Is it possible to pay $0 in taxes on a six-figure income? Yes it is and here is how you do it.

- 4 Comment

The tax system is setup to reward those that save. But half of the country doesn’t have any money saved so that is a tiny problem. However, if you are willing to put money away you can cut your effective tax rate down to a very low level. I know this seems absurd but it is possible if you are frugal and careful. There is no need for offshore accounts or expensive shell companies. You can do this simply by living below your means. This is hard in a consumption based economy like our own where everything is setup to encourage you to spend. In fact, we now have over $1 trillion in credit card debt which means people are spending money they don’t even have today! So let us get on with the method of how you will pay nearly zero in taxes by utilizing multiple tax shelters.

Paying zero in taxes on a six-figure income

Before I begin, I will state that there are a few key things you need to make this happen:

-Live frugally

-Live in a low to moderate cost of living area

-Not be addicted to spending

So with that, here is the scenario that I found over at Investor Junkie:

Source:Â Investor Junkie

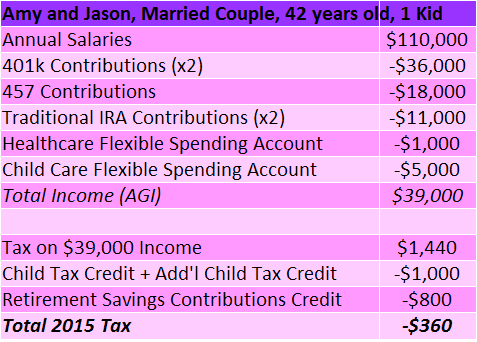

It is worth going through each section individually. Here we are assuming a couple that is both working. Their combined income is $110,000 per year. They max out their 401k contributions of $18,000 per year. Next, one of the above works as a teacher with the access to a 457 account. This essentially is another 401k for public sector workers. They put $18,000 here as well. Next, you are able to stash $5,500 per year in a traditional IRA so you can lower your taxable income.

Next, they utilize their HSA account to the tune of $1,000. They have a child in daycare and spend $5,000 a year here and are able to adjust their income lower here too.

So with all of that, their adjusted gross income drops from $110,000 to $39,000. The tax at this level for a couple with a kid is $1,440. Taking the child tax credit of $1,000 and the retirement credit of $800 they will actually get a refund of $360.

Does this seem farfetched given the median household income in the US is $52,000? Many families are in a situation like this. And you can see that there are many tools to cut your tax burden way down. But the problem is, most do not save and certainly not to this level.

The challenge of course is that the couple in this situation is stashing $65,000 in 401ks, 457, and their IRAs on a $110,000 annual income level. What that means is that their cost of living must be very low.

Is this doable? Absolutely if you are willing to be frugal. Mr. Money Mustache manages to run his household on roughly $25,000 a year. But of course, that budget supposes a paid off house since housing is the big expense for most Americans. But even if that isn’t the case, just by trying to be more aggressive with your savings you will realize that reaching retirement is much more doable. The act of being frugal is the bigger benefit. Most Americans are going to work until they die because they have no nest egg or exit strategy. I’ve gotten emails saying “great, that is the problem but what is the solution?â€Â Well here you go. Here is one tiny example of where you can save and cut back on your tax burden.

Paying zero in taxes on a six-figure income is doable.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

4 Comments on this post

Trackbacks

-

Tom said:

Interesting graph. One thing though, it is hard to get high paying jobs in low cost of living areas.Maybe I am wrong on that?

March 6th, 2018 at 7:11 am -

roddy6667 said:

Yes, you can have a high paying job in another area and spend half your free time commuting to your “low cost area”. The cost of driving many vehicles can be as much as $1.00 a mile. Do the math. Your commuting expenses are paid with after tax dollars, so divide by .75 or .8. Subtract this from your gross pay. Is it worth it? Remember, you don’t get paid for the thousands of hours driving. They get sucked out of your life and you never see them again. Also, statistically, your risk of getting seriously injured or killed rises with every mile driven. Your “safe area” may be more dangerous than a high crime area because of the commute.

March 9th, 2018 at 8:59 pm -

dbtuner said:

I’m not sure that you can contribute to a 401K, 457, and an IRA. As such, I call BS on this. I thought this article was going to be more intuitive and talk about dividends and capital gains exclusions, but I was disappointed.

March 11th, 2018 at 6:50 am -

Bucksnort said:

HSA contribution adds $8750 for a couple over 55. If the couple is living paycheck to paycheck they aren’t putting money into a 401K. I said screw it and retired at 59 a couple of months ago. Wife is 62 and between her SS and state pension of $1400 and working part time at $9K a year and my pension of $800 we qualify for Free Obama Care Silver Plan at a credit of $22K a year. We need to put $8750 for HSA credit and the $9K IRA deduction to get our AGI down to $18K a year to get the free health insurance. Plus with the $24K standard deduction we will pay no taxes for 2018. Who has 18-23K saved to offset your income? Very little do. In 3 years I’ll get $1600 SS and the wife will be on Medicare. By then we’ll be down in Panama sitting on the beach. We lived within our means, payed the house after 23 years and put 2 kids thru college making $75-90K both at most.

April 11th, 2018 at 11:35 pm