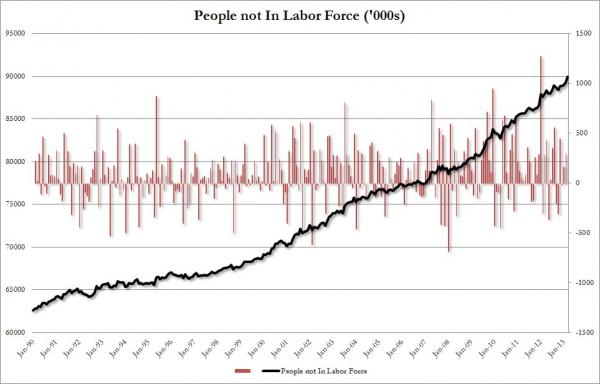

Where did the American worker go? 663,000 people were removed from the labor force pushing the figure to 90 million Americans not looking for work.

- 8 Comment

The employment report was very weak no matter how you sliced it. The unemployment rate fell but this was largely driven by an incredibly large number of people dropping out of the labor force. This recession has been extremely tough on US households. The recession was technically over in the summer of 2009 which seems like an eternity ago. However, the recession was over for a small group of Americans. Labor force participation is now down to where it was in 1979! The report was abysmal no matter how you diced it and this is coming on years of the Fed shoveling trillions of dollars to their friendly neighbor banks. This was supposedly the recipe for recovery but a recovery for which group? Certainly not the typical American family. We have all these measures of distress hitting high levels: people on disability, about 15 percent of our population on food stamps, and labor force participation down to 63.3 percent. This is what happens when 663,000 people drop out of the labor force. Where did the workers go?

Dropping out of the labor force

A larger number of Americans are simply dropping out of the labor force:

Source: ZH

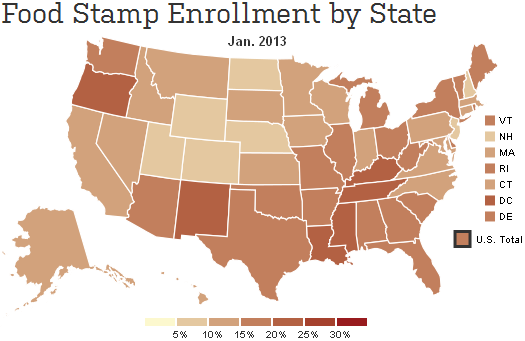

This figure is very high and cannot be explained by baby boomers hitting retirement age. We have many working age Americans dropping out of the labor force for a variety of reasons. Some are sticking it out in very expensive colleges or some are applying for disability which has spiked dramatically in this recession. Yet this trend is ongoing and also explains why we have 47.3 million Americans receiving food stamps:

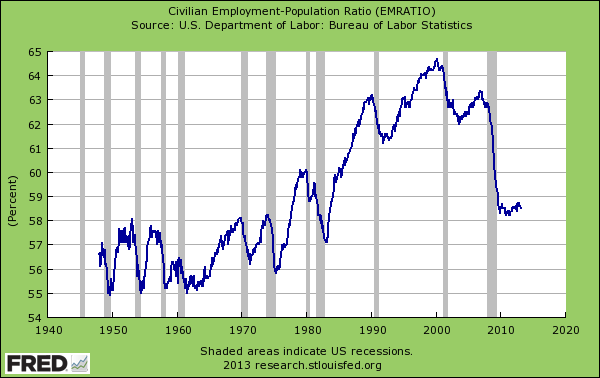

Some states like Mississippi have over 20 percent of their population on food stamps. This is probably not the kind of recovery people had in mind. The 663,000 removed from the labor force dropped the participation rate to levels last seen in 1979:

Keep in mind that since that point a higher percentage of women now participate in the labor force so this figure is showing how poor the labor force really is for your typical worker. We should have roughly 5 more million jobs than we currently have today to meet the needs of our current labor force. Here is the trend if you are interested:

This weak report comes at a time when bank profits are at near record levels again, the stock market is peaking, and bonuses are flooding Wall Street. Yet the real economy appears to be in shambles. Why? Because the Fed and government have largely chosen to bailout Wall Street while throwing crumbs at the rest of workers. This is why it is tragic that the one place where Americans store their wealth, housing, is now turning into another bubble and Wall Street investors are buying up what little supply is available to increase rents or to flip for quick profits. Yet this is not the path to better employment. The drop in the unemployment rate is simply a trick of statistics. Really, how can 663,000 people dropping out in the labor force be a sign of economic progress?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

8 Comments on this post

Trackbacks

-

sandy r said:

nice post, and to the point.

April 6th, 2013 at 1:05 pm -

Gary Reber said:

Without the growth of an economy, job opportunities will decline. The absent discussion on a national level and in such publications as The Washington Post and other progressive and conservative news analysis sources, is WHO OWNS AMERICA and WHO SHOLID OWN AMERICA? We need to address the reality that jobs are being destroyed and devalued in terms of wage and salary levels as tectonic shifts in the technologies of production intensify and permeate every sector of the economy. We need to address the reality that businesses, faced with fewer and fewer “customers with money” have to find ways to reduce their production and operational costs, which translates to employing less and less people, substituting “machines” for people, and overall devaluing the level of earnings paid out to workers (attacks on unions, for example) in order to compete in a global economy where “slave” wages are de facto along with the rapid expansion of technology.

