The young and the jobless – Half of bachelor’s degree-holders under the age of 25 are unemployed or underemployed, in the US. Social Security short fall highlights deeper reality of economy.

- 2 Comment

The news for young Americans doesn’t seem to be getting any better. Earlier this week it was announced that Social Security will be running out of funds by 2033, three years earlier than expected. What this means if nothing is changed is that future retirees will receive only 75 percent of expected payouts. Not a good item of news considering inflation in daily goods is high thanks to the bailout policies and quantitative digital printing taken on by the Federal Reserve. The full retirement age of Social Security for those impacted will be 66 or 67 by 2033 for everyone born after 1954 or 1960 and 21 years from now will come up a lot quicker than most realize. Yet many recent graduates, those under 25 with a bachelor’s degree are either unemployed or severely underemployed. What is worse, the young generation is shouldering most of the massive debt in the student loan market. Older generations are being impacted since many are moving back home or are requiring resources merely to stay afloat. Hard to imagine a future generation with lower financial living standards but this is simply the continuing trend of breaking apart the middle class.

The young and the unemployed

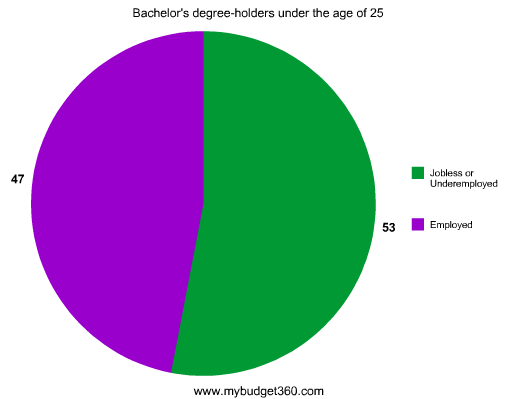

A really troubling study looking at Census data by Northeastern University and Drexel University found that 53 percent of bachelor’s degree-holders under the age of 25 were jobless or underemployed:

Source:Â Census, Current Population Survey

The media has made an example of Spain and Greece for their incredibly high youth unemployment rate but here we are, inching closer to a similar situation. This difficult economic position is only made more difficult by the higher education bubble saddling many of these students with unsupportable levels of debt. It is important to note that underemployed means someone not utilizing their degree in a field in which they studied. If someone is working at Pizza Hut and has a degree in History you are likely not utilizing your four years of study at least not to your full potential. However you are counted as employed which helps that pesky headline unemployment rate.

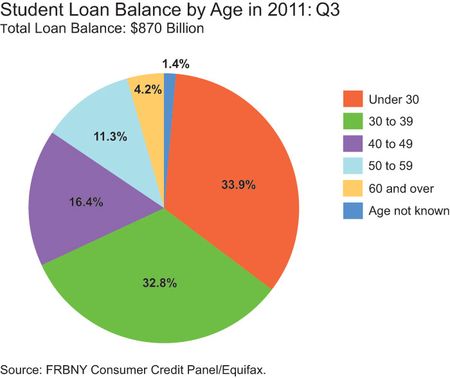

The Fed has only recently started keeping track of this data but we realize that most of the outstanding student debt was accumulated in the last decade and largely by younger Americans:

Over 66 percent of all student debt is held by those 39 and younger. What makes this even more difficult to shoulder for young Americans is they have also entered into the worst economy since the Great Depression as noted by the current unemployment and underemployment for recent graduates. Some of the issues accelerating the crisis have been for-profits pumping out degrees that largely carry little career value in the marketplace. This is rarely explained to students who are lured in by promises of high paying careers. Not likely when the average per capita income in the US is $25,000 per year.

The Social Security short fall

The Social Security short fall tells us a lot more about the underlying economy. Transfer payments are incredibly large at the moment with items like food stamps looking to consume $82 billion this year. The money comes from somewhere obviously. For payroll taxes everyone pays up to a certain level and that is what is disturbing with this shortfall. The missed projections tell us that analysts and financiers once again are now accurately picking up the micro trends that most Americans are living. How can we fall short by three years, pushing things forward from 2036 to 2033 when we have been three years in a recovery! What kind of recovery is this where half of recent college graduates have no job or are underemployed and have student debt amounts that rival a tiny mortgage.

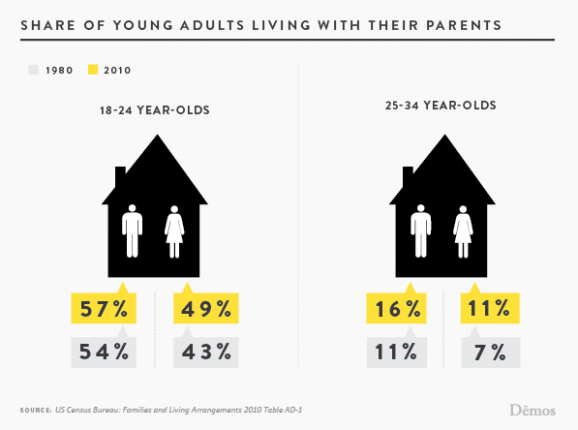

Many are unable to support this large debt load and are moving back home:

For both 18 to 24 year olds and 25 to 34 year olds the number of those living at home with parents has significantly increased from where it was in 1980. Given the cultural demand for independence this overall trend is unlikely to be happening because younger Americans want to come back under the wing of mom and dad. No, this is likely being pushed by economic necessity.

One of the main culprits here is the dilution of quality education and a mismatch of demand versus supply. First, the financialization of higher education has turned out to be a boondoggle just like it has been for housing. The fact that we have the most “educated†society today in terms of college degrees means very little if millions were simply given a piece of paper from a for-profit where very little learning took place. This is part of the reason why we have seen college earnings overall fall in the last decade:

Ironically the cost of college keeps going up because a large part of students are simply funding their education with massive debt. Interestingly enough, a cheaper and better option of going to a community college and then a state university is much better both in learning quality and marketability but the state systems do not have the insane telemarketing presence that some of the for-profits have. Even then, many lower tier private schools and public institutions have incredibly high costs and are yielding very little economic return once students hit the market. Given the peak debt situation we are in, both quality public and private schools have also steadily increased tuition far outpacing the overall inflation rate.

Young Americans have it very tough especially now that it is looking like Social Security is going to be one less item to rely on. Today, 1 out of 3 Americans rely on most of their retirement income from Social Security and many more use it as a supplement. Young Americans now have to rely on raw savings and a stock market that has gone nowhere for over a decade. How can they compete with a financial system designed for booms and busts and simply as a way to extract short-term profits at the expense of society? Do we have a better housing market since Wall Street got heavily involved in the late 1990s? Do we have a better education system now that investment banks have a major stake in extracting profit over true learning? I think the overall statistics are showing us that we simply have a predatory financial system that is bent on breaking the backs of the middle class and so far, it is working and the young are feeling it in every way.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Retiredpara said:

You had me until you blamed Wall Street. Insert “The Federal Government”, into every use of “Wall Street”, and you will have correctly identified the real problem. Want to know why the interest on all those loans is going to double? See the law Obama and the marrxists pushed through to control the student loan program. It takes a LOT of money to support those federal workers…

April 27th, 2012 at 9:28 pm -

Hillary said:

its sad but I not really shocked by these numbers, I am fortunate not to have college debt unlike many people I know. I am gainfully employed and make more than they do with a degree and debt.

June 18th, 2012 at 7:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!