Subprime Auto Nation: American Households now Carry $1.34 Trillion in Auto Loans on an Asset that Depreciates While Covid-19 Creates Demand Destruction.

- 4 Comment

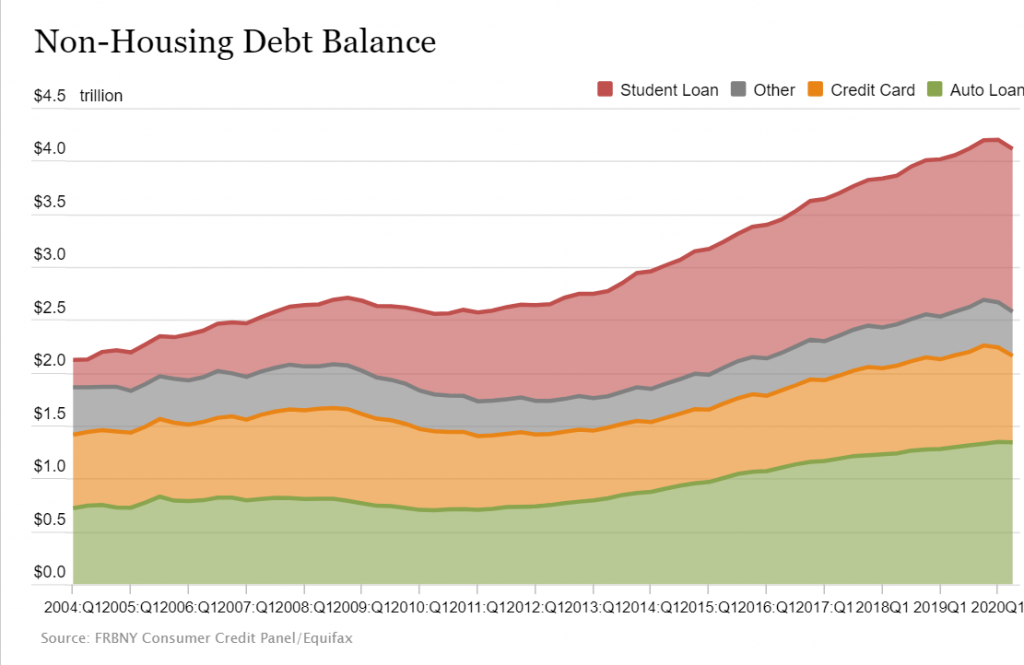

America is literally driving itself into debt. US households now carry a stunning $1.34 trillion in automotive debt. What is troubling about this is the amount of driving taking place has plunged courtesy of Covid-19 and much of our economy is built around driving. People take the morning and evening commute, and this was seen as simply normal – but now with many working from home, that may not be the case. Also, the notion of buying cars (a depreciating asset) every few years is just a bad financial move. The buying would not be so bad but the level of debt being taken on to finance a car purchase is. Not too long ago a three- or four-year term on an auto loan was standard. Now we have loans of six to seven years! You also have billions of dollars going to subprime borrowers and in this climate, a large number of Americans are financially on the edge. Where do we go from here when it comes to auto debt?

The state of auto loan financing

It is astonishing how much debt is used to finance car purchases. When you look at companies like Tesla, a large portion of purchases come with financing. And you also have this for every other traditional car maker like Ford, Chevy, Honda, Toyota, and many other makers. At the end of the day, many Americans are only able to purchase a car by going into significant debt.

The numbers are clear:

There is $1.34 trillion in auto loans outstanding and part of this is now in subprime auto loans. If we go back to 2011 we had $710 billion in auto loans. In nine years auto debt has grown by 88%. That is astonishing given that household incomes have been largely stagnant over that period.

And if you look at some of the ads, you can see how easy it is to finance a purchase:

$0 down payment, $0 security deposit, $0 first month’s payment. And this is for a lease! So you don’t even get to keep the car after the lease is over. People are now fully conditioned to think that it is normal to go into deep debt to purchase a car. They are also programmed to think that you should be buying or leasing a new car every three to five years. Why? Cars can last a lot longer with basic maintenance but our debt-based system has conditioned people to always be buying and thinking utilizing heavy debt to purchase a depreciating asset is totally fine.

