How the Financially Connected Prospered in a Decade where Wealth Evaporated for the Majority: S&P 500 Down 24 Percent for the Decade, Real Home Values down 3%, U.S. Dollar down 23%, and Unemployment back to 1980 Levels.

- 2 Comment

As we usher in the New Year the filthy rich are counting their blessings and must be very appreciative of the massive bailouts that protected their wealth. The top one percent of this country control 42 percent of all financial wealth so it shouldn’t come as any surprise that most of the bailouts went to Wall Street and those that are tethered to it for income. As the stock market continues to rally Americans collecting food stamps stands at the highest number ever at 37 million. We also have 27 million Americans looking for work or are simply stringing a few hours together to keep some sort of paycheck coming in.  The vast majority of Americans are simply exhaling a sigh of relief that the 2000s are now a thing of the past. Yet if something isn’t changed radically in our system we are bound to enter another financial shock in the near term.

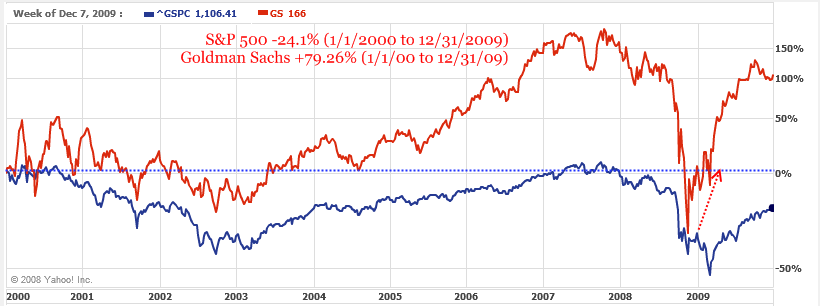

First, the S&P 500 is down a stunning 24.1 percent since the start of the decade. Yet Goldman Sachs managed to pull off almost an 80 percent gain during the same time:

So for the poor average American who simply dollar cost averaged into the stock market as every good corporatocracy banker would tell them, they would have fallen behind someone who simply dollar cost averaged into their mattress. Yet if you happened to dump your money with the government sponsored and back stopped Goldman Sachs you would have done much better. Ironically these bankers are the same people who created the financial instruments that sent our economy into a tailspin.

The average American is finally realizing that much of the corporate power in Washington is doing very little for them and doing more and more for Wall Street. So the stock market over the decade brought negative returns to Americans. How did the housing market do?

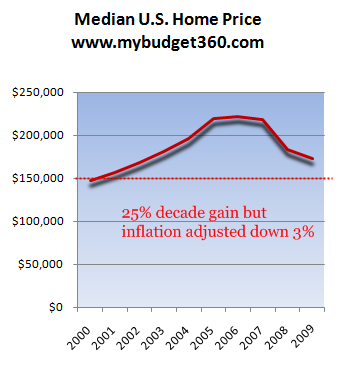

The median U.S. home price in November of 1999 came in at $137,600 and ended November 2009 at $172,600. This 25 percent gain is wiped out once we factor in the Federal Reserve inflating away the U.S. Dollar. Housing over the decade is actually down 3 percent. This is where the largest store of the average American wealth is stashed and it went negative for the decade. Yet somehow the ultra rich seemed to make out like bandits with all the bailouts even though are economy was still fizzling out from two mega bubbles. There is a reason they call it a golden parachute.

Let us recap. The stock market brought negative returns both nominally and in real terms for the decade and housing is actually down in real terms. So how did Americans do over the decade in the employment front?

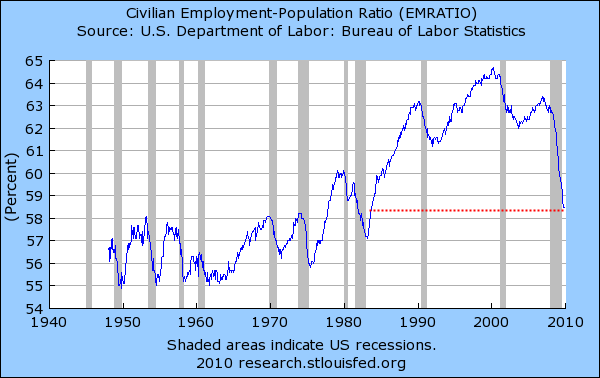

The unemployment rate is the highest it has been since the early 1980s. If we look at the employment population ratio we will see that our economy is still trending to the downside. Yet the corporatocracy is happy to feed the propaganda line that the average American is better off. Really? How so? Once the bubble decade wealth imploded the typical American is now in a worse position. The national debt also exploded during this decade. So housing values cratered, the stock market is still massively down, and employment is still in shambles. Yet we are to believe things are just fine. People are now finally waking up to the reality that the current system is designed to rip them off and steal from them at every point in the road.

