The next massive debt bubble to crush the economy – 10 charts examining the upcoming implosion of the student loan market. $1 trillion in student loans and defaults sharply increasing.

- 9 Comment

In the land of predatory bubbles it looks like higher education is now fully caught up in the credit market implosion. In the same debt produced vein as housing, college used to be a relatively cheap bet with decent results in the long-term. Even if you went to public universities and picked up a degree in a field with low job prospects, at least you didn’t have the cloud of student loans hanging over your head when you graduated. Today it is a very different ballgame and the mythology behind college is being used to lure people into institutions that are little more than paper mill factories. Even quality institutions are having a harder time justifying tuition and fees that cost upwards of $50,000 per year (or the median household income of an American family). Can the next major crisis come from the student loan market? There is currently close to $1 trillion in student loan debt outstanding. During this crisis most debt sectors contracted except for student loans. Let us examine 10 charts to see why a bubble in student loan debt is about to implode.

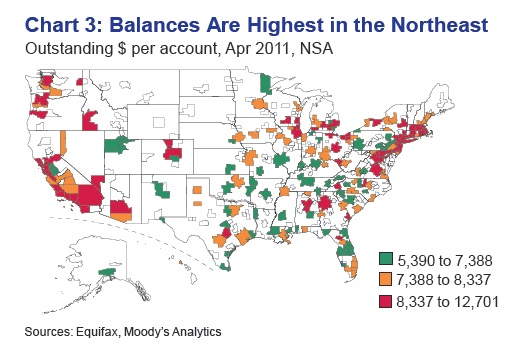

Chart #1 – Student loan balance rising

Moody’s Analytics came out with a comprehensive analysis of the student loan bubble. The data presented does not add confidence to the problems occurring in higher education. More to the point, it is the way people are financing their college endeavors. Part of the problem is college costs are soaring while incomes are stagnant or falling. So you have graduates coming out with heavier debt burdens and their incomes are much lower. It is a mathematical problem that was destined to cause issues. As the chart above shows, high cost states which already eat deeply into middle class incomes also have the highest student loan balances only doubling the problem in these states.

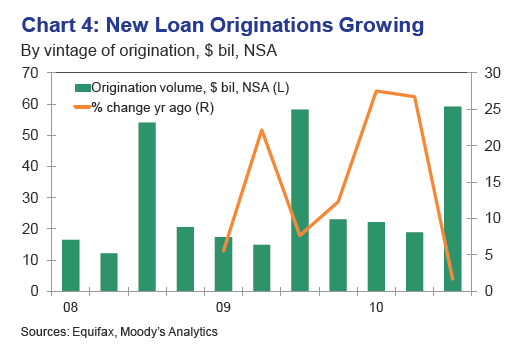

Chart #2 – New loan originations growing

It is an odd sort of American situation where the economy contracts but the student loan market is exploding. No other country faces this kind of issue. Yet this is symptomatic of our current perpetual bubble banking system that is designed to increase liquidity in all sorts of markets so Wall Street traders can make a buck on suckering the public into more debt from previously secure sectors like housing or even education. Origination volumes are even higher as more people jump into the higher education bubble feet first.

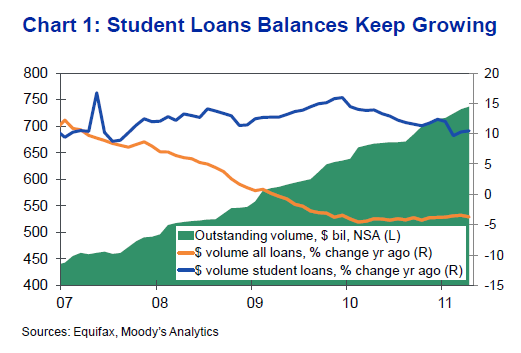

Chart #3 – Student loan balances keep growing

Student loan debt now surpasses total credit card debt in the United States. While you hear horror stories about credit card debt all the time there is very little discussion on the epidemic of student loan debt. The chart above doesn’t account for the recent trend and it is very likely that we are quickly approaching $1 trillion in total outstanding student loan debt. Keep in mind that the above chart doesn’t cover the total cost of education as you also have many students financing books and other expenses on their credit cards compounding the debt burden.

