Federal Reserve openly targets dollar demise – U.S. Treasury and Federal Reserve solution to economic crisis is to crush dollar and target the standard of living for American families.

- 4 Comment

The collapse of the global stock markets was something that was supposed to happen if the debt ceiling wasn’t raised. But here we are, seeing a sudden correction even after the debt ceiling was raised. The Federal Reserve and U.S. Treasury are actively trying to crush the U.S. dollar so the debts of their banking allies will get cheaper as the years go by and the quality of life for most Americans continues to erode like a tide washing away a sand castle. Of course it will be expected that at some point some other archaic form of quantitative easing part three will be brought to the table but the Federal Reserve is a faith based system. Suddenly people are having less and less faith from a central bank that has sat idly by for the working and middle class while allowing the wealthiest in this country to become even wealthier simply by gaming the current financial system. The markets are not pleased with raising the debt ceiling without actually looking for new revenue streams. This is like getting a credit card line increase without your income rising. The Fed is targeting the dollar not because it is good for America, but for the specific reason that it will allow banking allies to hide the ill bets of the 2000s.

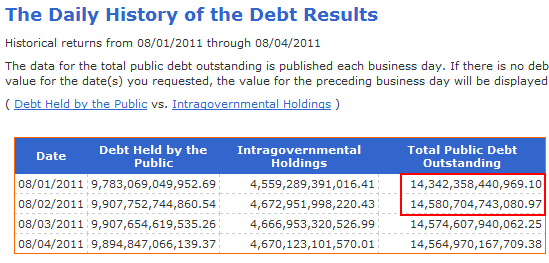

National debt jumps $238 billion in one day

Source:Â U.S. Treasury

The national debt went up an incredible $238 billion in one day after the debt ceiling was raised. You don’t need to live a life like a Hollywood superstar to spend on a gigantic scale. Most Americans are wondering why so much money is being spent with such little results in the real economy. The underlying reality is the Federal Reserve is focused on fixing the balance sheet of member banks and if this helps Americans as a secondary result, so be it. Yet the opposite is occurring. Those connected to the financial sector are becoming wealthier while the other 90 percent of Americans witness their quality of life collapsing.

The phony recovery

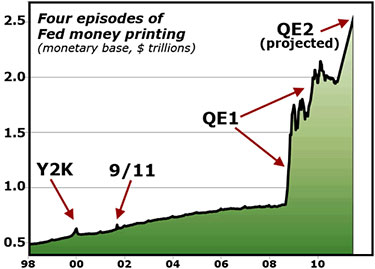

The vast majority wouldn’t realize we are in an “official†recovery but that is what we are told from key people in the Federal Reserve. In fact, we’ve been in recovery since the summer of 2009 if you can believe it. Of course the recovery is for those in the banking and financial sectors because most Americans are not seeing any of this massive spending and bailout growth. Quantitative easing is not supposed to be a common way of fixing an economy. In fact, take a look at this chart of QE actions from the Federal Reserve:

Source:Â Info Wars

Since the above chart was printed, another $300+ billion has been added to the Fed balance sheet. What is this money being used for? It is being used to secretively bail out horrible bets placed by banks during the go-go days of the real estate bubble. It is being used to exchange junk loans for Treasuries to banks to help them stay afloat while they kick out millions of Americans from homes and charge them onerous over draft fees. It should come as no surprise because of these actions that the U.S. dollar has taken a hit over the last few decades. We have been on a giant spending binge but a large portion of that has been to finance a toxic banking system.

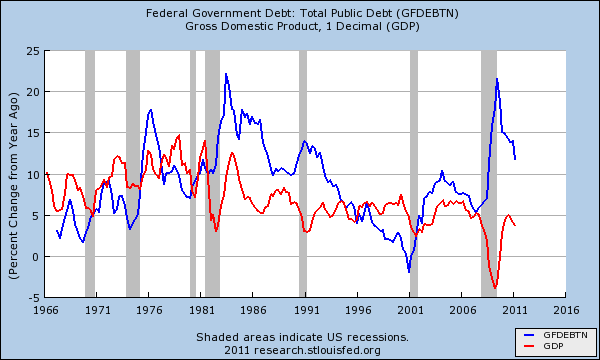

Government debt and GDP

It is normal for a government to expand if the underlying economy is expanding. More success usually will demand more services on a growingly prosperous nation. Yet in the last decade we seemed to expand debt with very little growth in GDP. Keep in mind that it was our former head chief at the Treasury begging Congress for a $700 billion no questions asked bailout package. From that we went on to quantitative easing. What has that accomplished many years later? Bailout after bailout to the financial sector yet no solid reforms have been put in place.

