The Retirement fantasy – middle class Americans are quickly realizing that a secure retirement future may only be a myth. Stagnant income, debt illusion, and the future outlook for working Americans.

- 2 Comment

Americans are having a tougher time finding extra disposable income to save and create wealth. It is hard to plan for the future when you are worrying about having enough money to purchase a couple of frozen meals. When looking at overall statistics we rarely get a glimpse at how tough things have become for the working and middle class. We usually get data discussing retirement account worth but most of these reports fail to acknowledge that 1 out of 3 Americans have zero dollars to their name. That is obviously an important caveat. You also have a banking system that imposes predatory practices on those least able to afford it. Case after case has been reported of those living paycheck to paycheck while having to pay multiple overdraft fees that can range from $25 to $40 per charge. Banks realize they can simply place a stop but why let all this easy money free? For those who can save and end up purchasing a home, most of the wealth is derived from home equity which in a nationwide housing bubble is like having all your money in one stock. Income is not a good measure of wealth. The per capita income in the United States is $25,000 and after paying the mortgage or rent, healthcare costs, and buying food little is left over. What all these items point to is that retirement as many envisioned may largely be a fantasy that is only available to a select few.

Personal savings rate deceptive

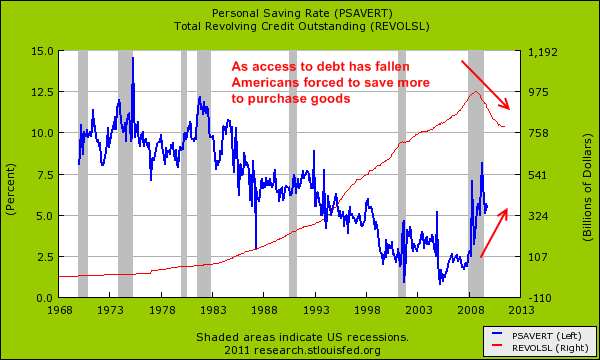

Part of the big change since the recession hit in 2007 has been access to debt to American households. Working and middle class Americans have been under the illusion, not all but many, that somehow debt equaled wealth. This credit binge could only last for as long as the banking system did not transform into a Ponzi like system, which it did. The housing market at one point simply relied on the greater fool theory of investing and became so ludicrous, that it was destined to pop and pop hard. Yet the above chart shows this new change which on the surface may seem positive but really is reflecting a decreased standard of living.

A few years ago some articles started making their rounds talking about how great it was that Americans were saving. However what wasn’t mentioned was the subsequent collapse of access to debt which many Americans were simply substituting for actual earned money. The above chart shows this change. Revolving credit has contracted by a stunning 18 percent since peaking in 2008 reversing a multi-decade long trend. Hundreds of billions of dollars in debt purchasing power has been sucked out of the economy. So it should be no surprise that many Americans have enabled the rise of the dollar store in many regions. Bigger stores like Target in many regions have added consumables since many have shifted from needs to wants.

Household income stagnant

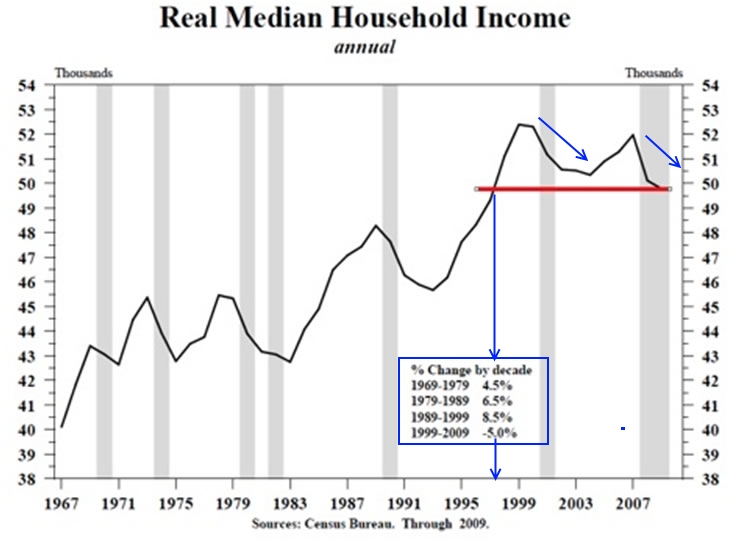

A subsequent issue that ties in with the debt increase has come from the lack of real household income growth which also puts into question the retirement for many:

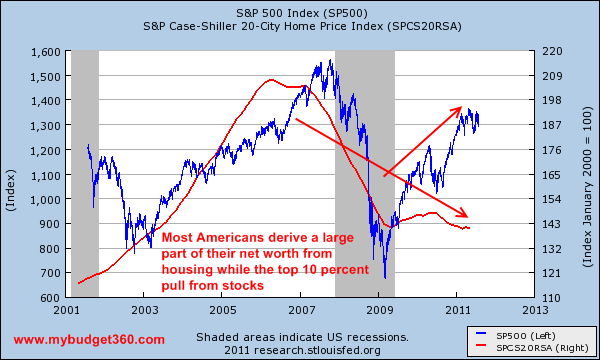

What is troubling regarding the above chart is while the housing bubble was raging, actual household income was falling dramatically. Most Americans, say the lower 90 percent, derive a large portion of their household wealth from real estate if they have any wealth to their name so the real estate bubble provided a false sense of financial success. The income distribution figures highlight the story but again, when placed into aggregate hide the reality of what is truly transpiring:

