How Much is a College Degree Worth? The Value of College in a Pandemic and Crisis Filled Economy.

- 1 Comment

The pandemic has created some incredible rifts in our economy and society. Those with technical degrees working for companies like Amazon, Google, Facebook, or Microsoft are thriving in this socially distant economy. However the vast majority of the country does not have a college degree, let alone a degree that is technical to work in these types of organizations. So it is no surprise that the latest figures show $1.54 trillion in student debt floating in the market as Americans do everything they can to remain competitive. With many students returning to college in a virtual setting, many parents and students are asking how much is a college degree worth without the in-person experience? This is a hard question to answer and many colleges are struggling to stay relevant. Keep in mind that the U.S. has nearly 5,000 “colleges†and like many businesses, there is a wide variance of quality in this group. Many colleges will not make it out of this pandemic. So how much is a college degree worth?

An insurmountable mountain of student loans

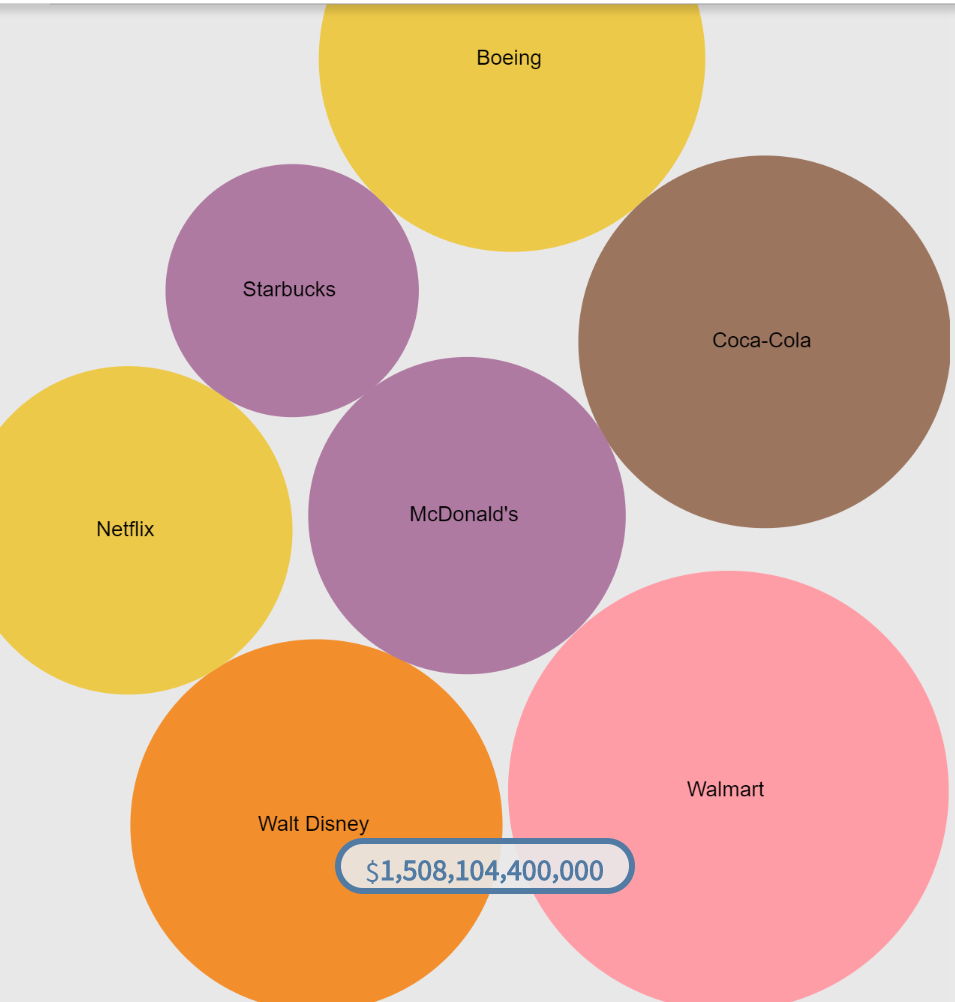

The amount of student debt in our economy is startling. For reference, take a look at total student debt relative to some of the largest companies in our country?

Even throwing in the value of these large organizations like Netflix and Wal-Mart and you still have more student debt outstanding. This is something that has exploded in the last two decades. More to the point, student debt has doubled in the last decade alone.

