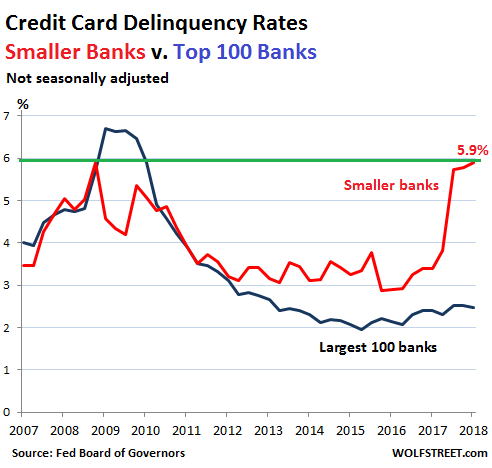

Subprime credit cards – Credit card delinquencies higher than financial crisis peak at 4,700+ small US Banks.

- 0 Comments

Americans are trying to keep up the pretense of a middle class lifestyle with credit card debt. Out of all the debt available, credit card debt is the least helpful in building a viable financial future. With credit card debt, you are spending future earnings on consumption today. It would be one thing to pay off your credit card balance in full each month but many Americans are not. In fact, there is now over $1 trillion in credit card debt outstanding in the United States. Smaller banks trying to keep up with big banks have found that they need to take greater risk in building out their client base. So what they have done is gone after lower credit customers. And it should not come as a surprise that delinquencies are now rising at a dramatic pace.

Subprime credit cards

Credit card delinquencies at more than 4,700 small US banks are now past the figure reached at the peak of the last financial crisis. You heard correctly – higher than the financial crisis peak:

The good news if anything can be taken from the above is that these smaller banks hold very little in terms of US banking assets. The Fed isn’t even batting an eye on this. But what is important to know is that we may be reaching a peak in terms of risk taking when it comes to consumer debt. These smaller banks have pushed the limits and it looks like we are seeing the maximum amount that can be given out without destroying a bank’s balance sheet.

Americans are continually going into debt because the middle class continues to erode. Credit cards allow Americans to spend money they don’t have. The surge in delinquencies is showing that many people just don’t have the means to pay their debt back. This was at the core of the last financial crisis – solvency.

So let us run down what subprime debt is out in the market today:

-Subprime credit card debt ($1 trillion)

-Subprime auto debt ($1.1 trillion)

-Subprime student loans ($1.4 trillion)

We are looking at $3.5 trillion in total outstanding non-mortgage debt with a good portion of it being to borrowers that are one step away from insolvency. This is a bigger problem than many think especially when much of our economy is built on people buying and consuming. What happens when credit gets harder to come by?

I know this may be a surprise but these delinquencies at smaller banks may be a canary in the financial coal mine.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â