Federal Reserve wild financial beast of Maiden Lane – How the Fed silently helped Hilton and Waldorf properties for the benefit of JPMorgan while placing the cost on working and middle class Americans.

- 2 Comment

The Federal Reserve has done an excellent job in covering up the trillion dollar banking bailout by essentially pretending it did not occur. To show how much it doesn’t care, it actually named a few bailout vehicles “Maiden Lane†for the New York Fed’s address in lower Manhattan. This sounds better than the “New York Fed†being bailed out by the Fed not to conjure up images of a snake eating its own tail. Like a professional liar, pretending with full conviction is usually a good way of getting away with theft. The Federal Reserve was one of the largest players in the commercial real estate market bailout. Many in the U.S. have no idea that their central bank has purchased and supports luxury products like multi-million dollar hotels in California. They would hesitate at calling it a purchase but they do own the liabilities securing the property. The bailouts were marketed and branded as a way of helping out the working and middle class. Given the massive financial destruction that the working and middle class still face it is easy to conclude that the stated policy failed. Yet looking at banking profits it did succeed for this segment of our economy. The Federal Reserve doesn’t even bother hiding this massive bailout and even labels these toxic vehicle hotels with its own address. Let us look closely at the Maiden Lane product.

Maiden Lane – A nice name for a bailout

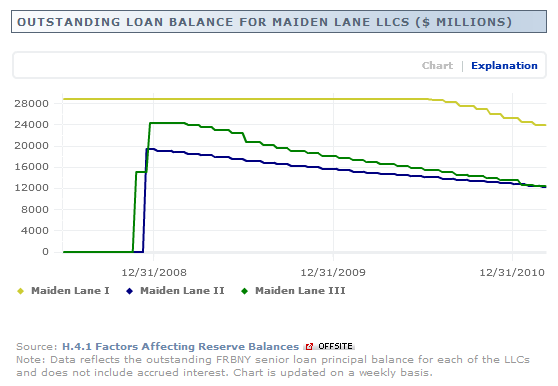

Source:Â Federal Reserve, New York

As we have stated, the Fed doesn’t even bother hiding the fact that they have pursued trillion dollar bailouts to support the banking sector. The Fed has purchased over $1 trillion in mortgage backed securities alone. Of course don’t expect to hear about this in the media. The only talk we have heard about any of this in the mainstream press is when the U.S. Treasury was proudly talking about banks repaying their TARP funds. This is like giving a gambler $1 million in the hole another million and having him pay you back when he hits blackjack. This gambler however failed to mention he also was in debt by $100 million. The Fed on the other hand does conduct complicated banking procedures but in the end it winds up being a bailout for banking gamblers.

The above chart shows the various Maiden Lane Limited Liability Companies (LLCs). These were designed with differing purposes. The original Maiden Lane was designed to support the bailout of Bear Stearns:

“Purpose: ML LLC was created to facilitate the merger of JP Morgan Chase & Co. (JPMC) and Bear Stearns Companies, Inc. (Bear Stearns) by purchasing approximately $30 billion in assets from the mortgage desk at Bear Stearns.â€

Source:Â New York Fed

Now what in the world is in this portfolio? The Fed doesn’t allow a full audit even today. But we do know that Maiden Lane I holds assets for JPMorgan that it found to be too risky. So the Fed essentially gave JPMorgan a $30 billion credit line to the LLC to help unwind whatever was in the portfolio.

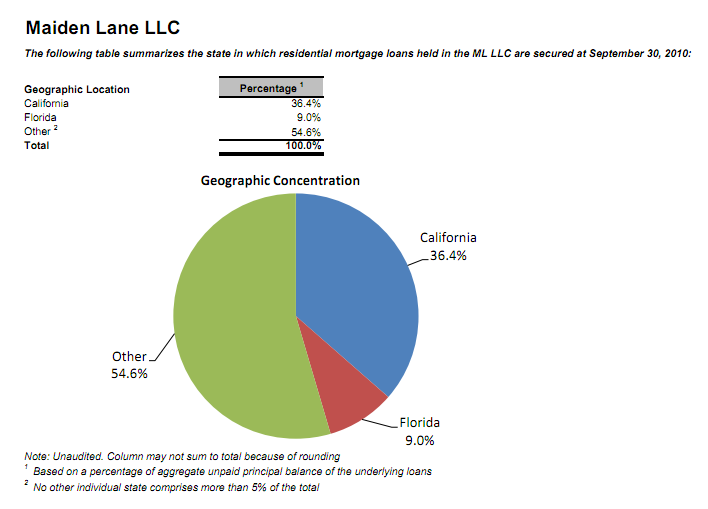

We don’t get exact details but we do know it holds a ton of real estate in the battered state of California:

36 percent of the portfolio is located in California. Of course if you follow the news even slightly you realize that California real estate is one of the worst investments in the last few years. And this is what the Federal Reserve is backing up.

