Gear up For Higher Prices through Inflation: You Should Christmas Shop Early Based on Shipping Costs.

- 0 Comments

The world is flush with access to capital and it is very clear that there is massive pent-up demand from the last 1.5 years because of the pandemic. As the US and other economies started to open, people have money to spend and are going out there and putting pressure on supply chains. For all the talk that inflation is relatively muted, all indicators are highlighting higher prices are here to stay at least until 2022. All we need to do is look at a few metrics and understand that there are many interconnected pieces to our global economy and complicated supply chains that serve billions of people worldwide. In the US, the typical households has additional money from stimulus and lack of other expenses because the pandemic did require many to stay relatively closed off. While some of this money went to regular households, a lot of the low-rate capital went to banks and Wall Street that are now inflating the housing market and crowding out regular buyers. So let us look at why we anticipate higher prices moving forward.

Container Costs

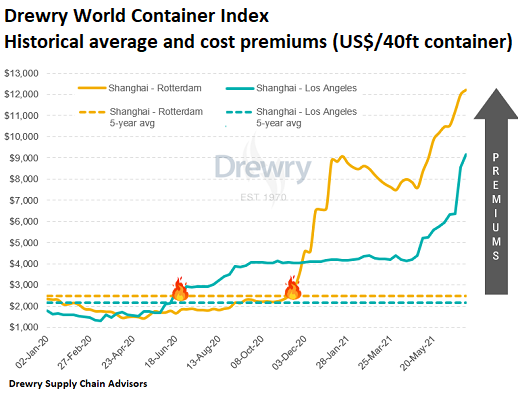

As I had mentioned before, supply chains are complicated and need to address billions of people. Many did not take a pandemic serious or did not stress test for this scenario. But just take a look at the cost of paying for a shipping container to get goods to the US and Europe from China:

This is unprecedented. The cost for a 40’ container from Shanghai to Rotterdam is over $12,000. Just in January of 2020, it was around $2,000 (a 500% increase). From Shanghai to Los Angeles the cost is over $9,000 when in January of 2020 it was under $1,900 (a 370%+ increase).

Now why is that a problem? Suppliers need to purchase cargo to get it to customers. A large portion of goods still come from China and it is clear, people are willing to pay this price to get the goods to the US and Europe. So retailers and other buyers are willing to pay these higher prices. While some are absorbing this cost others will start passing this down in the form of higher prices. This is simply the way it will go. Given the current demand and supply chain issues, this is unlikely to resolve until 2022 at the very earliest. Some analysts are estimating $15,000 to $20,000 per 40’ container shortly.

In other words, start doing your Christmas shopping now if you want to save money.

Inflation in other Commodities

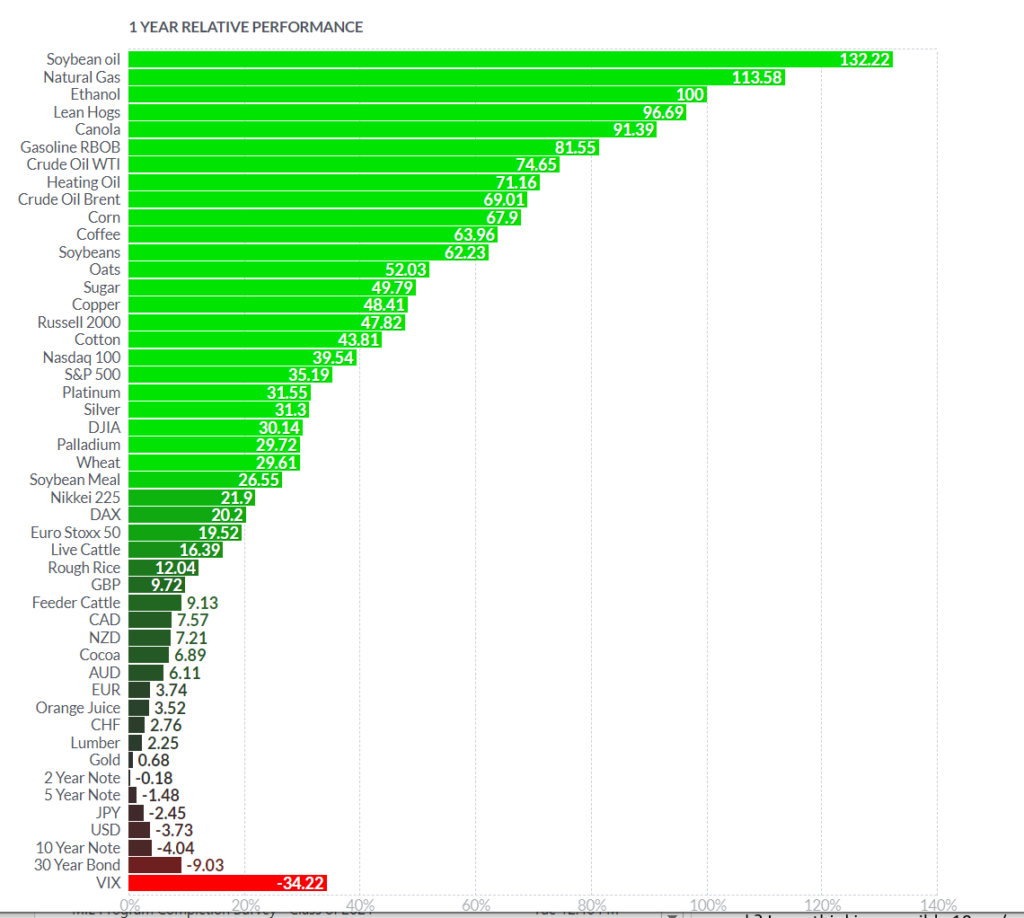

And inflation is hitting in every part of the market as well. Look at this chart for the last year:

Soybean oil is up 132 percent. Natural gas is up 113 percent. Ethanol is up 100 percent. Crude oil is up 69 percent. Corn is up 67 percent. Coffee is up 62 percent. Sugar is up 49 percent. Cotton is up 43 percent. Yet somehow, overall inflation is okay? I’ve seen some stories about lumber now crashing down. Look above. Lumber is still up 2 percent over the last year. And this is clearly an outlier because there was a local market surge for this.

The trend is unmistakable. We are going to see higher prices in the short-term and this will trickle down to consumers. We are also seeing this with homes:

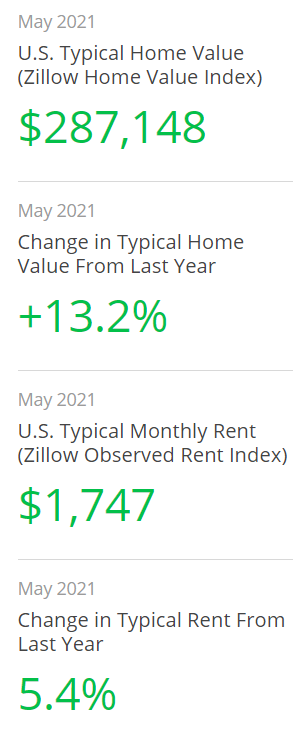

The typical home price is up 13 percent in the last year and rents are up 5 percent in the last year. Minimum wage remains unchanged and you wonder why some people are not heading back to work when everything is else is going up except wages.

This path of inflation is unsustainable and something has to give. What would be optimal is if wages increase to mitigate some of this but that is based on market demand for many jobs. You cannot force this. You can adjust it at the lower end but it is clear, we are on a trend for higher prices for the rest of 2022. Go out and stock up because things are unlikely to drop in price soon.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!