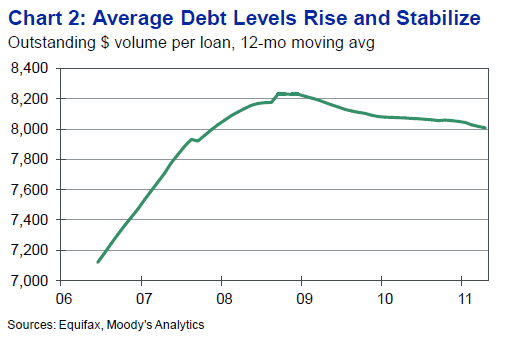

Chart #4 – Average debt levels

The economic crisis hit in 2007 yet through this time the average student debt levels have increased. This is not a positive development especially when data from the job market is so poor. The fact that more debt is being taken on is troubling for a variety of reasons but one of the most insidious is the fact that many recent graduates are starting to pay on loans with no jobs or jobs that pay just enough to get buy. This is the issue of a low wage capitalism system that has a financial system designed to filter money back to the top one percent through crony politics and protection.  Â

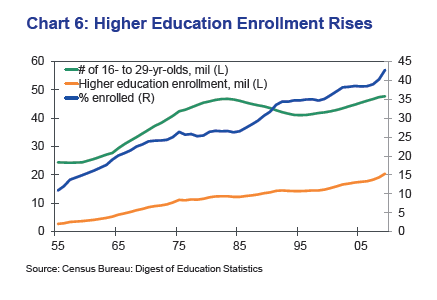

Chart #5 – Higher education enrollments rise

This is where things get dark and remind me of the housing bubble. Historical data for an entire generation showed only home price increases. That is an exceedingly good record. But investment banks and their government colleagues then decided to turn a once safe investment into a casino by using historical trends that just don’t justify the modern day irresponsible corruption in our banking system. The same kind of argument is being used for higher education. Pundits point to historical trends but keep in mind, these are trends that occurred in better times when people weren’t leaving school with insane amounts of debt and entering the worst job market since the Great Depression. As the chart above shows, enrollments are moving steadily up because of this mythology that is being perpetrated.

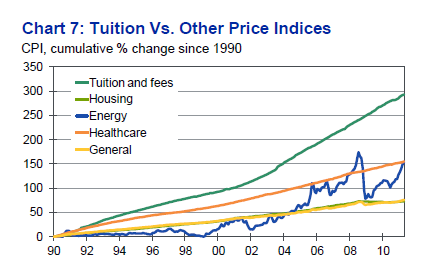

Chart #6 – College costs versus other costs

No other sector in our economy has seen costs rise so quickly like those of colleges. Tuition and fees have far outpaced every other sector in our economy even surpassing items like healthcare and housing which is hard to believe. But just like housing, since incomes have gone nowhere for decades people are simply financing the pursuit without looking at the real long-term costs of what they are diving into. Being educated is incredibly important. That goes without saying. But how much is too much when it comes to tuition? There is a difference from a nicely built large home in a good area going for a nice amount of money versus poorly built McMansions selling for levels not justified by incomes in those areas. The same goes for a college education. Just because someone adds a “university†or “college†to their title or institution does not make it worth the money.

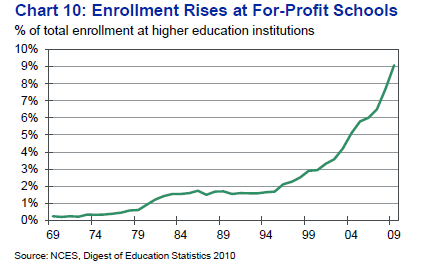

Chart #7 – Rise of for-profit enrollments

This is really where a large part of the paper mill action is happening. Many for-profits are simply designed to siphon off money from unknowing students and saddle them with unsupportable debt levels in exchange for a piece of paper that isn’t worth it. It is no shock that for-profit enrollment growth shot through the roof with the de-regulation of Wall Street in the late 1990s. Just like subprime loans and exotic financing for-profits are a large player and this only occurred in the last 10 years or so. These institutions have enormous marketing budgets and staff that basically fill out financial aid information for students to exchange paper for paper. This game is going to end and we are starting to see major cracks in the system.

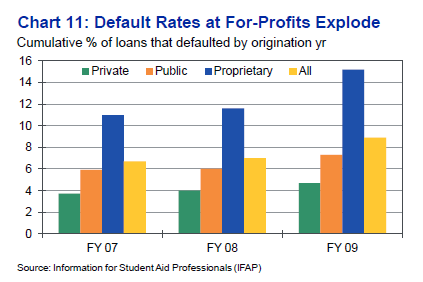

Chart #8 – Default rates at for-profits

Default rates at for-profit institutions are soaring similar to subprime debt in housing. Yet what else do you expect? Employers who are hiring can pick up graduates from name brand schools instead of going with for-profit schools where many simply get a piece of paper with no measurable track record. The default rates are simply a reflection at how extreme the system has become. For-profits are the most egregious problem in higher ed but even name brand schools are having issues with student loan debt levels.

