The wrecking ball of hidden inflation and Fed based strategies – food inflation far outpacing overall inflation and eating away at the purchasing power of 46,000,000 Americans on food stamps.

- 2 Comment

The Federal Reserve has openly called for a steady growth of inflation. This almost dogmatic view on inflation is problematic because it is detached to the lack of wage growth being experienced by working and middle class families. What you do not hear articulated from the Fed is that they would like to encourage wage inflation as well. The inflation growth is really a shadow bailout of the banking sector in our economy that still requires billions and billions of dollars for horrible bets and poorly placed gambles. If the beat of inflation marches on, these debts can be washed away simply because purchasing power is lost moving forward. Yet this is bad policy for the vast majority of Americans. Inflation has crept into the daily lives of Americans because of this policy. Food prices have increased steadily while energy remains expensive. The cost to go to college still continues to increase in spite of a bubble in student debt. Inflation is a double-edged sword and the Fed is aggressively pursuing this option largely to aid their banking allies.

Inflation is already here for working and middle class Americans

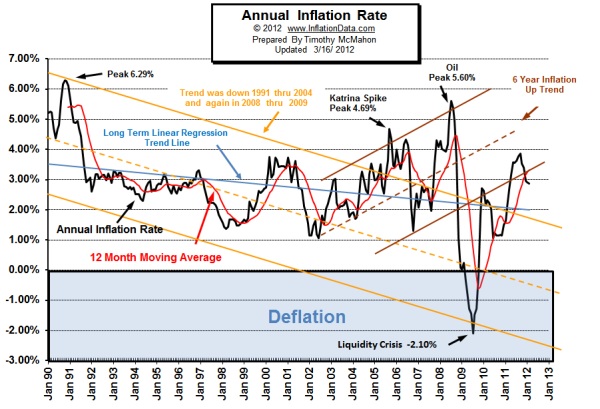

Inflation is already hitting the wallets of most Americans. After the liquidity crisis and trillions of dollars infused into the system, inflation is now on an upward march:

The inflation rate for nearly 1.5 years is now running between 3 and 4 percent. So the Fed is getting a desired result by also putting the US dollar at risk. While the inflation rate inches along the wages of Americans are going sideways. So a 3 to 4 percent rate might seem modest if we were also seeing a similar rate of increase in overall wages. But with the unemployment rate above 8 percent and the underemployment rate around 15 percent, slack in the workforce makes this an employer’s market and they are seeking out low wage employees.

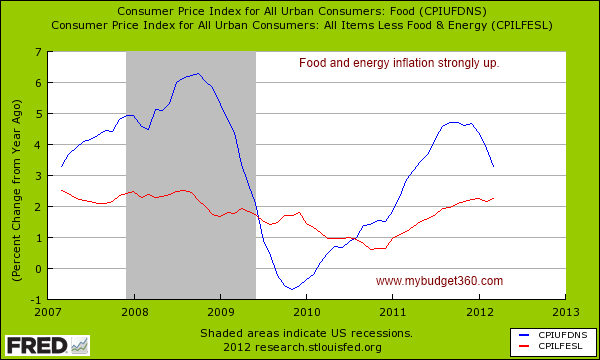

Food stamp usage is also losing its purchasing power as food prices outstrip other items in the economy. Remember that we have over 46,000,000 Americans on food stamps:

Since 2010 the inflation rate in food has far outpaced the rate of inflation overall. With so many Americans struggling to get by this is being felt in many ways on a daily basis. Anyone shopping at the store realizes how much more expensive food items have become. You also see disinflation where you pay the same price but get less because of creative packaging:

“(Country Consultant) Tropicana orange juice: 64 oz. container is now 59 oz. – a 7.8 percent reduction.

Ivory dish detergent: 30 oz. bottle is now 24 oz. – 20 percent reduction

Kraft American cheese: 24 slice package now holds 22 slices – 8.3 percent reduction

Scott toilet tissue: 115.2 sq. ft. now 104.8 sq. ft. – 9 percent reduction

Chicken of the Sea salmon: 3 oz. can now 2.6 oz. – 13.3 percent reductionâ€

The trend to higher inflation is now picking up steam:

What makes this trend more insidious however is that it is not being accompanied by wage gains. Even if inflation was two percent but wage gains were falling, the pain is more deeply felt. It is like running on a treadmill with the speed increasing. Many have to run faster and faster economically just to stay in the same spot.

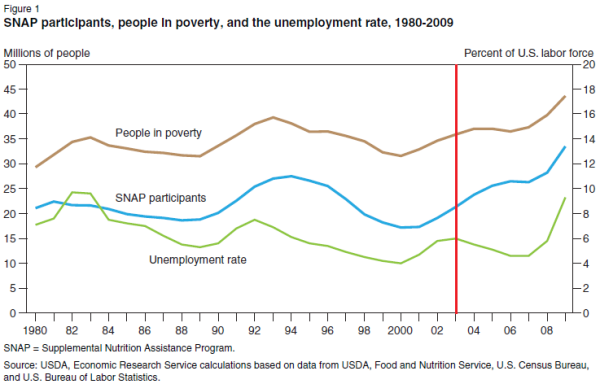

I find it amazing that nearly 14 percent of the US population is on food stamps, a record high level:

Source:Â Seeking Alpha

Food stamp users, and there are many are definitely feeling the impacts brought on by the higher overall inflation in the food sector. Yet the Fed openly talks about a hope for higher inflation:

“(WSJ) Meanwhile, what is now an 8.1% unemployment rate is seen grinding down to an average of 7.2% in the final quarter of 2013. On the inflation front, the bank predicts reduced pressure from energy markets will allow inflation to “slow notably” to just over 2% this year. The Fed’s official target is for 2% inflation.â€

The Fed’s official target for inflation is 2 percent but we are already running higher than that while the Fed has no open policy on wage inflation. Why would you want overall inflation if wages were not going anywhere? This has been the outcome of the massive banking bailouts. The real winners with the inflation rate moving up are the banks with their horrible debt laden balance sheets. The losers are the working and middle class Americans. People need to wake up that a massive shadow bailout is being done via increasing inflation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

Dumbfounded said:

How’s that Hope and Change working out for everybody?

May 13th, 2012 at 6:43 pm -

jake said:

Really how many are receiving food stamps? I believe they only count the actual person “receiving” the food stamps and not the multitudes of little people who are Also on the food stamp roles. If the children were counted, and these people have children in order to obtain food stamps, then the numbers would most likely be around 150 million on food stamps. And why does any immigrant receive food stamps? We bring them here so they can live off of us?

Don’t forget, all of these welfare benefits are paid by taxing businesses not indivuals. Thus in everything you buy, ever license plate you pay for, every govt fee, the welfare benefits are being subsidized throught increased fees and costs. Right not because of China as our “employee”, the costs of goods remains low. If not for this, everything you buy would cost at least four times as much.

May 19th, 2012 at 7:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!