Take credit cards and bailouts for example. Some credit card companies are hiking fees up on customers before new regulations hit this year. These are the same companies that benefitted handsomely from the corporatocracy bailouts. This money came from the average American yet they are sticking it to them each and every other way. For example, last month I was stuck by a “savings withdrawal fee” from Chase. I never saw this before. So I called up the bank and asked them what this was. It amounted to a $12 fee for each transaction. As it turns out, the wonderful Federal Reserve through Regulation D yanks money out for people making more than 6 ACH transfers per month from savings accounts. So if you wanted to move your money from say your toxic too big to fail bank to say a local community bank, make sure you don’t do more than 6 transfers for the month or you are going to be hit with a $12 fee for this. Insane policies like this make me realize that something is going to give in this decade.

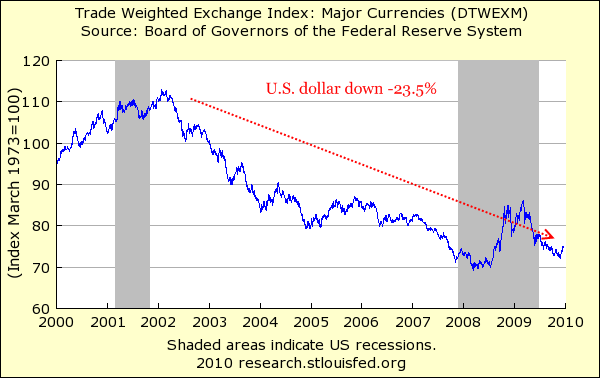

But over the decade our U.S. dollar must have gone up right? Let us take a look:

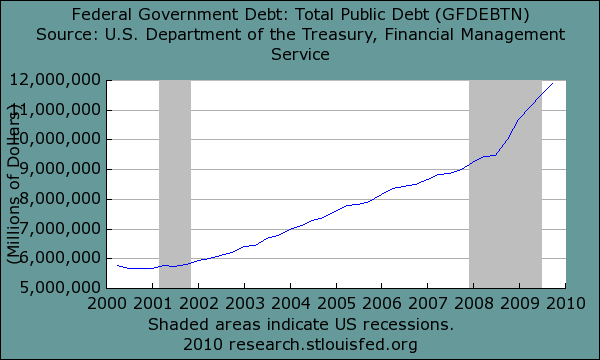

The U.S. dollar is down 23.5 percent for the decade. So if any of you actually left the country and spent abroad you would quickly realize how weak the dollar has gotten. This has to do with the massive government spending over the decade. Over the holiday Congress voted to up the debt ceiling since we are breaking through every imaginable barrier possible. Take a look at this below chart:

We went from $5.7 trillion to over $12 trillion in Federal government public debt in 10 years. And what did we really get? We just went through countless data points and where are we better off? The reality is the money is being dumped into the vortex of the banking and corporate interest that run this country. It is amazing that even with unemployment claims the media is championing this as a good sign yet they don’t even bother to look at emergency unemployment claims that are flying off the chart! That is, they are focusing once again on the wrong data.

So it is going to be a challenging decade for average Americans. The economy flew off the cliff and instead of reforming the system things are back to normal and the corporatocracy keeps on stealing from the population. The mega wealthy are doing fine and the gap between rich and poor is the largest it has been since the Great Depression. Welcome to the new gilded age. Our lost decade is now in the bag. Are we up for another one? Let us hope not.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Terrance Stuart said:

It appears that we are going to have greater government spending and support for the banking industry to forestall an economic crash that will continue to devalue the dollar and set the stage for large scale inflation. In additon we have studiously avoided using our world’s largest oil deposits (these are not reserves because to be a reserve it has to be accessible) due to our political will not to. Thus we have had year after year of trade deficits, which have to some extent been offset by our surplus in services activity overseas. We have exported manufacturing industry overseas; China produces about 10X the steel we do, to emerging economies that heavily pollute and have a very low ratio of production to energy use. Our domestic economy is unbalanced due to this. We have a bubble of aging Americans who will tax the medical system, but will not be large consumers of commercial products. We are absorbing one of the largest influxes of immigrants in our history with mixed results; all the while allowing our physical and energy infrastructure to age without adequate replacement. We have become believers in the notion that our attempts at staving off nature, a prime purpose that civilization exists for, is evil, and despite an embryonic climate forecasting science most believe that our use of energy and not the variability of the sun’s distribution of it is the prime cause of climate trends. We have decided to intrust our soverign future to globalization—a very interesting postion to be in given our founding father’s admonition to avoid entangling alliances. Despite all of this, the world will survive us, and God willing the United States will also survive our current policies and short sighted decision making.

January 4th, 2010 at 7:13 am -

Alan said:

This article should have shown a chart of Americans’ average salary, inflation adjusted, for the last decade so workers can see how much less they are being paid now by the corporatocracy…

January 6th, 2010 at 7:40 am