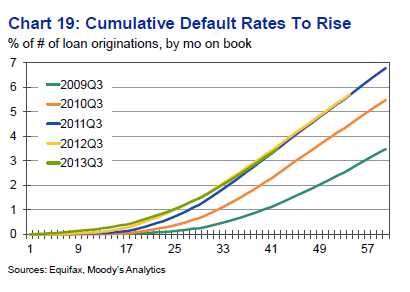

Chart #9 – Default rates to rise

Given the turmoil in the economy default rates are projected to rise. So where does this burden fall? Most of these loans are backed by the government but are issued from banking institutions. Do we have another debt crisis in this sector? I believe we do. Ultimately you will have back breaking student loans that don’t allow strategic defaults like strategies being employed in the housing market. So what will students do if they don’t have the income to pay these loans off? Who takes these losses? These are things that we will soon find out unfortunately.

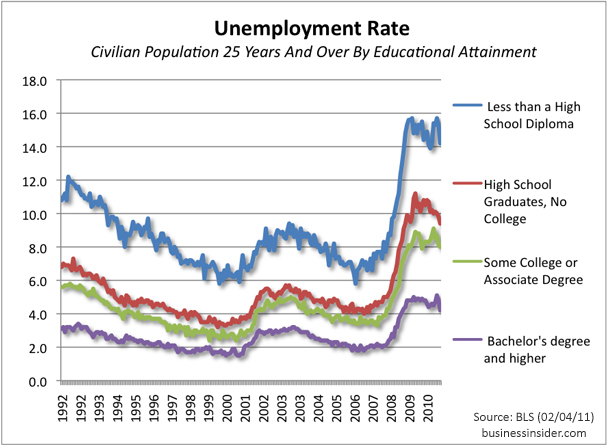

Chart #10 – Employment by education level

Source:Â Business Insider

The chart above again reflects this recent trend. A 4-year degree no longer protects you with secure employment. For the first time in our record keeping history do we have over 4 percent of those with a 4-year degree unemployed (roughly 1 out of 4 working Americans has a bachelor’s degree or higher). Yet recent graduates have it much worse. This figure will soar as many more paper mills push out graduates with very little real world employment prospects.

We can see where this higher education bubble is going but in the meantime, you have investment banks and those connected in the government making money hand over fist on the exploitation of working and middle class Americans. I think many Americans are being educated for free on how the system is currently rigged.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Nick said:

Sad to see greed and profligate spending extending from Wall St to our higher education systems.

We need to consider European nations’ systems where vocation/occupational training provide better (i.e. more cost effective) options than traditional universities

August 11th, 2011 at 2:21 am -

Mike said:

The only solution is the way long overdue…REVOLUTION…

August 11th, 2011 at 2:53 pm -

Talmage Murray said:

The college loan market will collapse it is a matter of time.The college education is not worth the money and the diploma is not worth the paper it is printed on.The america people have been lied to by the us government leaders the last 100 years.What is government doing in education?

August 12th, 2011 at 1:31 am -

Arianwen said:

I doubt student loans will be the next crisis as they can’t be discharged in bankrupcy. We might see riots or other displays of frustration, but if loans default students get hit with fees and interest on those fees for decades with no end. They will spend the rest of their lives paying off a debt that will never get repaid in full. But they can’t cause a crisis because the loan remains on the bank’s books till there’s a death certificate. The industry made sure of that.

August 12th, 2011 at 8:44 am -

Jose said:

Strategic default of student loans is possible, but it requires some creativity.

While yu can’t default on student loans, with such free-wheeling access to credit, you can pay off your student loans and stick it to the banks on the other end.

If you can’t afford your student loans you should start putting expenses on credit cards, pay down the student loans, and hit the bankruptcy reset button.

August 12th, 2011 at 3:09 pm -

Norm said:

Majors in art, psychology, history, or philosophy are useless in the job market.

Pick something with a future.August 13th, 2011 at 7:04 am -

Osiris said:

My 50k for B.S. in psychology and some clinical grad school is getting me nowhere. I graduated magna cum laude, and the best I could land is 24k/ year. This is bull. We need to stop pushing this “go to college no matter what” crap on our high schoolers. It does not pay off. There are no opportunities out there for graduates, and even degrees for fields like public accounting have such high burnout rates that they aren’t really a safe bet either. Honestly, I work in a therapeutic mental health setting, and my student loans are causing me to contemplate an early demise.