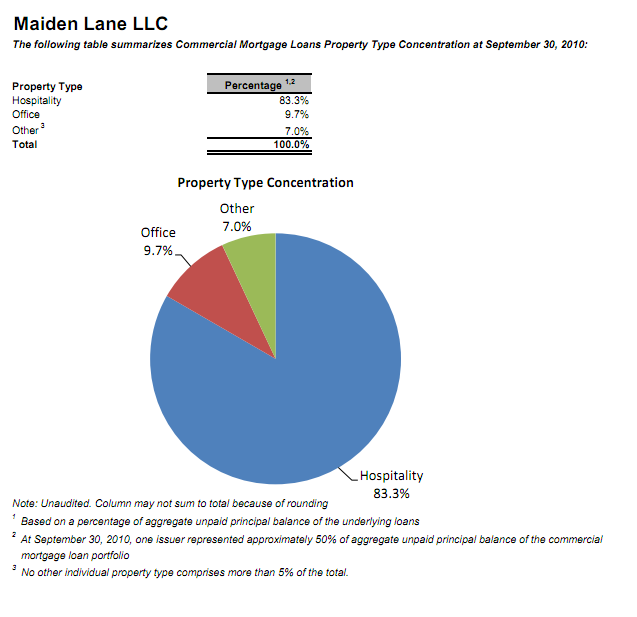

On further investigation, you realize that a large number of the commercial loans come from hospitality:

This industry has not performed well and is largely overpriced especially if it is in California. How is this not a bailout? The Fed tries to keep the data obscure but we can even pull up some of the actual borrowing entities here:

Doesn’t take a genius to make out who was dipping their hand here. Last time I checked the Hilton and Waldorf were not catering to working and middle class Americans. The Federal Reserve has been bailing out the wealthy at the expense of everyone else. How much proof and evidence do people need? In fact, the Fed flat out doesn’t even care since the media does no reporting on this so they simply put the data where the public can access it if they only wished to do so.

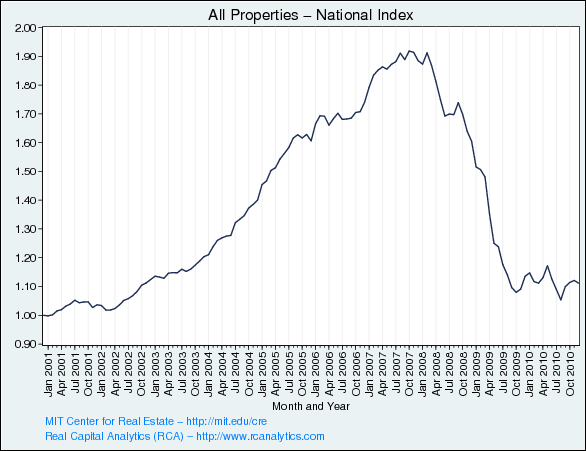

There is absolutely no way the public would have bought into this kind of commercial real estate bailout so that is why it happened behind closed doors. This is your money at work here. By the way, the commercial real estate industry has collapsed in the last few years:

Source:Â MIT

Maiden Lane was put together in 2008 near the peak of the CRE bubble. Of the $30 billion portfolio, the Fed put the fair market value at $28.478 billion as of October of 2010. Apparently this portfolio, a toxic wasteland that JPMorgan did not want to touch without a guarantee has only fallen by 5 percent while the entire industry is down near 50 percent. This is why if you go back to the first chart the unwinding of this LLC is occurring behind closed doors and they just hope the public has conveniently forgotten. Remember everyone, TARP was paid back by Wall Street investment banks so nothing more to see here.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

LiberatedCitizen said:

Behind Administration Spin: Bailout Still $123 Billion in the Red

http://www.propublica.org/article/behind-administration-spin-bailout-still-123-billion-in-the-red

The $165B Bank Bailout That Will Never Be Paid Back

http://dailybail.com/home/the-165b-bank-bailout-that-will-never-be-paid-back.html

All that and oh the back door bailouts too!

Unlimited credit for GSEs seen as backdoor bailout

http://www.reuters.com/article/2010/01/05/us-usa-housing-bailout-idUSTRE6044YU20100105

Bunch of crooks yet no perp walks now we are no better then the banana republics.

March 17th, 2011 at 9:42 pm -

michael siwinski said:

Maybe they can convert those Hotels into public housing for us since we’ll all be on the street pretty soon. Would you keep giving money to a degenerate gambler? Same thing, just on a lager scale. If the govt doesn’t regulate these markets we will all be further screwed!

March 20th, 2011 at 10:12 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!