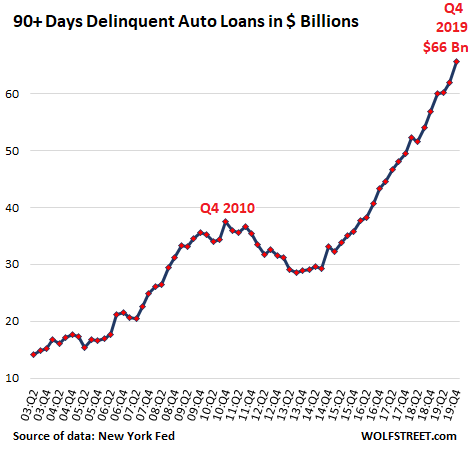

Given that cars do last longer, the market for new car buyers is limited. And car companies have to dip deeper into their pool to find buyers. So it is no surprise that subprime debt took off but is now imploding:

That is a dramatic rise in delinquent loans and keep in mind this chart only went out to end of 2019. The figures are probably much more problematic now given Covid-19 impacting all households economically. Those least able to afford better terms went with onerous loans and many are likely in positions that took big hits with the pandemic.

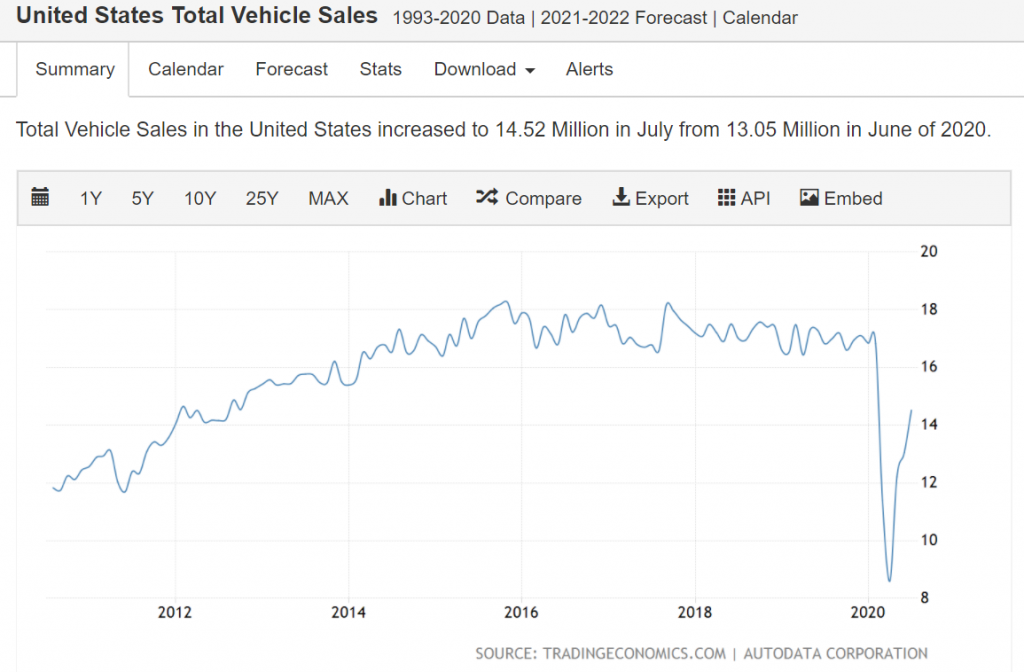

Why this matters? With millions of people now working from home, the need to drive has declined substantially. Car companies are built on churning out new cars every year but only if people have a demand for them. The dipping into subprime territory signals that the market is simply getting smaller, and this was before the pandemic hit. Covid-19 is going to continue to put a strain on automotive companies. And the auto sales pattern had been steady until Covid-19:

That is a big shift for a market that is hyper competitive. $1.34 trillion in auto debt is inching closer to the $1.54 trillion in student debt in the United States. What happens when demand for auto purchases finds a new normal?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

R Moffett said:

I paid $1800 for a 94 Corolla in 2004. I still have it. I paid $800 to have it painted last year. Due to Covid I have only driven it 4 times since March 8. I am paying $1100 a year on car insurance. At this rate I will be paying $125 per trip to Walmart for car insurance.

my nephew requires a truck for his work. he paid 54,000 dollars for a new chevy. in one year the transmission went out. In 2009 my one bedroom apartment was only valued at $17,000. Now it is around $32,000. To pay $54,000 for a vehicle seems insane to me.August 16th, 2020 at 6:00 am -

Blather said:

I have a car much older than yours. I put on about 1200 miles a year. I pay onel $400 a year in isurance.

I can’t see paying thousands and thousands for a new car that depreciates at 30% in the first year that they charge the highest amount in insurance for the 1st year they can.

Double jeopardy losing game.

August 16th, 2020 at 3:04 pm -

Rupe Huzz said:

“To pay $54,000 for a vehicle seems insane to me” – because it is! That is essentially a mortgage in some parts; and not to mention the fact that you have not even started to account for rent or a real mortgage – and if you were a little too smart – student loan payments.

August 17th, 2020 at 5:15 pm -

gmatch said:

America is the only country on the planet where used cars can cost more than new ones.

August 17th, 2020 at 9:38 pm