What we should be focused on is creating a future system of economic democracy based on equality of opportunity for every person to become an owner of productive capital––the non-human means of production embodied in land, structures, human-intelligent machines, super-automatoin, robotics, digital computerized operations, etc.––that is the driver of productivity gains.

The reality, which is ignored in our political discussions and by conventional economists and the media, is that productive capital is increasingly the source of the world’s economic growth and, therefore, should become the source of added property ownership incomes for all. The ownership of productive capital is the source of wealth and income for the richest Americans––not a job.

Businesses, whether small or large, or sole proprietors, partnerships, or business corporations are formed to provide products and services at a profit. Their success or failure is dependent on whether or not there are “customers with money.”

The solution to creating economic growth, with the aim of building a future economy that can support affluence for EVERY American, is to focus on expanding the economy while simultaneously and concurrently creating new capitalist owners of the FUTURE productive capital means of production. Thus, as wealth is created so also will “customers with money” be created as a result of the dividend income earned from their capital ownership holdings. This, in turn, will create demand for jobs as the nation will need people to contribute their labor and build this future affluent economy that constantly utilizes technologies to reduce the need for toil labor and affords more leisure time for its citizens.

It is the exponential disassociation of production and consumption that is the problem in the United States economy, and the reason that ordinary citizens must gain access to productive capital ownership to improve their economic well-being.

What we really need is a national discussion and education on the topic of the importance of productive capital ownership and how we can expand the base of private productive capital ownership simultaneously with the creation of new productive capital formation, with the aim of building long-term financial security for all Americans through accumulating a viable income-producing capital estate.

If we are to significantly expand the population of “customers with money” and significantly grow the economy, then the ownership of productive capital must be spread more broadly and simultaneously with the growth, without taking anything away from the 1 to 10 percent of the people who now own 50 to 90 percent of the wealth controlled by businesses. Thus, productive capital income would be distributed more broadly and the demand for products and services would be distributed more broadly from the earnings of capital and result in the sustentation of consumer demand, which will promote economic growth. That also means that society can profitably employ unused productive capacity and invest in more productive capacity to service the demands of a growth economy.

See my article “The Absent Conversation: Who Should Own America?” published by The Huffington Post at http://www.huffingtonpost.com/gary-reber/who-should-own-america_b_2040592.html and “The Path To Eradicating Poverty In America” at http://www.huffingtonpost.com/gary-reber/the-path-to-eradicating-p_b_3017072.html

Support the Capital Homestead Act at http://www.cesj.org/homestead/index.htm and http://www.cesj.org/homestead/summary-cha.htm

April 7th, 2013 at 9:16 am -

zorba the greek said:

when will the government stop lying and admit we are in a depression?

April 7th, 2013 at 7:31 pm -

bob said:

The flaw is too many accept the definition of “recession” as two quarters (or more) of negative growth. Why do people accept this? Why is this not challenged? It clearly is not correct.

My personal definition of recession is when the inflation rate is higher than the interest rate. That ONLY occurs when the economy is sick. I don’t care what they tell me about “recovery”. It we TRULY were in a recovery, the government wouldn’t be implementing emergency negative real rates. If we had honest real rates, the economy would contract. Therefore, the recession never ended.

In fact, by my definition of recession, we’ve basically been in a recession since 2000, which feels about accurate. The only growth we’ve achieved since 2000 has been through debt, through hollowing out the country. That’s not a real recovery.

April 8th, 2013 at 2:35 am -

Steve said:

This article is so right. I have not been working for over 2 years. Glad to be a drop out. Not counted as unemployed or underemployed or existing, moved to another state and not even registered. Even I have a side cash business making a pittance and technically vastly underemployed. This warped Fed with the Wars, Taxes, Policy, Corruption, Priorities is so disgraceful. Cash becomes king when in a prolonged depression as so many resort to the underground economy and live off others. Starve the beast until it dies or gets it right. Yes I would love to be working and paying taxes, but for now I have time and will wait it out. If this is the new normal then I will be long retired, when may be the next generation will set it right. National priorities should be Jobs 1st, Education 2nd with some moral indoctrination. The US has lost it’s moral compass and pray someday get it back.

April 8th, 2013 at 8:11 am -

Digby said:

Great post

Very frightening.I wish the economists would focus more on the real economy.

Jobs, imports, exports and debt.There is too much focus on Wall Street and Europe.

April 8th, 2013 at 11:45 am -

William @ Bite the Bullet said:

Here’s a telling chart, compiled from BLS statistics: employment at large vs. small employers:

http://bit.ly/smalllerWhat’s telling is this is over a long period, before, during and after the last big recession. There is a huge, and long term, shift happening in employment in the USA.

April 11th, 2013 at 7:42 am -

Dan said:

Excellent post. Great analysis of the numbers. Thank you and keep up the good work.

April 11th, 2013 at 1:11 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!