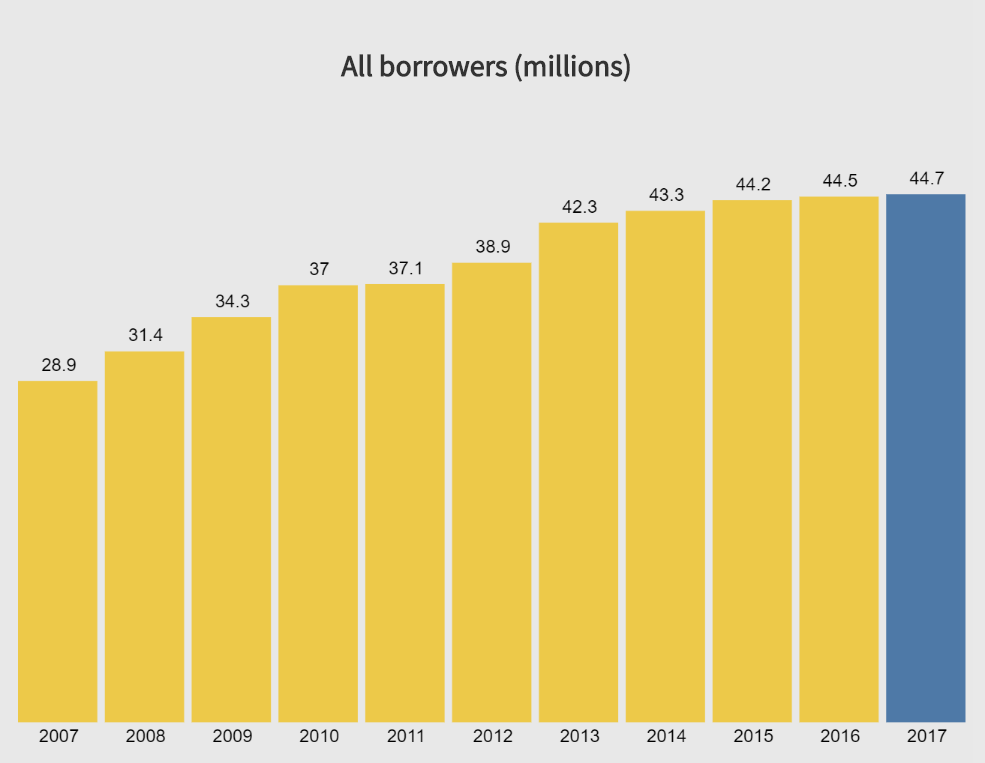

Because of this trend, we now have many more people that carry some form of student loans:

Back in 2007 we had 28.9 million Americans with student debt. Now it is up to 44.7 million (an increase of 54% in ten years). What this means in practical terms is that more Americans either carry student debt or know of someone that is carrying debt.

What you study in college matters

One of the more startling facts is that most college graduates are working in fields unrelated to their degree:

“(Inside Higher Ed) After those jobs, however, the report starts to look more like the findings from a study from the Federal Reserve Bank of New York, which found that only 27 percent of college graduates work in a field related to their major.

Emsi found that most graduates’ outcomes are dispersed widely, among a broad array of careers. They tend to move in and out of careers during their first, second and third jobs. And those job changes often take graduates into totally different fields.â€

This is an important point to understand. Many people go to college so they can have better employment opportunities. There is this odd line of thinking in some colleges that you will pay $50,000 per year merely to get an experience and enjoy nice amenities and thinking about earning potential is secondary. Well today when millions of college students are learning via Zoom, that college experience is not on the table so it is forcing many to really ask, what is the value of going to college? For many and I would argue most, it is to increase their employment opportunities. But if only 27 percent of college graduates are working in a field related to their major, what is the value of college then?

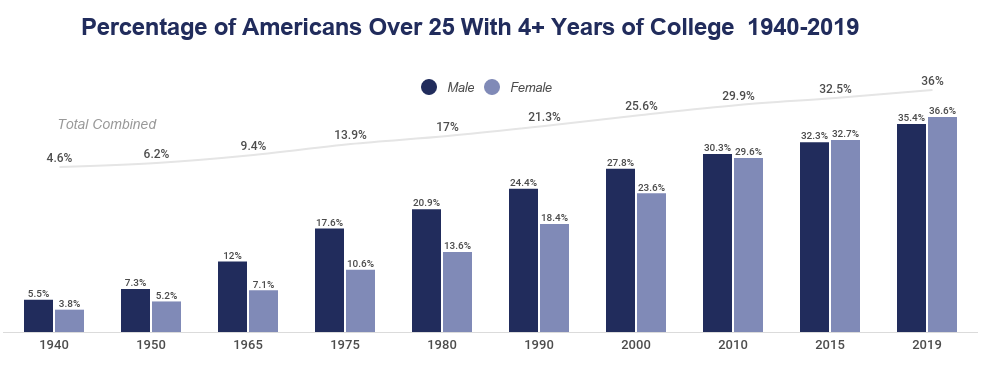

A 4-year degree used to be rare

There is now a much larger number of Americans with college degrees:

Back in 1940, 4.6% of Americans had college degrees. Today it is 36%. That is an interesting trend but what has happened is that there is a saturation of college graduates in this employment market. What does it matter if we graduate 1 million people with a non-technical degree if the jobs in demand require technical aptitude? So this mismatch is one reason for the majority of college graduates working in fields unrelated to their field of study.

