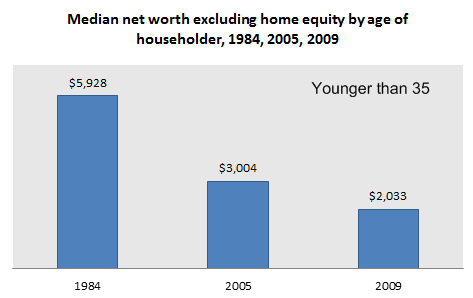

The above is a scary chart. The participation rate is projected to fall for the next 30 years while expenses for the retired and non-working is soaring. Young Americans have barely anything to their name to begin with:

The median net worth for those 35 and younger is slightly above $2,000 or the price of two months of rent in many places in the US. We are going to face some significant challenges moving forward with these demographics.

Step 4 – Move back home with mom and dad

So it shouldn’t come as a shock that many young Americans have moved back home with parents. The number of Americans moving back home has ascended since the recession hit:

Source:Â Sober Look

The number of young Americans living at home, those 25 to 34 has increased by over 50+ percent since 2005. This is interesting because it shows that the massive debt was already having an impact two years before the official start of the recession. The housing bubble also probably pushed many of these people out of contention for purchasing homes.

The challenges are large for our nation but a big brunt of this recession has been put on the backs of young Americans. In fact, for the young this is still a recession when it comes to the low-wage employment market and the massively inflated higher education market. If you wanted to develop a recipe on how to bankrupt the young this is likely how it would look.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Dumbfounded said:

First, “buy” a McMansion you could never afford for a day let alone 30 years. Second, matriculate at the very reputable nouveau-ivy league University of Phonics using loans that can never be discharged in a bankruptcy. Third, enroll in SNAP to maintain your Cheetos diet. Finally, continue to vote for hope and change.

There you have it. The four steps to becoming a full fledged American Idiot.

Congratulations!

May 8th, 2012 at 6:22 pm -

Bud Wood said:

Seems as if the young people of today have been convinced that a college degree is a ticket to a “fancy job”. Surprise! Production is the key rather than depending upon a “ticket”.

Years ago, when I was in my mid-twenties, I was employed and got married. Five years later, with a wife and 2 small dependents, I started out in my own business and haven’t looked back.

Even now there’s such opportunities. Today, I just paid a guy in a one-person business for some repair to my house. Whether he went to college didn’t make any difference to me; he did the job quickly to my satisfaction and went on his way. The key was production and customer satisfaction.

If those people who are contemplating college look around, those years of study and costs of college could better be invested in a one person business – – like I did and which a few people are doing right now!

May 8th, 2012 at 8:19 pm -

Stephen said:

There will be a massive intergenerational fixed wealth transfer but most of this will happen in the white community. Studies of black family wealth have shown little assets to transfer. It is why in the past the overall wealth gains of whites vs people of color increased and why whites sought to lock in those gains with no inheritance taxes. Bad move IMHO. What also concerns me is a generation that has little knowledge of household economics and will likely see them lose all of those gains by attempts at instant gratification. I see it in my nephews and it’s not a pretty sight. The next generation of banksters will have some easy prey.

May 9th, 2012 at 9:12 pm -

ron dawson said:

Part of the solution would be to get the baby boomers to retire, and many would like to, but the treasure at the end of the 401k rainbow turned out to be fool’s gold and they have to keep working. However, many would retire if uncle sam were to say them, “hey, look; if you retire within the next year or two, i’ll knock down your top tax liability to 15% and make up the lost federal revenue with a surtax on the investment bankers.”

May 12th, 2012 at 2:13 pm -

John Berkowitz said:

I just came across this article and I´m stunned by the similarity of the problems American and Canadian students share. The only difference is that in Canada, our government is not interested in learning about the mistakes done in your country. The protesters in Montreal and the intent to raise prize of education is a clear example. If we connect it with the problem of high household debt of the Canadian population you are definitely getting an idea where it all goes.

May 26th, 2012 at 8:43 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!