Let us count the ways of inflation: While the CPI understates inflation Americans are living out the days of a contracting standard of living.

- 0 Comments

Americans are experiencing the impacts of inflationary pressures on their pocketbooks. The Consumer Price Index (CPI) used by the Bureau of Labor and Statistics does a poor job of measuring inflation because it uses derivative measures to reflect the price of things we can readily get. The most obvious example is the measure used to value homes. The CPI missed the first housing bubble and is now missing the rampant rise in home prices again. Why? The CPI uses a measure called owners’ equivalent of rent (OER) which is a hypothetical measure of what you would get if you rented out your house. Yet as we know in many expensive markets, someone may rent a home for $1,500 but the full carrying cost of owning the place may be $2,000 or more even after tax advantages are considered. The bottom line is the Federal Reserve has pointed to the CPI as sufficient reason to continue using Quantitative Easing even though we are seeing large banks and hedge funds flooding the housing market. No inflation? Let us count the ways.

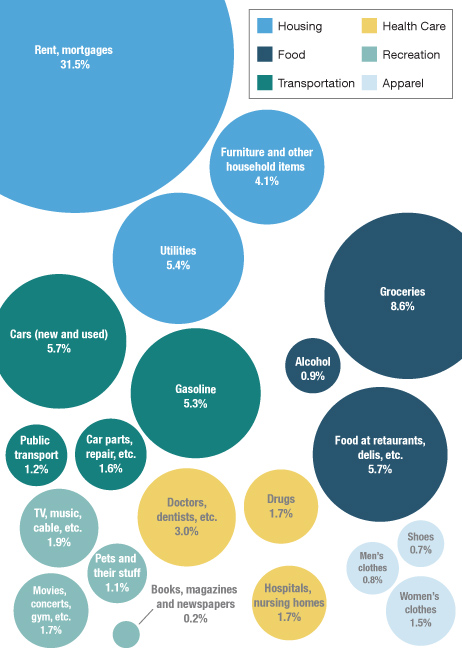

Where do Americans spend their money?

It might be useful to first see where Americans spend their money:

Source:Â NPR

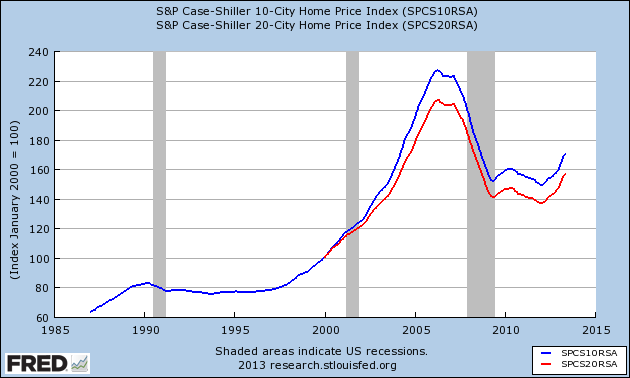

Without a doubt, Americans spend the largest portion of their income on housing. Since most Americans “own†their homes, you would think that the BLS would want as clear of an indicator as to how much money it actually costs to carry a home. Yet the OER is simply a hypothetical when we can easily derive home prices by other measures like the Case Shiller Index:

Once again, home prices are rising at an intense pace unjustified by underlying economics. More to the point, it appears that over the last few years large financial institutions are leveraging the easy money provided by the Fed to invest in real estate crowding out regular families. In 2013 the largest buyer of real estate in the US is the investor class (the first time in history this has happened). Home prices are moving up by double-digits yet incomes look like this:

Household income still shows dramatic signs of weakness so how is it that home prices are up by double-digits? Again, the largest buyers are not typical families but investors that have access to the easy debt provided by the Fed.

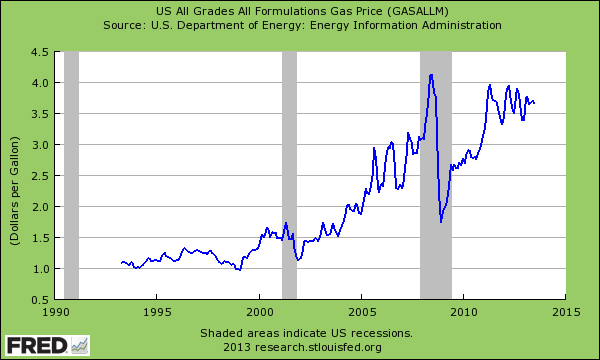

Going back to the chart above, Americans also spend a good amount of money on food, energy, and utilities. These are impacted by fuel so let us look at how gas is doing:

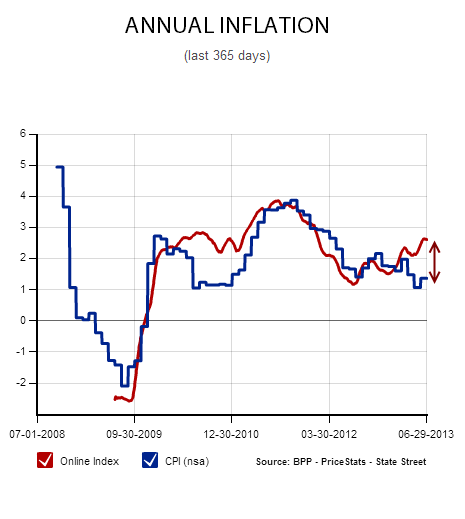

The price of gas has quadrupled since 2000 yet incomes are stagnant. So more money is being allocated to the necessities of life and less disposable income is left. If we look at the MIT BPP inflation figure we see that yes, prices continue to go up:

Source:Â MIT

While the CPI is closer to a year-over-year increase of 1 percent the MIT BPP is closer to 3 percent. When incomes are stagnant (or falling) this is a massive increase and people are feeling this. What use is the massive rise in home values if families are not part of the reason home prices are going up? In fact, it appears that investors are crowding out the market and banks have circumvented simple accounting rules like mark-to-market to hold off inventory and jack up prices. Instead of real estate being a simple conservative asset where most Americans derive their net worth, it has simply become another slot machine in the casino for hedge funds and Wall Street investors.

So as you can see, there are many ways that inflation is crowding into the market. The Fed in our debt based system simply creates more debt (money) and banks use these tools to purchase real assets (driving prices up). In the past, inflation was closely associated with more money in the system yet in a debt based system, the Fed now has a balance sheet above $3.4 trillion and big banks have access to this while the public is limited to their access to this debt. It is no surprise that financial institutions are now the biggest buyers of real estate (and this is where most Americans actually spend their money consequently). No inflation? What about rising prices in tuition, housing, fuel, food, and healthcare. It appears that there are many ways to count the impact inflation is having on households.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!