Source:Â Â Ignorant Investor, Survey of Consumer Finance

“Wealth is not directly related to income. The more income you make the more wealth you can have as a percent of our income. For example, the Lowest 20% of income have a Median Wealth of 8,500 for a Mean Wealth to Income Ratio of .65. The wealthiest 10% by comparison have a Mean Wealth to Income Ratio of 5.4. This makes sense, as the more money you earn, the more things you can accumulate. Rather than spend all your money on things you immediately consume like food, gas, electricity, etc, you can spend it on assets that have an on-going value like houses. Also, you have more income you don’t need to user right away that you can obviously invest in stocks, bonds ,etc.

The total wealth of the nation is concentrated at the very top. The top 10% owns nearly 60% of the wealth.â€

In terms of actual wealth, that is owning stocks, bonds, and true capital the top 10 percent own 60 percent of the entire nation’s wealth pool. The bottom 60 percent of Americans own 16 percent of the entire nation’s wealth. This is an interesting breakdown because as would follow, most American families actually make $50,000 or less a year and much of their wealth was concentrated in real estate (the data pulled from the most recent study looks at 2007 data which was at the absolute peak of the housing bubble).

What we can say with confidence is that the lower bands of income classes have faced a much more severe drag on their wealth share while the wealth aggregated at the top has increased. This falls in line with the stock market soaring nearly 100 percent since the 2009 low yet housing prices continue to make new lows:

This is why the so-called recovery never really felt like any recovery to most working and middle class Americans.

The banking system problems

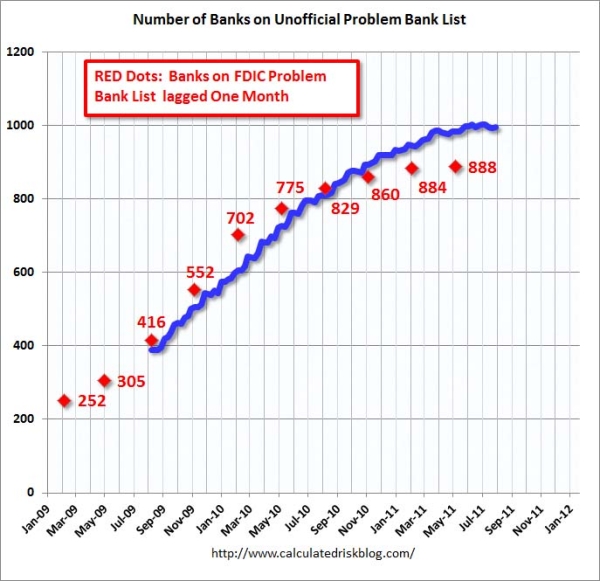

Many forget that the U.S. has over 7,000 different banks. This is an easy omission to make because most of the banking capital and assets are concentrated in the too big to fail. What is important to understand however is that many of these more local and regional banks are still facing large problems since they do not have access to the bailout machines provided to a certain handful of banks. Retirement may appear to be a luxury only for the those connected to the right kind of bank. In fact the troubled bank list is still near peak levels:

Source: Calculated Risk

Roughly 1,000 banks are still considered to be in trouble. Why? It largely has to do with loans not being paid on time and delinquencies. So this is a reflection on the magnitude of the issue and the FDIC is insuring trillions of dollars in deposits with an insurance fund that is depleted. We are to be assured that if push came to shove, the U.S. Treasury would simply print more money as if we had this money handy to bailout more banking problems.

With inflation figures being distorted many Americans are told that nothing is rising in costs. Of course this excludes food, college, energy, and practically everything else you use on a daily basis. The middle class is largely becoming a small group and at what point does the middle class no longer warrant carrying that label? And for millions on fixed incomes, these rising costs are simply a form of lowering the standard of living. Retirement in the sense that we know it may be a large fantasy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

DownriverDem said:

How many Baby Boomers were duped into thinking they were voting for Guns, God & Gays all those years while the repubs were sticking it to them behind their backs? Let’s see if they vote their hate or their old age in 2012.

August 3rd, 2011 at 8:20 am -

The Cash Flow Is King said:

The fact that income has remained stagnant for the last decade coupled with the fact that 1 and 3 people have zero in the retirement account is staggering. Do not be fooled by the recent report that that “average” retirement account has $7,000 more in it in 2010 than it did in 2009. The S&P 500 has recovered close to 90% since 2009 so it makes since that there is an increase in the “average,” but the average of all retirement accounts does not have anything to do with the working class.

Not only this, but the way the US currently views retirement needs to be completely revamped. The typical 401(k) is simply a tool the financial industry uses to charge usurious annual fees. If you are simply “keeping up with the market,” you will be completely broke by the time you wish to retire. It is time for people to recognize that they can control their financial future if they stop listening to the rhetoric professed on cncb.

August 3rd, 2011 at 9:31 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!