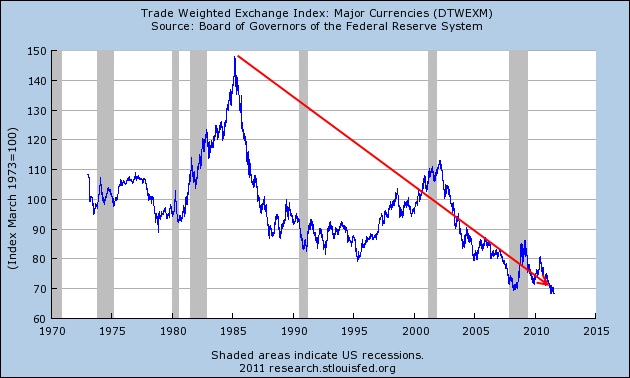

With all this spending in place this is the path of the U.S. dollar:

The danger that we are now witnessing is the global markets are losing faith in a system that simply allows constant spending to support a banking system that simply acts as a leech on the entire economy. People forget that the underlying mission of the Federal Reserve is to protect member banks. It holds no allegiance to the United States and isn’t part of the government. It lives in an odd quasi-governmental world where it can digitally print money yet is not answerable to Congress. As time moves forward, we are starting to realize that the government and the financial powers are starting to blend into one and the people are suffering for it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

d francis said:

– does ‘lower us$’ briefly help us exports… later, imports to u.s.

more ‘costly?’

.

do other EU capitols decide on max. borrowings a la

d.c eiling ? oft EU simply defaulted (UK issues roll over gilts)?ok site

August 8th, 2011 at 12:18 pm -

John F Donohue said:

I want to leave the USA. I will miss the good things, but it has reached a point of no return and I wonder when their will be a resistance or a standing up to this (what I see as tyranny).

Today at the market I turned away from an older white woman who was either waiting for someone to help her or waiting on a friend.

She was older than my mother would have been, and in that split second she looked at me and sadly shook her head as if to say, “you too?”.

I don’t like what I’ve become living in the last years of this once free nation. I came home and was hating myself.

I can handle having myself, young people having to tough it out or live broke but something in me just screams bloody murder when I see one of my own, a white woman who probably did all the right things and never broke any rules and worked her whole life.

I honestly never understood the liberals all through the eighties who told me that things like that weren’t my problem, that they didn’t reflect on me or my country.

WRONG WRONG WRONG

They do. My turning away and being just a little bit colder is the why this country is so doomed. This banking issue stuff is just the start of a very long due lesson on many levels.

The wicked folks who believe that screwing that older white woman out of whatever safety she has left in life will face justice sooner rather than later.

I am not liberal. Not conservative. I believe in respect for the elders even if they don’t like me, agree with me, whatever. It’s how I was brought up. Thank God(I mean that), my mom died just a little while ago, and I was able to take care of her and we had a somewhat good medical experience. I shudder to think what that woman was going through in the market.August 8th, 2011 at 5:51 pm -

Frank said:

Look, we have to support the Fed in starving the U.S. I’m fine with it, really.

August 8th, 2011 at 8:58 pm -

Jim said:

This post does a decent job of describing why TARP was perhaps the most destructive legislation ever enacted.

For any sane individual, TARP ensured through the devalued dollar that especially the poor would bail out the rich.

Some of us also speculated that the economy would not recover until all that bad debt was written down. Bankrutpcy would have done that quickly. Now it is being done one loan at a time over the course of decades.

Any strain of economics that can not understand these simple concepts is beyond hope. At the least, the financial crash should have warned us that most economists have no place in the corridors of power over the rest of us. Good lord what a mess.

August 12th, 2011 at 12:38 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!