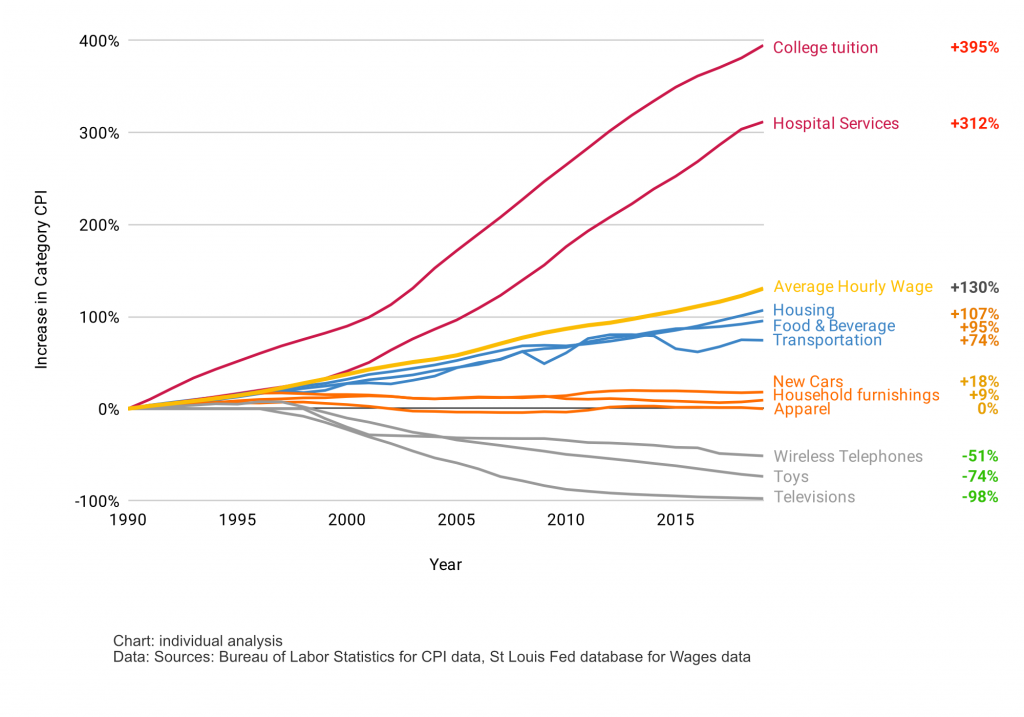

It is also important to note that the cost of going to college has far outpaced income gains (hence the need to borrow so much to go to school):

This chart is rather telling. You can see that while average hourly wages are up 130% since 1990, college tuition is up a startling 395%. So, wages are not keeping up and students are borrowing to go deep into debt to finance their college education. This is problematic because you are locking in future earnings to service an already large amount of debt. Instead of saving money to buy a home or invest, a large portion of income is going to go to paying off student debt.

Part of this has to do with how we finance a college education. Just think about buying a home. You need to show some level of income and ability to pay this back. Same thing with a car. But for college, you are giving older teenagers the ability to pay for a $50,000 a year college education with no demonstrated way of paying this back. And of course colleges are in an arms race to have the biggest gyms, best housing, and many activities that really have little to do with knowledge building. And since these loans are largely federally backed, colleges will try to push the cost higher to the level of debt that is accessible.

In aggregate college graduates do earn more than non-college educated Americans. The data is clear on this. But like many things, the details provide more information. If someone pursues a STEM degree and does well, the likelihood of earning a good income after graduation is high. But if you pursue a degree in say history and pay $50,000 per year (or go into debt for this) to learn this, you might find a job after you graduate but it is unlikely to pay you well (this is where you need to do a careful cost valuation of major and earnings potential).

Going to college is still seen as part of the American Dream for many families and their children. Many Presidents we have had have gone to college (in many cases an elite school) and they have sent their kids too. Yet right now with so much debt in the market and many going to school via Zoom, the question of the worth of college is seriously under debate and rightfully so.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

BG said:

An extremely important article for those who recall much better times than these. After all, financially over-burdened students borrowed on the unchallenged premise of a brighter future. The ultimate irony is the mega-financial corporations which made the loans will not listen to any pleas of inadvertent hardship– student loans cannot be canceled by personal bankruptcy, even if bankrupt businesses can settle their own loans through commercial bankruptcy. The bitterest reflection of all is Wall Street lenders with the massive student indebtedness they hold refuse to forgive students, although the banks and funds, themselves, got a massive federal bailout during the Wall Street scandal of 2007-2009.

September 18th, 2020 at 1:35 am