March 26th, 2012 at 9:39 pm -

jake said:

The reality is this: Colleges and Universities (not ones like University of Phoenix which many believe are paper mills) are supporting the infrastructure and not the students. Look at what the Presidents of the Universities are paid and their benefits: a Disgrace!!! Students do not have to pay for rich lifestyles of University Presidents, this should be the first cut. These jobs have always been about truly being dedicated to the students and not to your own lifestyle. Second, look at the Free tuition those who work for the university, including professors children and even the janitors get. This is a disgrace. No FREE tuition that students subsidize. Then look at the twenty years to retirement. No retirement for anyone especiallyprofessors before forty years. Professors get sabbatical every seventh year and summers and all holidays off; hardly a tough schedule. Make them work for Forty years as was always the case until the communists started rewarding themselves at our children’s expenses. Then lastly, where is a lawsuit over the cost of college books? A college education is vital to an ability to think. It is not a quid pro quo for a job. We need thinkers not just shoe makers.

May 19th, 2012 at 7:16 am -

Mary said:

When I graduated from college with a bachelor degree in nursing, in 1980, I had almost $10,000 in student loan debt. I only worked in the summer at that time because our program was so rigorous.

My starting salary as a Registerred Nurse was $6.82/hr and that was less than my brother earned working as a laborer in the summer for my father’s construction business.

The very day that I receieved my state board test results I went an applied at two facilities and was offered a job at one, on the spot, because our program was a program whose grads got the highest test scores in the nation. My score was so high I did not ever have to retake a state board exam if I wished to move.

I want to emphasize that while in college I studied my ass of and for 2 months between graduation and the state board exam I studied for 18 hours per day reviewing every bit of course notes and rereading texts and completing NLN practice exams. I also tutored my classmates in pathophysiology while a student.

We had to do research as a student and I was offered multiple jobs to consider when I graduated, again because of the rigors of our academic and clinical program.

I accepted the first job offered that day of applying for jobs and began work the next day. My commitment was to pay off all my student loan debt and my new $5,000 Ford Fiesta that I purchased immediately……all within 5 years. That was a lot of debt for 1980 on a salary that was anything but great.

I lived very frugally for those 5 years. At the end of those 5 years my debt was paid, and I had loaned $5000 to my brother and purchased a used truck for him. I also provided all the clothing for his 4 children.

THERE ARE WAYS TO PAY OFF DEBTS, but it requires a strong sense of what is essential for life vs. What is “nice to have but NOT essential.”

I NEVER had a television, so I had no cable bill or extra electric bill. I listened to public radio for my news. I walked 15 miles per day for entertainment and health. Everything I purchased was ON SALE and deeply discounted. My clothing was fantastic and new and “preppy”. I planned ahead and stocked up on on-perishable foods I regularly ate when they were on sale.

I STOPPED SMOKING. I stopped drinking.

I had great fun with friends, walking and camping, and biking. I read books. I read the newspaper at work on my breaks.

I was so busy, and so active, and having so much good quality fun with friends that it seemed a shame to sleep.

Now, tell me why the graduates of today, many of whom have moved back home to live with mom and dad, are not able to pay their debts……go ahead……tell me. Tell me something that I can believe.

Do you mean totellme that all those unemployed student grads are unable to find any work? Can they mow lawns or clean houses? Can they bag groceries or scoop dog poop from people’s yards? Can they walk dogs? Can they babysit? Can they do odd jobs for relatives or neighbors? Mw hat about washing cars for the neighbors for the same price it would cost to go through a car wash? Hell, people need their windows washed and yards raked also.

There is work to be done that people with jobs will pay these grads to do. I had 3 jobs simultaneously after I took my state board tests and was waiting to get my results. I worked from 6 AM to 11:30 PM five days weekly and then also worked in a friend’s law office doing paperwork on weekends. It was a great treat when she would treat me to a soft shell taco at the end of a weekend work day….. A REAL treat.

I have little or no sympathy for these grads. They made CHOICES, just as I did. I went to a public university in my home state, but I chose that university based upon the results that students experienced within college and after graduation.

I was not afraid to work my butt off, day and night, if need be.

I know of no young grads who have anywhere near the same work ethic……none.February 3rd, 2015 at 3:51 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!